The real determinants of currency value

Jul 6, 2023·Alasdair MacleodThere are two components to the inflation story: the cycle of bank credit, which left to itself is self-cancelling, and the longer-term erosion of currency values. In examining the causes, this article goes back to monetary basics to explain what is required to make a currency’s purchasing power stable.

Economists generally seem unaware of the importance of credit in the economy. In a world of fiat currencies, they wrongly take central bank currency to be money, and also routinely describe bank credit as money. But they are credit, which drives everything, not only statistically recorded credit, but in our personal relationships as well.

Since the Bretton Woods Agreement was abandoned in 1971, the loss of credit’s attachment to sound money has been ruinous for its purchasing power. These events are obviously linked. Yet the long-term increase in money supply, or more correctly bank credit, is not the main reason for the loss of purchasing power.

In this article I explain that even under a gold standard currency is entirely credit, and why the secret to stabilising its value is to link credit to that of gold, which remains the only true legal money.

Introduction

I have spent most of my working life excoriating Keynesianism’s denial of free markets and over the decades have moved from not fully understanding why statist intervention in the economy is so destructive to being able to thoroughly denounce it on sound theoretical grounds. My journey has taken inspiration from the Austrian School of economics, and from Ludwig von Mises in particular. But the inquiring student should never take everything his favoured professor wrote for granted, and as I have familiarised myself with his logic and analysis, I find myself in a position to enquire more deeply.

An unbiased economist today dismissing Keynesian macroeconomics and monetarism in favour of arguments that disprove them is fully aware that the classical economics formulated under sound money regimes didn’t get everything right. For most, the need to continually examine assumptions was dealt with by the simplicity of just accepting free markets and the division of labour to exploit them, and why they were to society’s benefit. Empirical evidence confirmed that this was so, and that socialism in its various guises was doomed to fail. But Mises was able to put flesh on that skeleton.

Considerable confusion comes from not understanding how statistics and economic reasoning have changed from under conditions of sound money to those of fiat currencies. One can never be sure that a fiat currency’s value in terms of goods is stable. If the currency’s purchasing power changes over time, then long runs of statistics used by econometricians and macroeconomists become completely meaningless, while under a sound money regime we can be sure that for practical purposes they might be worthy of interpretation. At the heart of this problem is the degree to which a currency becomes subjective in its value, when we automatically assume it is always objective and that in transactions the variation of value is entirely in the product being exchanged. On the basis that the medium of exchange is rapidly disposed of in an individual transaction, it might not matter for that specific purpose. But it does matter for the balance of unspent credit liquidity that people normally retain.

Yet today’s economists and laymen rarely, if ever, appear to understand this point, and they are simply mesmerised by their charts and economic models fed with duff information which does not and cannot take a currency’s changing values into account. The early Austrians formed their theories, like everyone else under a base assumption of sound money. And today, many of their sympathisers routinely make a similar mistake as the Keynesians, not understanding how truly subjective currency values and distorted data have become.

If you state that the price of gold has moved from $35 to $1900 today — you are believed because it is there in black and white. But if you say that in 1970 the dollar was worth 1/35 of an ounce of gold and that today it is worth 1/$1900, and that therefore the dollar is worth only 35/1900 or 1.8% of its 1970 value, you can see some surprise in your interlocutor’s face. When you point out that this means the dollar has lost nearly all its value over the last five decades, you may be met with hesitant recognition, but not an understanding of the implications. And when you explain that gold is legal money today and has been since Roman law gave it that status, and that the dollar is only credit and is valued as such, you risk having lost your audience entirely because they are brainwashed into thinking gold is no longer money and the dollar has replaced it. I have even known Austrian economists bend to this propaganda.

Pax scholae Austriacae! Do not throw your toys out of the pram – I shall explain all. But first, we must accept some clear definitions for the purpose of this article.

- Physical gold, normally in coin form, is the only money. Technically, silver and copper coins are as well for small transactions. In fact, they are all credit in the sense that they are the proceeds of one’s labour yet to be spent. But these metals have no counterparty risk and are legally accepted internationally as money and are therefore independent from other forms of national credit. That is why we must call gold money to differentiate it from other forms of credit which do have counterparty risk, being promises to pay at a future date.

- Bank notes, which for many people have replaced gold coin are always credit. Even bank notes freely exchangeable for gold coin at the holder’s option represent credit under the command of the state, issued by its central bank. The counterparty risk may appear minimal, but if it is not anchored to money, which is gold, its value becomes wholly dependent on the faith and credit of the issuer.

- Bank credit in the form of their customer deposits, is as it says on the tin. This category of credit makes up the majority of so-called M2, M3, or M4 money supply. The value of this credit is firmly tied to the bank notes in which it is denominated, with the addition of counterparty risk for individual banks.

- Currency is the term for money and credit in circulation. But since coins are token and no one spends their gold coin except as a last resort, in this article currency refers collectively to the two principal forms of credit: bank notes and bank deposits.

The question to which an answer is sought is as follows: what determines the purchasing power of the currency?

It is only by answering this question that we can know how to address the loss of purchasing power, which in the dollar’s case has reduced it to less than 2% of its 1970 value relative to legal money.

A timeless debate

The true causes of a currency’s loss of purchasing power have been argued intellectually since the science of economics emerged as a separate discipline. And in mid-nineteenth century England, the debate led to two schools of thought. The currency school favoured a rules-based approach to the issuance of currency, while the banking school sought a more flexible approach. One of the currency school’s claims was that money creation should be a state monopoly, which cuts across the Austrian school’s free market philosophy. Indeed, Mises strongly criticised the German historical school and Georg Knapp (who wrote the State Theory of Money, published in 1905) for taking this line.

Otherwise, much of the currency school’s approach found favour with Mises. The debate between the currency and banking schools occurred at the time of the 1844 Bank Charter Act, which set the terms for the Bank of England’s modus operandi subsequently. Under that Act, the entire banking system was reformed, with the issue of banknotes by other banks in first restricted and then ceasing, giving the Bank of England the note-issuing monopoly. This was a win for the currency school. And in our quest to establish what leads to today’s currency debasement, this was an important if poorly understood development.

At the root of the currency school’s argument was the understanding that inflation was caused by the excessive issue of banknotes. This led to the terms of the BoE’s banknote issue tying it to gold by requiring the Bank to cover banknotes over £14m in circulation fully with gold, exchangeable into sovereign coin. While circumstances led to this provision being suspended on three occasions, it limited the expansion of banknotes in circulation.[i]

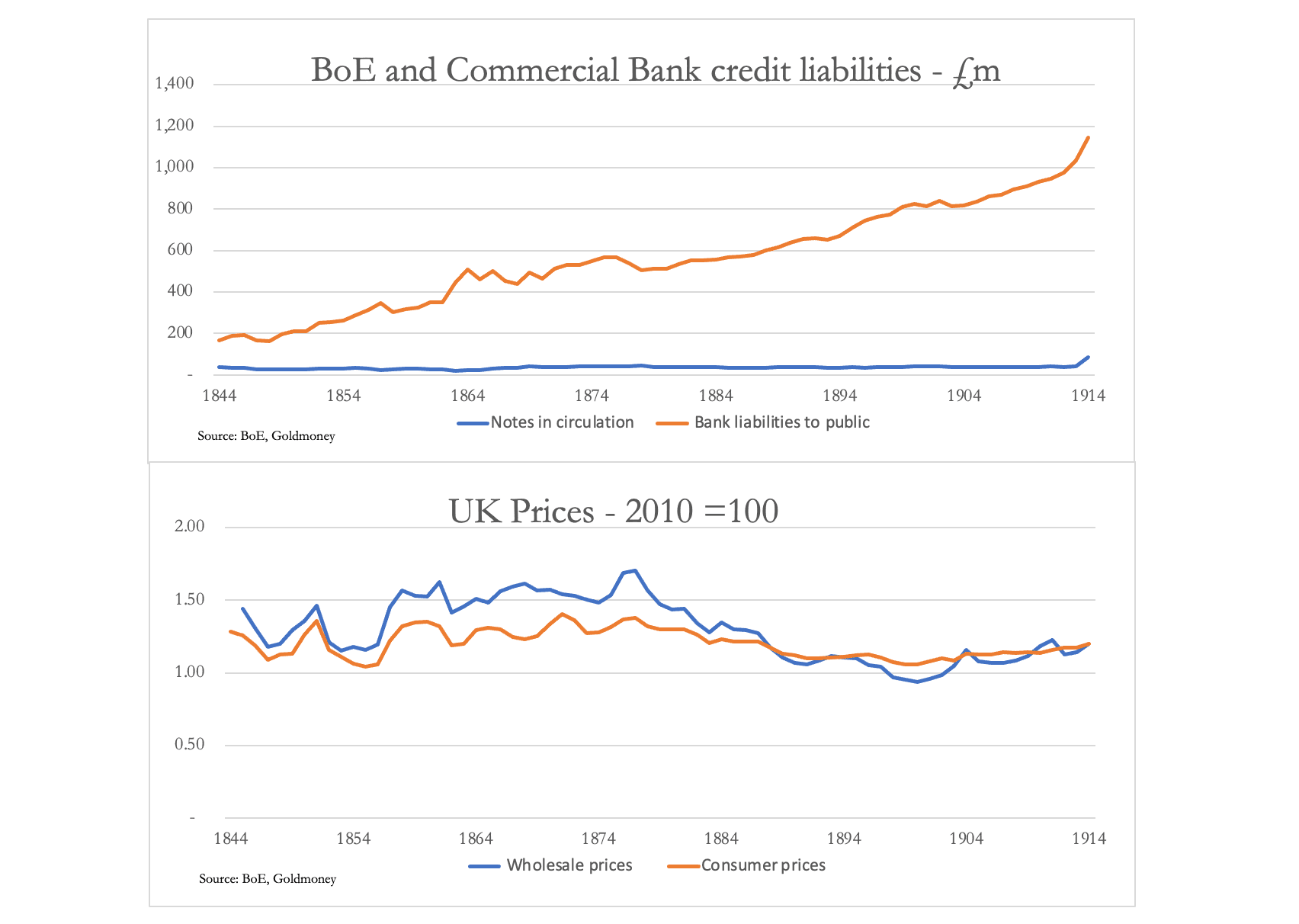

Therefore, between 1844 and 1900, the Bank’s note issue only increased from £37m to £42m[ii]. Meanwhile, the development of joint stock banking led to growing use of cheques drawn upon them substituting for Bank of England notes as payment media. Bank credit in money supply increased from £167m to £824m. The upper chart below shows this relationship up to the declaration of war in 1914, and the lower chart shows estimated consumer and producer price levels.

Clearly, the note issue hardly expanded, while bank credit did multiple times. The currency school’s contention that an expansion of currency undermines its purchasing power appears to apply to the note issue, but not to bank credit. And the long-term expansion of credit not undermining the currency’s purchasing power appears to support theories of the banking school.

But the banking school opposed restrictions on the note issue as well. Its supporters argued that both bank notes and deposits performed the same economic function. The school’s supporters contended that “The amount of paper notes in circulation was adequately controlled by the ordinary processes of competitive banking.” Subsequent evidence displayed in the first chart above shows the banking school was incorrect in their assertion.

At the same time, the currency school argued that demand deposits were not money (currency) and were therefore of no consequence for bank policy and the prevention of financial crises. The school has subsequently been criticised for omitting to understand that bank deposits act as currency.

Interestingly, the decades that followed the 1844 Act showed that the currency school was generally correct to ignore bank credit, if only for the wrong reasons. Bank credit is most certainly circulating currency, but its contribution to the currency’s changing purchasing power appears to be limited to a self-correcting cycle of bank credit leading to booms and busts along the way. But for the longer term, it is the steadiness of the bank note value tied to the gold sovereign and not the level of bank credit in the economy which was important.

The theoretical debate between the two schools was diverted by the 1847 crisis, which led the Bank to suspend gold convertibility at the request of the government. The government faced a crisis from the collapse of a speculative bubble, with many businesses failing. The situation was aggravated, or triggered, by a poor harvest and potato failure leading to increased food imports. Bank credit in 1846 stood at £192m, contracting to £167m in 1947, similar to the problem we might face today. In other words, it was the downturn of the credit cycle exposing malinvestments and excessive speculation which were the problem, not the gold coin standard.

Through the crisis, the Bank of England’s balance sheet was remarkably stable, allowing for an accounting quirk. In 1844, its balance sheet total was £82.9m and in 1847 it had fallen to £59.9m, most of which occurred in 1845. On the face of it, this is a severe contraction. But on its balance sheet the Bank recorded notes held in the bank as both an asset and a liability, which declined by £24.5m between those dates, approximating to the fall in total balance sheet assets. This is an accounting nonsense, because bank notes only have value when they are in public circulation: when they are in the issuer’s possession, they are no more than bits of paper. Therefore, the Bank’s balance sheet net of this anomaly was actually reasonably stable.

While the Bank also acted as a normal bank, taking in deposits and making advances, these do not appear to have been excessive enough to detract from its note issuing function. That there was a run on the Bank’s gold reserves appears to have led to a dip in coin and bullion assets from £13.7m to a trough of about £9.9m in mid-April 1847[iii]. This arose due to an error made by the framers of the 1844 Act, who failed to understand that the run on its gold reserves arose not from one source, but two. They had anticipated that only bank notes could be redeemed for gold coin, not realising that cheques could be used for extracting bullion from the Bank as well. Therefore, the Act was mistakenly predicated on an expectation that a reduction of gold reserves would be matched by a reduction in notes in circulation.

Besides this error, the idea that the decline in gold reserves threatened the currency school concept with respect to the note issue overlooks the actuality. Bank notes in circulation held steady at about £20m, and that being the case, the public obviously regarded gold-backed BoE banknotes as safety during the crisis, which surely, was the legislators’ intention. For so long as the public have confidence in the gold coin exchange facility, it sees little need to hold gold coins.

The error committed by the Bank leading to the Act’s suspension was to not raise the discount rate earlier, and only then by too little. The crisis commenced in 1846, and the drain on the Bank’s gold reserves began. But the Bank did not raise the discount rate until 16 January the following year from 3% to 3 ½%. The run on its gold reserves continued, so a fortnight later the discount rate was raised to 4%. The run still continued until it lost another £3m in gold, when it then raised it to 5% on 10 April. If the Bank had raised its discount rate earlier and more aggressively, the run on its gold reserves would not have happened.

The 1847 crisis, so soon after the Bank Charter Act, has been taken by economists in the twentieth century as evidence that a gold standard is a straitjacket, preventing economic flexibility, seemingly supporting the Banking School’s approach. But we saw what we observe exhibited by central banks today: a government agency not taking a purely commercial approach to its own business.

As always, the situation is more complex than snap judgements on matters of principal. A deeper understanding of the role of credit is necessary.

Bank credit is central to our monetary system

As stated above, credit comes in two recognisable forms. There are bank notes, today issued by central banks but formally issued by commercial banks as well. These notes are a liability of the issuer and appear on a central bank’s balance sheet as such. And there is bank credit, the liability of commercial banks in the form of customer deposits, checking, or current accounts. Unofficially, credit also exists in shadow banking and further credit goes unrecorded between individuals.

Credit among individuals is an economic factor of the greatest importance, yet few economists appear to be aware of this fact. A father might tell his son or daughter that he will fund him or her through university. That is credit extended by a parent to a child. A local shop might offer an account for valued customers, allowing them to pay weekly or monthly, rather than as they spend. A builder or gardener will offer credit to customers by doing their work in anticipation of payment when the work is done. It is all credit.

Wholesalers offer retailers the facility to pay for goods a month after delivery, or even more — that is credit. When a trader buys securities for settlement the following day, that is credit until it is settled. The purchase of a futures contract on margin is a credit obligation for the full amount unless the obligation is sold before expiry. The examples in our daily life are numerous. These informal or non-banking arrangements are vital to the functioning of society, greasing the wheels of personal and business relationships. All this goes unrecorded in the monetary statistics.

Given the ubiquity of credit, would it be right to entirely ban banks as dealers in credit, who formalise credit arrangements benefiting trade, and whose credit is only a small part of the real total? But the whole economy revolves on credit. If there was no credit, the economy would cease to exist. And if there was no bank credit, we would simply return to feudalist conditions.

In accordance with Gresham’s law, people hoard gold coin instead spending bank notes and deposits. Everything is done on credit. Gold coin does not circulate, even under a gold standard, because people realise it is superior money to notes and deposit money. It is there as a backstop to bank notes and deposit accounts. And a population confident that it can always exchange bank notes for gold coin has little or no need to hold gold coin. Bank notes and bank deposits are far more convenient anyway. The stability of the BoE’s note issue during the 1847 crisis mentioned above refers.

So far, we can probably agree there is little contentious in these statements. When we take the subject further the disagreements arise. Gold should no longer be part of a modern monetary system, argue neo-Keynesians and most monetarists. Credit expansion is the source of inflation, argue others, particularly monetarists and the Austrians.

The Austrian tradition is exemplified by the writings of Ludwig von Mises and Friedrich von Hayek. Mises observed the effects of inflation in Europe after the First World War, particularly in his native Austria. He understood why the crown collapsed and knew the remedy. Since then, he wrote extensively about the business, or trade cycle, undoubtedly caused by a cycle of bank credit expansion and subsequent contraction. But in all his writings, collectively running to over 7,000 pages, he mentions “bank credit” surprisingly little. In a word-search I counted only sixteen references to the phrase. It is not even listed in the glossary to the scholars’ edition of Human Action.

Mises’s lecture to the Vienna Congress of the International Chamber of Commerce on May 1933 is typical, when he stated that “The cause of the exchange rate’s depreciation is always to be found in inflation, and the only remedy for fighting it is a restriction of fiduciary media and bank credit”. That was one of the sixteen references to bank credit. But nowhere in his comments, so far as I can see, does he recommend a complete ban on bank credit — only its containment.

Hayek devised a triangle to illustrate to his students at the LSE the consequences of an artificial lowering of interest rates — the consequence of interest rate suppression and consequently credit expansion. It is tempting for the followers of these great men to conclude that credit must be banned if the purchasing power of currency is to be preserved. But we must acknowledge that a wholesale currency collapse through continual and accelerating debasement, such as that which afflicted Austria in 1922, is an entirely different matter from a cycle of bank credit.

But is banning bank credit practicable? The timing for raising the question is propitious, since we appear to be on the verge of another bank induced slump, this time of such potential severity that it could threaten the future of the entire banking structure from central banks downwards. But if bank credit expansion has an economic role that can be justified, then its replacement could end up being less beneficial, particularly if the state takes the initiative in establishing a different banking system. If it does, we can be sure it would be designed to serve the state more than the productive economy.

Some neo-Austrians put forward a simple proposition. That is, they recommend the ending of bank credit with banking being split into banks acting as custodians, the deposits remaining the property of the depositors, or as arrangers of finance to distribute savings to businesses in need of investment capital — never both. The world of circulating media supposedly becomes free of bank credit and from all the problems that it has created.

We should ask ourselves whether this is the nut we need to crack. Cycles of expansion and contraction of bank credit have existed for as long as we have statistical evidence. It dates back to Roman Law and the invention of double-entry bookkeeping. And yet we are still here and have a better standard of living than our forebears. It fuelled the industrial revolution. But with a time-lag, the price effect of changes in bank credit levels even under a gold coin standard did lead to significant fluctuations in the general price level, the consequence of the expansion and subsequent contraction of bank credit — credit-driven booms and busts. The length of time whereby bankers seem to forget the consequences of excessive credit expansion for their own operations is roughly eight to ten years, a periodicity which still held until the Lehman crisis.

In the nineteenth century, government economic policy was broadly to mind its own business and to let events in the economy take their course. Interestingly, fluctuations in the general level of prices in the United Kingdom diminished over the century, during which time the underlying trend of bank credit outstanding expanded significantly on the back of collective wealth, trade, and technological progress. Clearly, growing financial sophistication of credit markets was having a beneficial effect, particularly following the Bank Charter Act of 1844 which in its framing omitted to recognise the potential of bank credit to destabilise the gold-backed currency. This point is examined in greater detail later in this article.

Therefore, a question is raised as to whether fluctuations in bank credit are the evil some neo-Austrians believe. Could it be that the greater evil is central banking intervention — attempts that turned into efforts to manage demand for bank credit though interest rate policies in the decades following the First World War? If so, a solution whereby no bank credit is created is not the remedy, but the abolition of central banking’s attempts to manipulate credit markets makes more sense.

The difficulty with Mises’s analysis of bank credit

In his The Theory of Money and Credit Mises attempted to differentiate between deposits representing savings loaned through the banking system to investing businesses, and what he termed circulation credit extended by banks in the form of demand deposits created for the purpose. He argued that it was the expansion of circulating credit in excess of genuine savings available for general lending that led to artificial booms, inflation, and subsequent slumps.

His reasoning was from a purely theoretical standpoint, disregarding the legal position to make the point that excess credit always led to a reduction in its purchasing power. That is certainly evident in the cycle of bank credit, but the artificial division of credit originating from savings and that which does not cannot be established.

In search of the theory behind inflation, Mises’s description of the process of bank credit creation is at variance with the facts. In Chapter 2 of Part 3 of Mises’ The Theory of Money and Credit, under “The two ways of issuing fiduciary media” he wrote the following:

“Fiduciary media may be issued in either of two ways: by banks, and otherwise. Bank fiduciary media are characterized by being dealt with as constituting a debt of the issuing body.

They are entered as liabilities, and the issuing body does not regard the sum issued as an increase of its income or capital, but as an increase on the debit side of its account, which must be balanced by a corresponding increase on the credit side if the whole transaction is not to figure as a loss.”

In his argument about excess credit, Mises infers that bank loans (assets) come into existence via deposit creation (liabilities), which is incorrect.

This is not how bank deposits originate.

Since the London goldsmiths invented modern banking in the seventeenth century, under banking law and in practice banks have been dealers in credit, not intermediaries. Loans are created with matching deposits. We must accept that Mises was making a separate and valid point. But from the quote above, he appeared to make the common error of believing that it works the other way round. The following is an extract from Money creation in the modern economy, published by the Bank of England in its Quarterly Review for 2014 Q1:

“Commercial banks create money, in the form of bank deposits, by making new loans. When a bank makes a loan, for example to someone taking out a mortgage to buy a house, it does not typically do so by giving them thousands of pounds worth of banknotes. Instead, it credits their bank account with a bank deposit of the size of the mortgage. At that moment, new money is created. For this reason, some economists have referred to bank deposits as ‘fountain pen money’, created at the stroke of bankers’ pens when they approve loans.”

The Bank of England’s description of loan creation with deposits matching them was clearly laid out by Henry Dunning Macleod, a barrister specialising in banking law in the second half of the nineteenth century.[iv] The principal is fundamental to banking practice.

Therefore, every deposit is the result of a loan; the loan is not the result of a deposit. There can be no practical distinction between savings deposits and credit created specifically to fund circulation credit. All bank credit is created out of loans. When the loan is drawn down by the borrower to pay third parties, it is by cheque, or more commonly today by electronic transfer. The payment comes out of the deposit which matches the loan on the bank’s balance sheet, and is either encashed for bank notes, or more commonly transferred to the recipient’s bank. All banks continually experience these transfers, and some will end up with an excess of balance sheet assets, and some with a deficiency. These imbalances are continually rectified through money markets.

Today’s inflation fallacies

Central banks attempt to manage the depreciation of their currencies so that they lose two per cent of their value annually. This is supposed to stimulate consumer demand and provide a margin of safety over the feared condition of a recession in business activity. Policy makers believe that by managing the level of interest rates they affect how much households and companies want to borrow. They attempt to achieve this by influencing the loan rates charged by banks, and consequently by managing the growth of bank credit to ensure a low and stable rate of inflation. But recent experience has shown how this policy fails. Whether through a bias towards interest rate suppression or errors in macroeconomic policy, interest rates ended up being artificially suppressed for a considerable time and consequently have had to be raised sharply to correct this error.

The mistake among many mistakes is to believe that interest rates represent the price of credit. It may appear to be so for borrowers. But as we have seen above, loan creation creates deposits. For depositors retaining their deposits or disposing them for bonds, interest represents the discount of future possession of currency relative to its possession today. The components are time preference representing loss of use, counterparty risk, and anticipated changes in a currency’s purchasing power before it is returned to the lender. From the depositor’s viewpoint, interest is compensation for deferring his consumption, not a price.

For a time, domestic holders of a currency can be corralled by a monopolist state into accepting a rate of interest which does not compensate them adequately. The problem with this policy nearly always arises on the foreign exchanges first, where international depositors and bond holders will readily sell a currency whose interest compensation is judged by them to be inadequate.

As well as misrepresenting the role of interest rates, central banks are misled by other macroeconomic fallacies. A government agency constructs the statistics upon which it models the economy, and over time these statistics inevitably become self-serving. The growth target does not represent economic progress which cannot be measured, only observed. The list of errors is extensive, and the suppositions behind them have become risible, if it was not so serious.

But the most obvious error which nearly everyone ignores is to take historic and static evidence as the basis for forecasting a dynamic future which depends on unforecastable human action. It is what Mises called the concept of an evenly rotating economy, “where everything is imagined to continue exactly as before, including all human ideas and goals”.[v]

Another fallacy is that of the monetarists who mechanically link changes in the quantity of credit with changes in a currency’s purchasing power. Monetarist theories were behind the currency school’s stance in the 1840s, ahead of and following the Bank Charter Act of 1844. Today, monetarists argue that changes in the quantity of credit should inform monetary policy, which is not the same objective as the currency school had in the framing of the 1844 Act. But the root of their understanding is unchanged, despite the transition from credit anchored to money to credit anchored to nothing at all. It is based on the monetarist’s equation:

Money supply times velocity = prices of goods and services times their quantity

Mises pointed out the errors in this line of thinking in his Human Action. It is true that an increase in the quantity of credit tends to raise prices, but the effect is uneven. Furthermore, the public’s anticipation of future prices is based on their most recent experience, and they will adjust the relationship between goods and services being purchased and their credit resources accordingly. If the public collectively begins to believe that prices generally will rise at a higher rate, then it adjusts the ratio between spending and their cash resources accordingly by accelerating their purchases. And if the public awakens to the possibility that it is currency which is falling in value rather than prices rising, they will dump their currency entirely.

It can be seen therefore, that the equation of exchange which attempts to balance itself with a mythical value of velocity ignores the human element in valuing currency. If in a banking crisis the public anticipates an inflationary response from the authorities, they will dispose of the currency while they can. Becoming valueless is the fate of every fiat currency in history, and doubtless will be that of today’s major currencies, unless the authorities can stabilise their purchasing power by bringing back money into the credit equation.

The true determinants of price stability

The failures of economic and monetary policy are obvious and need not be investigated further. But in our search for price stability, there are two specific elements to consider. The first is the instability of prices due to the cycle of bank credit expansion and contraction which are self-correcting over the cycle, and the second is the long-term prospects for the purchasing power of credit.

Let us remind ourselves of the evidence from Britain in the nineteenth century by repeating the charts above.

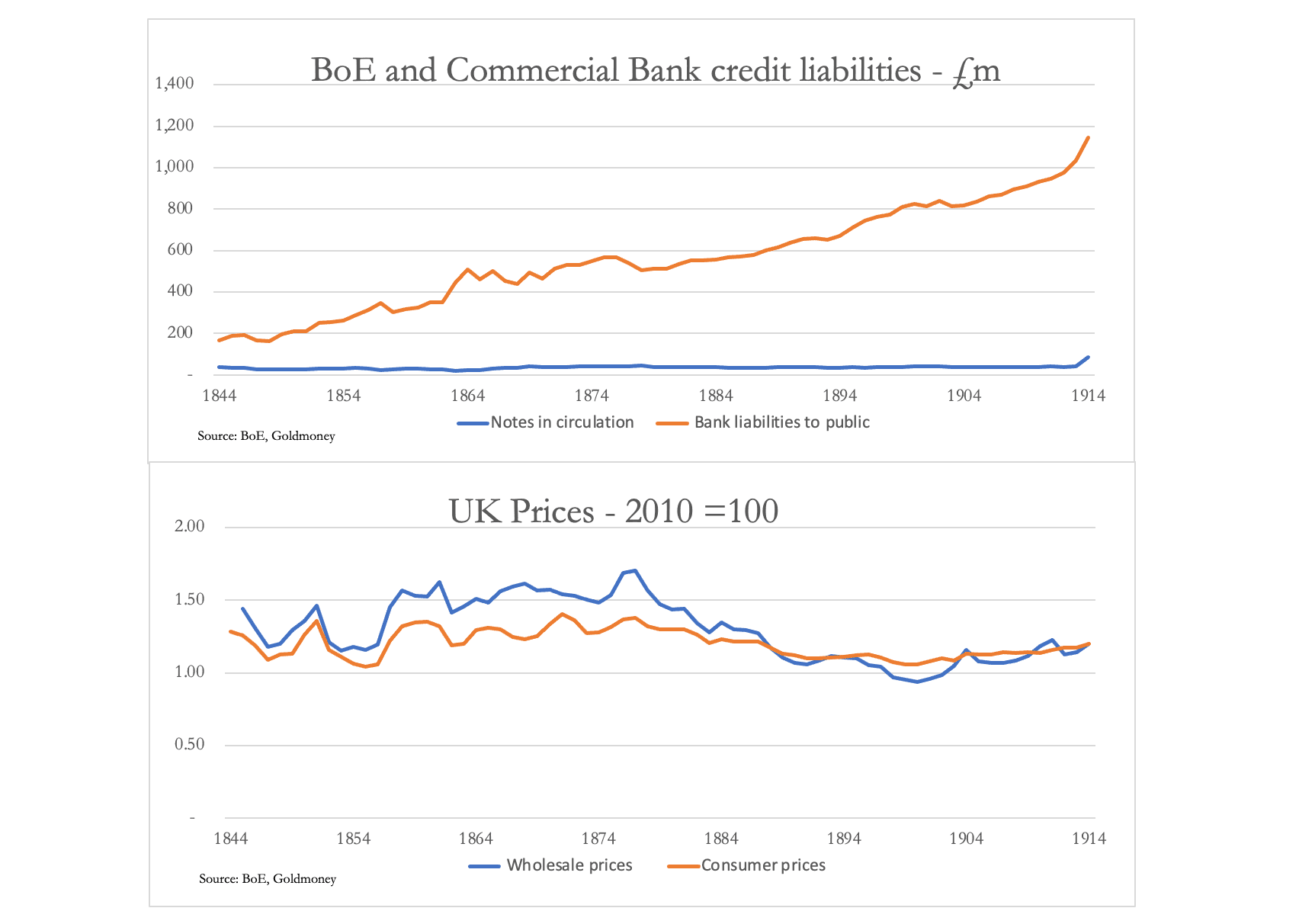

We can see from the first chart how under a gold coin exchange standard, the note issue was stable while bank credit expanded. The crises of 1847, 1857, and 1866 which led to the suspension of the Bank Charter Act of 1844 are notably reflected in wholesale price fluctuations in the lower chart, but the self-correcting nature of disruption to the general price level generally applies. This is evident in the next chart, which is of consumer price inflation.

The effect of the bank credit cycle on prices is clearly shown, and the average rate recorded over the sixty years was a positive 0.3% as the swings cancelled themselves out. Allowing for the impracticality of actually measuring the general price level and the errors in statistical back calculation, it is nothing. But over time as the 1844 Act bedded in, the swings between inflation and disinflation diminished. This was undoubtedly aided by improvements in the clearing system.

Before 1775, every banker had to maintain bank notes, or alternatively draw cheques against the Bank of England with which to settle differences with other banks on a daily basis. After 1775, London banks got together in a room which acted as their clearing house to settle their mutual claims against each other instead of sending clerks out to visit each individual counterparty bank.

Bank notes were still partially used. In 1810, 46 banks were recorded as clearing about £4,700,000 daily, of which £220,000 were settled in bank notes. These are the equivalent today of £1.88bn and £88m respectively. In 1854 the joint stock banks were admitted to the clearing house, and in 1864 the Bank of England joined the system. In 1860, a clearing house was also established for the country banks, which allowed the national banking network to operate as one, using bank credit to settle differences without the use of notes and coin. And by 1875, over £6bn (equivalent to £2.4 trillion today) were interchanged that year between the clearing banks.

As well as improvements in the credit system, and the continuing improvements in the banking system, doubtless the public’s growing confidence in the gold standard and the banking system generally contributed to declining volatility in the general level of prices.

Conclusions

In our search for price stability, we must differentiate between disruption due to cyclical factors and those of the longer term. Money does not usually circulate — it is credit in the form of bank notes and bank deposits which make up the entire circulating media. Mostly this is credit in favour of depositors, originating from the creation of loans. While we can explain the consequences for the economy and the currency’s purchasing power, the cycles are self-cancelling in a Schumpeterian process of creative destruction.

It is a mistake to think we can do without credit, let alone its expansion. But the less volatile its cyclical expansion and contraction, the less economically disruptive bank credit becomes.

Dealing with cyclical factors by, for example, removing limited liability from bankers to discourage them from excessive balance sheet leverage, we are left with the quantity of bank credit in the economy being set by economic demand for it. This economic demand must originate from the markets and cannot be managed by central banks, as events have proved. From the BoE failing to raise interest rates in a timely fashion during the 1847 crisis to today, central banks have demonstrated their commercial and economic ineptness.

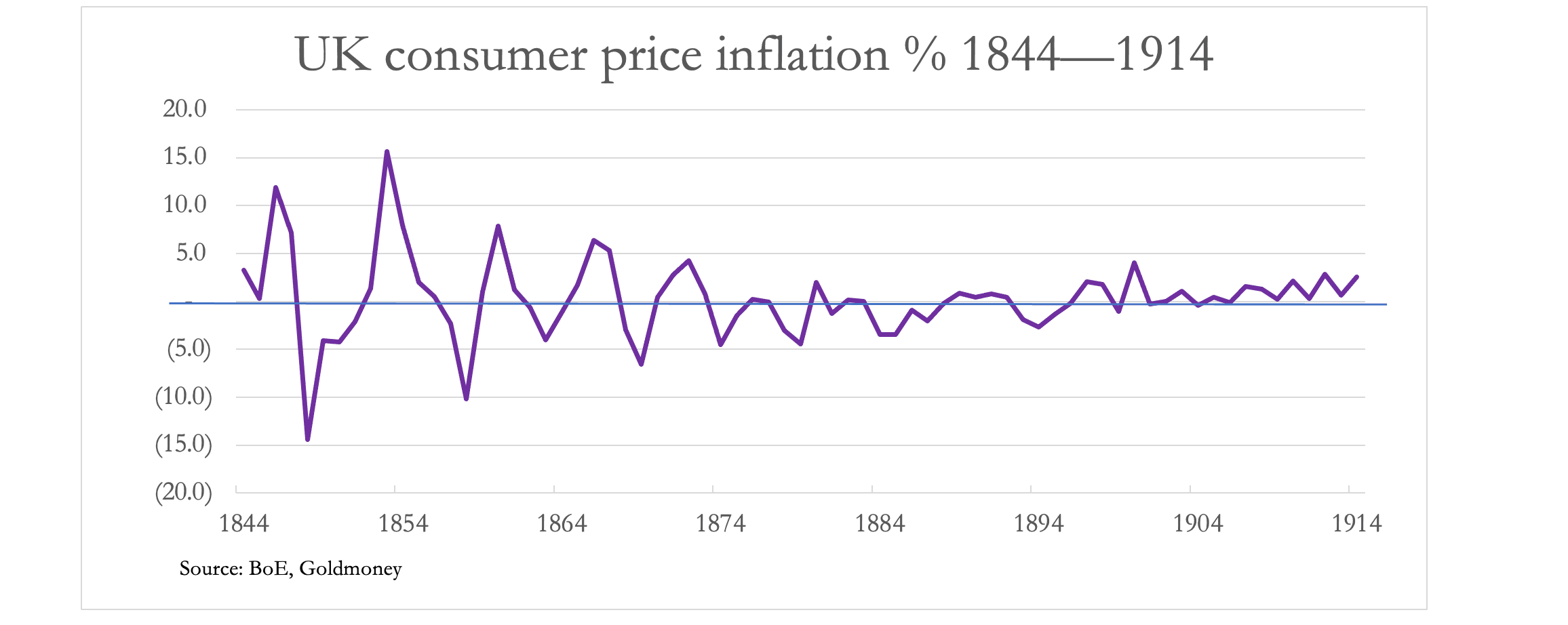

We have seen that under a gold coin exchange standard, bank credit can expand significantly over time without undermining the currency’s purchasing power. Confirming this finding, our next chart shows oil priced in dollars and gold in the twenty-one years before the Bretton Woods Agreement was abandoned in 1971, and subsequently.

Even under this barely tangential relationship between the dollar and gold under Bretton Woods, we can see that before the Agreement was abandoned, the price of oil in both dollars and gold was remarkably stable. And when the Agreement was abandoned, not only did the oil price in dollars soar, but it became extremely volatile. Undoubtedly, even the considerably lower volatility measured in gold grammes was increased above what it would otherwise be by the disruptive influence of the reserve currency which sought to replace it.

Another comparison is of residential house prices in London.

Again, we can see how house prices have soared in volatile fiat sterling, while they have been remarkably stable in gold.

The key to long-term price stability it to ensure that bank notes are firmly tied to gold by being exchangeable for coin. Assuming sensible measures to discourage the excesses of the bank credit cycle, only then can the entire system of credit respond to economic demands for it, and its value remain stable over the long term with minimised fluctuations in the short term.

[i] In 1847, England suffered a poor wheat harvest and the failure of the potato crop, leading to a surge in food imports and an outflow of gold. In 1857, following price rises of raw materials and freight charges caused by the Crimean War, the Indian mutiny and financial crisis in America led to bank failures of connected banks in London. And in 1866, Overend Gurney failed, a bank whose importance to the British financial system was probably as significant as that of JPMorgan Chase to that of the American financial system today.

[ii] Bank of England’s Quarterly Bulletin 1969: The Bank of England note: a short history. The Bank was empowered to issue notes to a ceiling of £14m, any excess had to be fully covered by gold.

[iii] See HD Macleod’s Elements of Banking (1876) pp 212

[iv] Ibid.

[v] Human Action, glossary.