Goldmoney provides clients with a secure platform to purchase, sell, and store precious metal bullion.

Store precious metals physically in our global network of non-bank vaults. Manage your metals through the Goldmoney Holding.

We are a publicly listed company trading on the Toronto Stock Exchange under the symbol XAU. As a public company, we abide by the best practices in governance and auditing standards.

Real Ownership of Precious Metals

When you purchase precious metals through your Goldmoney Holding, we hold the physical metal in your name.

This is the next best thing to owning gold in your hands, but with the benefit of online access and trading as well as the security of our fortified vaulting system.

Protection Against Counterparty Risk

A Goldmoney Holding operates like other financial services accounts, with the convenience of online management.

However, once a customer owns settled metal, they are not exposed to the counterparty risk that can arise from bank or broker insolvency, or from the management of a securitized asset.

Goldmoney vs. Precious Metal Financial Products

Goldmoney is not a “paper metal” product, which means that your metal is not dependent upon the performance of, for example, an exchange traded fund (ETF), contract for difference (CFD), or commodity futures to obtain and redeem metal when you desire to access it or to sell it.

These products do not provide direct ownership of metal, and therefore expose clients to counterparty risk as they are dependent upon the program issuer’s ability to meet its obligations. Nearly all “paper metal” programs operate on a fractional reserve basis, which means that if the majority of the program’s customers would like to redeem their metal for cash at once, the program operator would not be able to fulfill its promises. In other words, “paper metal” products merely represent a promise to pay metal or cash equivalent.

Unlike the fractional reserve nature of “paper metal” programs, the quantity of allocated customer metal at Goldmoney Holding is always equal to the quantity of metal stored in our vaults. This one-to-one ratio is always maintained and is a foundational feature of Goldmoney’s governance model. Your precious metals are not recorded on Goldmoney’s balance sheet, which means that Goldmoney does not have any direct claim upon the metals. We simply safeguard them on your behalf.

Secure and Insured Physical Storage of Precious Metals

Precious metals held by Goldmoney clients is fully allocated. Clients are also able to register specific bars in their name for an additional layer of security. Neither Goldmoney nor the vault operator have any claim on the bars of our clients.

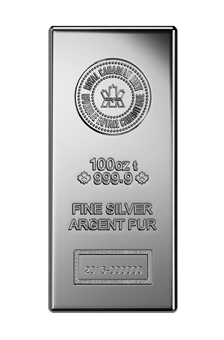

Clients’ precious metals are stored in secure, fully insured vaults in Canada, Hong Kong, Singapore, Switzerland, the United Kingdom, and the United States. All vaults are operated by leading professional private vault operators, including Loomis International (Nasdaq OMX: LOOM), Brink’s (NYSE: BCO), and the Royal Canadian Mint.

Goldmoney is responsible for guaranteeing that the insurance coverage maintained by our vault providers is at least equivalent to the value of metals they hold on behalf of Goldmoney clients, and we transparently disclose these insurance certificates to clients within the Governance section of their Holding Dashboard.

Independent Audits of Client Precious Metal Holdings

At Goldmoney, we take extra steps to ensure that client holdings and metal are independently audited and externally tested. Through a combination of independent third-party audits and our patented daily settlement technology, we ensure your metals are safe.

- As a publicly listed company, we file quarterly and annual financial statements and disclosures that are reviewed and audited by BDO Canada LLP. These statements are available here.

Precious Metal Quality, Testing, and Chain of Integrity

We only sell precious metals of the highest quality that adhere to a strict chain of integrity.

All precious metals held for customers by Goldmoney meet the London Good Delivery standard established by the London Bullion Market Association for gold and silver bars and the London Platinum and Palladium Market for platinum and palladium bars. By adhering to this rigorous and widely accepted standard, Goldmoney mitigates the risk that a bar of gold, silver, platinum or palladium does not contain the weight of metal it is said to contain.

Each bar is marked with the following stamps:- Fineness

- Year of production

- Serial number

- Assay stamp of refiner

Gold and Silver Bar Specifications

The precious metal Goldmoney purchases on your behalf always meets the following criteria:

Width 2.8” ± 0.6”

Height 1.4” ± 0.4”DimensionsLength 250 mm ± 40 mm

Width 70 mm ± 15 mm

Height 35 mm ± 10 mm

Width 5.1” ± 0.8”

Height 3.1” ± 0.8”DimensionsLength 300 mm ± 50 mm

Width 130 mm ± 20 mm

Height 80 mm ± 20 mm

The gold, silver, platinum, and palladium that Goldmoney acquires for you is produced by some of the most respected refineries in the world, including:

- Valcambi (Switzerland)

- Metalor Technologies SA (Switzerland)

- Argor-Heraeus SA (Switzerland)

- Johnson Matthey Limited (United Kingdom)

Robust Online Security Standards

The protection of your assets is of the utmost importance to us, which is why we employ the most advanced technology available to keep your assets safe. Goldmoney uses military grade encryption (RSA 4096 and AES 256) to secure your account and personal information.

Goldmoney addresses the issue of protecting client assets by enabling clients to link their mobile phones to their Holdings. This step allows clients to validate transfers, gold bar delivery requests, and funding withdrawals going out of their Holding on their mobile phone before completing the authorisation of the transaction online.

Your Holding will contain details of your bank account(s) so you can easily transfer proceeds from the sale of your precious metals. You can lock the bank accounts that are linked to your Holding so that no additional bank account details can be added. This adds another layer of protection, as even if someone manages to gain access to your Holding, they can only send funds to the bank accounts you previously assigned.

Dealing Rates & Storage Fees

As a Goldmoney client, you benefit from exceptional daily liquidity, which results in highly competitive prices for allocated gold, silver, platinum, and palladium.

We offer Individual, Corporate, and Trust account types.

We also offer Self-Invested Personal Pension Plans (SIPP) in the UK, as well as Individual Retirement Accounts (IRA) in the US through our partners Standard Life and Entrust.

Click here to learn more about our Pension Plan offerings.Precious Metal Buy & Sell Fees

We charge a 0.5% fee each time you buy or sell precious metal bullion on the Goldmoney platform.

Monthly Precious Metal Storage Fees

We provide a low-cost option for storing metal which is up to 90% less than ETF’s and other precious metal products. With Goldmoney, $100,000 of gold bullion can be stored and insured for as little as $15 per month. Unlike Bank Deposit Insurance, there are no limits to coverage of your vaulted precious metal bullion.

Please note that we charge a US $10 minimum monthly storage fee that applies to any Holding irrespective of the balance of precious metals. This is done to ensure that we abide by the best practices in Audit, Governance, KYC, and AML regulations. If your precious metal balance results in you already paying US $10 or more in storage fees, the minimum storage fee will not affect your account.

Account Funding Fees

We offer bank wire transfer and Direct Bank Transfer (CHAPS) as funding methods into our Goldmoney holding. Both funding options are free however your bank or financial institution may charge you for this transfer at the point of origin.

Account Withdrawal Fees

Goldmoney deducts withdrawal fees from your currency balance before funds are sent back to your bank account. These fees are charged by our banks and passed on to you. We transparently disclose these fees to you before each transfer is approved.

- Canadian Dollars35.00 per wire transfer

- Swiss francs25.00 per wire transfer

- Euros25.00 per wire transfer, 10.00 for SEPA

- British pounds20.00 per wire transfer, 7.00 for Faster Payments/CHAPS

- U.S. dollars25.00 per wire transfer

Bar Registration Fee

Goldmoney clients may register specific bars in their name with the vault custodian for a corresponding metal fee.

Physical Redemptions (From Vault)

Direct physical redemptions of precious metals from each vault can be arranged if you own at least 1 kilogram of gold or 1,000 ounces of silver.

An appointment will be made on your behalf, at which time you may visit the vault custodian with necessary paperwork to collect your metal. Any vault or administrative costs associated with taking physical processes will be conveyed to you at the time of your request.

Physical Delivery

You may take physical receipt of your precious metals via our secure and insured delivery services.

Click here to download our full fee schedule.