The failure of fiat currencies and the implications for gold and silver

Apr 14, 2022·Alasdair MacleodThis is the background text of my Keynote Speech given yesterday to European Gold Forum yesterday, 13 April.

To explain why fiat currencies are failing I started by defining money. I then described the relationship between fiat money and its purchasing power, the role of bank credit, and the interests of central banks.

Undoubtedly, the recent sanctions over Russia will have a catastrophic effect for financialised currencies, possibly leading to the end of fifty-one years of the dollar regime. Russia and China plan to escape this fate for the rouble and yuan by tying their currencies to commodities and production instead of collapsing financial assets. The only way for those of us in the West to protect ourselves is with physical gold, which over time is tied to commodity and energy prices.

At the end of the day, what constitutes money has always been determined by its users as the means of exchanging their production for consumption in an economy based on the division of labour. Money is the bridge between the two, and while over the millennia different media of exchange have come and gone, only metallic money has survived to be trusted. These are principally gold, silver, and copper. Today the term usually refers to gold, which is still in government reserves, as the only asset with no counterparty risk. Silver, which as a monetary asset declined in importance as money after Germany moved to a gold standard following the Franco-Prussian war, remains a monetary metal, though with a gold to silver ratio currently over 70 times, it is not priced as such.

For historical reasons, the world’s monetary system evolved based on English law. Britain, or more accurately England and Wales, still respects Roman, or natural law with respect to money. To this day, gold sovereign coins are legal tender. Strictly speaking, metallic gold and silver are themselves credit, representing yet-to-be-spent production. But uniquely, they are no one’s liability, unlike banknotes and bank deposits. Metallic money therefore has this exceptional status, and that fact alone means that it tends not to circulate, in accordance with Gresham’s Law, so long as lesser forms of credit are available.

Money shares with its currency and credit substitutes a unique position in criminal law. If a thief steals money, he can be apprehended and charged with theft along with any accomplices. But if he passes the money on to another party who receives it in good faith and is not aware that it is stolen, the original owner has no recourse against the innocent receiver, or against anyone else who subsequently comes into possession of the money. It is quite unlike any other form of property, which despite passing into innocent hands, remains the property of the original owner.

In law, cryptocurrencies and the mooted central bank digital currencies are not money, money-substitutes, or currencies. Given that a previous owner of stolen bitcoin sold on to a buyer unaware it was criminally obtained can subsequently claim it, there is no clear title without full provenance. In accordance with property law, the United States has ruled that cryptocurrencies are property, reclaimable as stolen items, differentiating cryptocurrencies from money and currency proper. And we can expect similar rulings in other jurisdictions to exclude cryptocurrencies from the legal status as money, whereas the position of CBDCs in this regard has yet to be clarified. We can therefore nail to the floor any claims that bitcoin or any other cryptocurrency can possibly have the legal status required of money.

Under a proper gold standard, currency in the form of banknotes in public circulation was freely exchangeable for gold coin. So long as they were freely exchangeable, banknotes took on the exchange value of gold, allowing for the credit standing of the issuer. One of the issues Sir Isaac Newton considered as Master of the Royal Mint was to what degree of backing a currency required to retain credibility as a gold substitute. He concluded that that level should be 40%, though Ludwig von Mises, the Austrian economist who was as sound a sound money economist as it was possible to be appeared to be less prescriptive on the subject.

The effect of a working gold standard is to ensure that money of the people’s choice is properly represented in the monetary system. Both currency and credit become bound to its virtues. The general level of prices will fluctuate influenced by changes in the quantity of currency and credit in circulation, but the discipline of the limits of credit and currency creation brings prices back to a norm.

This discipline is disliked by governments who believe that money is the responsibility of a government acting in the interests of the people, and not of the people themselves. This was expressed in Georg Knapp’s State Theory of Money, published in 1905 and became Germany’s justification for paying for armaments by inflationary means ahead of the First World War, and continuing to use currency debasement as the principal means of government finance until the paper mark collapsed in 1923.

Through an evolutionary process, modern governments first eroded then took away from the public for itself the determination of what constitutes money. The removal of all discipline of the gold standard has allowed governments to inflate the quantities of currency and credit as a means of transferring the public wealth to itself. As a broad representation of this dilution, Figure 1 shows the growth of broad dollar currency since the last vestige of a gold standard under the Bretton Woods Agreement was suspended by President Nixon in August 1971.

From that date, currency and bank credit have increased from $685 billion to $21.84 trillion, that is thirty-two times. And this excludes an unknown increase in the quantity of dollars not in the US financial system, commonly referred to as Eurodollars, which perhaps account for several trillion more. Gold priced in fiat dollars has risen from $35 when Bretton Woods was suspended, to $1970 currently. A better way of expressing this debasement of the dollar is to say that priced in gold, the dollar has lost 98.3% of its purchasing power (see Figure 4 later in this article).

From that date, currency and bank credit have increased from $685 billion to $21.84 trillion, that is thirty-two times. And this excludes an unknown increase in the quantity of dollars not in the US financial system, commonly referred to as Eurodollars, which perhaps account for several trillion more. Gold priced in fiat dollars has risen from $35 when Bretton Woods was suspended, to $1970 currently. A better way of expressing this debasement of the dollar is to say that priced in gold, the dollar has lost 98.3% of its purchasing power (see Figure 4 later in this article).

While it is a mistake to think of the relationship between the quantity of currency and credit in circulation and the purchasing power of the dollar as linear (as monetarists claim), not only has the rate of debasement accelerated in recent years, but it has become impossible for the destruction of purchasing power to be stopped. That would require governments reneging on mandated welfare commitments and for them to stand back from economic intervention. It would require them to accept that the economy is not the government’s business, but that of those who produce goods and services for the benefit of others. The state’s economic role would have to be minimised.

This is not just a capitalistic plea. It has been confirmed as true countless times through history. Capitalistic nations always do better at creating personal wealth than socialistic ones. This is why the Berlin Wall was demolished by angry crowds, finally driven to do so by the failure of communism relative to capitalism just a stone’s throw away. The relative performance of Hong Kong compared with China when Mao Zedong was starving his masses on some sort of revolutionary whim, also showed how the same ethnicity performed under socialism compared with free markets.

Monetarists make little or no allowance for these factors, claiming that the purchasing power of a currency is inversely proportional to its quantity. While there is much truth in this statement, it is only suited for a proper gold-backed currency, when one community’s relative valuations between currency and goods are brought into line with the those of its neighbours through arbitrage, neutralising any subjectivity of valuation.

The classical representation of the monetary theory of prices does not apply in conditions whereby faith in an unbacked currency is paramount in deciding its utility. A population which loses faith in its government’s currency can reject it entirely despite changes in its circulating quantity. This is what wipes out all fiat currencies eventually, ensuring that if a currency is to survive it must eventually return to a credible gold exchange standard.

The weakness of a fiat currency was famously demonstrated in Europe in the 1920s when the Austrian crown and German paper mark were destroyed. Following the Second World War, the Japanese military yen suffered the same fate in Hong Kong, and Germany’s mark for a second time in the mid 1940s. More recently, the Zimbabwean dollar and Venezuelan bolivar have sunk to their value as wastepaper — and they are not the only ones.

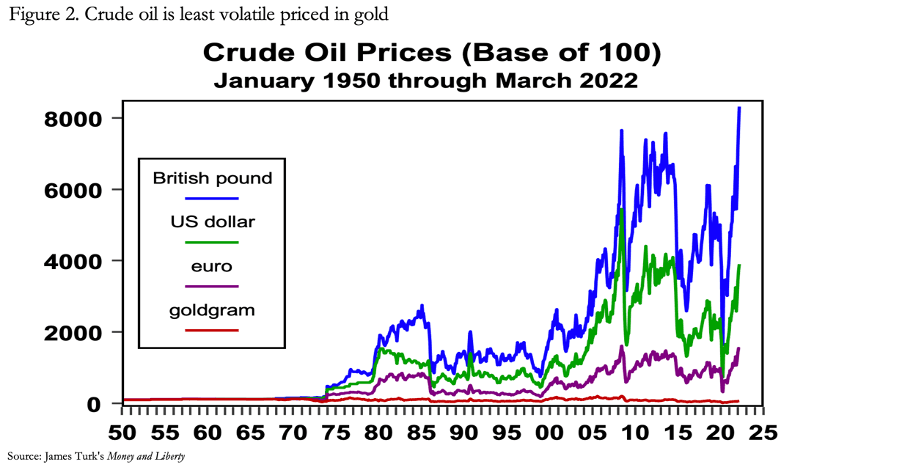

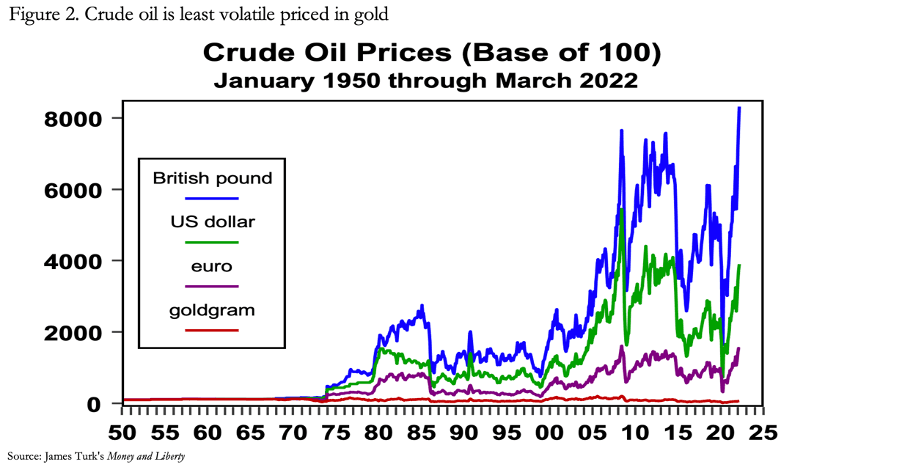

Ultimately it is the public which always determines the use value of a circulating medium. Figure 2 below, of the oil price measured in goldgrams, dollars, pounds, and euros shows that between 1950 and 1974 a gold standard even in the incomplete form that existed under the Bretton Woods Agreement coincided with price stability.

It took just a few years from the ending of Bretton Woods for the consequences of the loss of a gold anchor to materialise. Until then, oil suppliers, principally Saudi Arabia and other OPEC members, had faith in the dollar and other currencies. It was only when they realised the implications of being paid in pure fiat that they insisted on compensation for currency debasement. That they were free to raise oil prices was the condition upon which the Saudis and the rest of OPEC accepted payment solely in US dollars.

In the post-war years between 1950 and 1970, US broad money grew by 167%, yet the dollar price of oil was unchanged for all that time. Similar price stability was shown in other commodities, clearly demonstrating that the quantity of currency and credit in circulation was not the sole determinant of the dollar’s purchasing power.

Under the British gold standard of the nineteenth century, the fluctuations in the willingness of banks to lend resulted in periodic booms and slumps, so it is worthwhile examining this phenomenon, which has become the excuse for state intervention in financial markets and ultimately the abandonment of gold standards entirely.

Banks are dealers in credit, lending at a higher rate of interest than they pay to depositors. They do not deploy their own money, except in a general balance sheet sense. A bank’s own capital is the basis upon which a bank can expand its credit.

The process of credit creation is widely misunderstood but is essentially simple. If a bank agrees to lend money to a borrowing customer, the loan appears as an asset on the bank’s balance sheet. Through the process of double entry bookkeeping, this loan must immediately have a balancing entry, crediting the borrower’s current account. The customer is informed that the loan is agreed, and he can draw down the funds credited to his current account from that moment.

No other bank, nor any other source of funding is involved. With merely two ledger entries the bank’s balance sheet has expanded by the amount of the loan. For a banker, the ability to create bank credit in this way is, so long as the lending is prudent, an extremely profitable business. The amount of credit outstanding can be many multiples of the bank’s own capital. So, if a bank’s ratio of balance sheet assets to equity is eight times, and the gross margin between lending and deposits is 3%, then that becomes a gross return of 24% on the bank’s own equity.

The restriction on a bank’s balance sheet leverage comes from two considerations. There is lending risk itself, which will vary with economic conditions, and depositor risk, which is the depositors’ collective faith in the bank’s financial condition. Depositor risk, which can lead to depositors withdrawing their credit in the bank in favour of currency or a deposit with another bank, can in turn originate from a bank offering an interest rate below that of other banks, or alternatively depositors concerned about the soundness of the bank itself. It is the combination of lending and depositor risk that determines a banker’s view on the maximum level of profits that can be safely earned by dealing in credit.

An expansion in the quantity of credit in an economy stimulates economic activity because businesses are tricked into thinking that the extra money available is due to improved trading conditions. Furthermore, the apparent improvement in trading conditions encourages bankers to increase lending even further. A virtuous cycle of lending and apparent economic improvement gets under way as the banking cohort takes its average balance sheet assets to equity ratio from, say, five to eight times, to perhaps ten or twelve. Competition for credit business then persuades banks to cut their margins to attract new business customers. Customers end up borrowing for borrowing’s sake, initiating investment projects which would not normally be profitable.

Even under a gold standard lending exuberance begins to drive up prices. Businesses find that their costs begin to rise, eating into their profits. Keeping a close eye on lending risk, bankers are acutely aware of deteriorating profit prospects for their borrowers and therefore of an increasing lending risk. They then try to reduce their asset to equity ratios. As a cohort whose members are driven by the same considerations, banks begin to withdraw credit from the economy, reversing the earlier stimulus and the economy enters a slump.

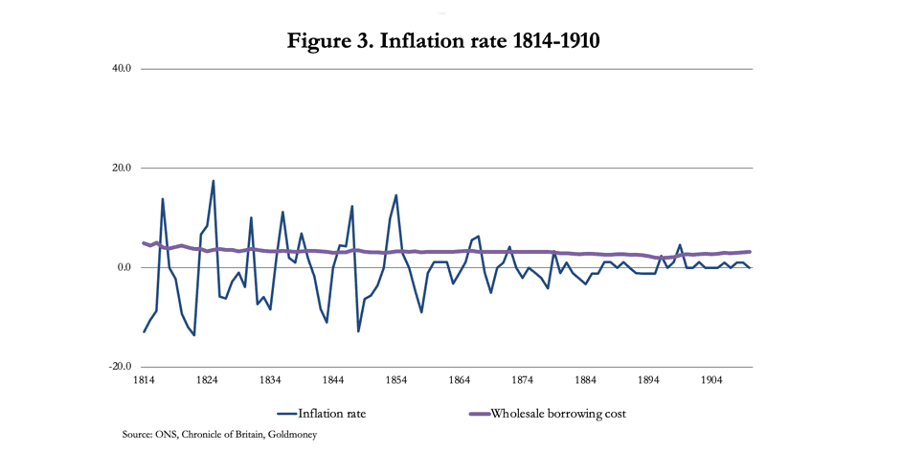

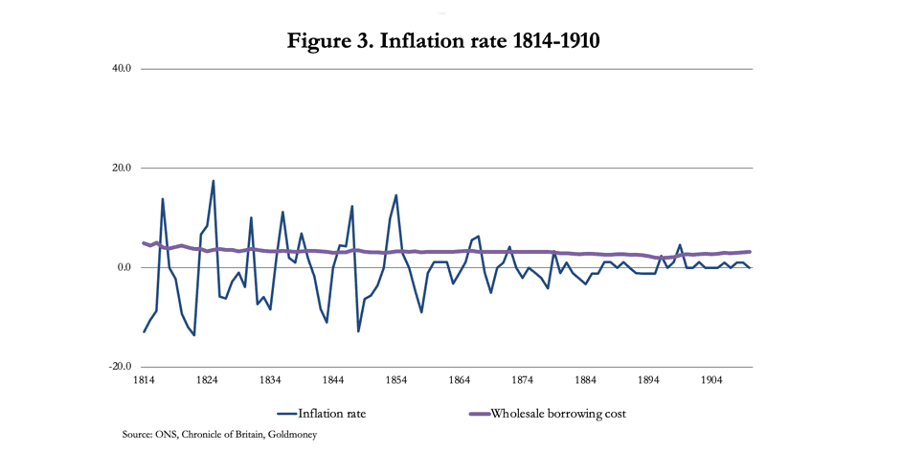

This is a simplistic description of a regular cycle of fluctuating bank credit, which historically varied approximately every ten years or so, but could fluctuate between seven and twelve. Figure 3 illustrates how these fluctuations were reflected in the inflation rate in nineteenth century Britain following the introduction of the sovereign gold coin until just before the First World War.

Besides illustrating the regularity of the consequences of a cycle of bank credit expansion and contraction marked by the inflationary consequences, Figure 3 shows there is no correlation between the rate of price inflation and wholesale borrowing costs. In other words, modern central bank monetary policies which use interest rates to control inflation are misconstrued. The effect was known and named Gibson’s paradox by Keynes. But because there was no explanation for it in Keynesian economics, it has been ignored ever since. Believing that Gibson’s paradox could be ignored is central to central bank policies aimed at taming the cycle of price inflation.

In the second half of the nineteenth century, central bank intervention started with the Bank of England assuming for itself the role of lender of last resort in the interests of ensuring economically destabilising bank crises were prevented. Intervention in the form of buying commercial bank credit stopped there, with no further interest rate manipulation or economic intervention.

The last true slump in America was in 1920-21. As it had always done in the past the government ignored it in the sense that no intervention or economic stimulus were provided, and the recovery was rapid. It was following that slump that the problems started in the form of a new federal banking system led by Benjamin Strong who firmly believed in monetary stimulation. The Roaring Twenties followed on a sea of expanding credit, which led to a stock market boom — a financial bubble. But it was little more than an exaggerated cycle of bank credit expansion, which when it ended collapsed Wall Street with stock prices falling 89% measured by the Dow Jones Industrial Index. Coupled with the boom in agricultural production exaggerated by mechanisation, the depression that followed was particularly hard on the large agricultural sector, undermining agriculture prices worldwide until the Second World War.

It is a fact ignored by inflationists that first President Herbert Hoover, and then Franklin Roosevelt extended the depression to the longest on record by trying to stop it. They supported prices, which meant products went unsold. And at the very beginning, by enacting the Smoot Hawley Tariff Act they collapsed not only domestic demand but all domestic production that relied on imported raw materials and semi-manufactured products.

These disastrous policies were supported by a new breed of economist epitomised by Keynes, who believed that capitalism was flawed and required government intervention. But proto-Keynesian attempts to stimulate the American economy out of the depression continually failed. As late as 1940, eleven years after the Wall Street Crash, US unemployment was still as high as 15%. What the economists in the Keynesian camp ignored was the true cause of the Wall Street crash and the subsequent depression, rooted in the credit inflation which drove the Roaring Twenties. As we saw in Figure 3, it was no more than the turning of the long-established repeating cycle of bank credit, this time fuelled additionally by Benjamin Strong’s inflationary credit expansion as Chairman of the new Fed. The cause of the depression was not private enterprise, but government intervention.

It is still misread by the establishment to this day, with universities pushing Keynesianism to the exclusion of classic economics and common sense. Additionally, the statistics which have become a religion for policymakers and everyone else are corrupted by state interests. Soon after wages and pensions were indexed in 1980, government statisticians at the Bureau of Labor Statistics began working on how to reduce the impact on consumer prices. An independent estimate of US consumer inflation put it at well over 15% recently, when the official rate was 8%.[i]

Particularly egregious is the state’s insistence that a target of 2% inflation for consumer prices stimulates demand, when the transfer of wealth suffered by savers, the low paid and pensioners deprived of their inflation compensation at the hands of the BLS is glossed over. So is the benefit to the government, the banks, and their favoured borrowers from this wealth transfer.

The problem we now face in this fiat money environment is not only that monetary policy has become corrupted by the state’s self-interest, but that no one in charge of it appears to understand money and credit. Technically, they may be very well qualified. But it is now over fifty years since money was suspended from the monetary system. Not only have policymakers ignored indicators such as Gibson’s paradox. Not only do they believe their own statistics. And not only do they think that debasing the currency is a good thing, but we find that monetary policy committees would have us believe that money has nothing to do with rising prices.

All this is facilitated by presenting inflation as rising prices, when in fact it is declining purchasing power. Figure 4 shows how purchasing power of currencies should be read.

Only now, it seems, we are aware that inflation of prices is not transient. Referring to Figure 1, the M3 broad money supply measure has almost tripled since Lehman failed, so there’s plenty of fuel driving a lower purchasing power for the dollar yet. And as discussed above, it is not just quantities of currency and credit we should be watching, but changes in consumer behaviour and whether consumers tend to dispose of currency liquidity in favour of goods.

The indications are that this is likely to happen, accelerated by sanctions against Russia, and the threat that they will bring in a new currency era, undermining the dollar’s global status. Alerted to higher prices in the coming months, there is no doubt that there is an increased level of consumer stockpiling, which put another way is the disposal of personal liquidity before it buys less.

So far, the phases of currency evolution have been marked by the end of the Bretton Woods Agreement in 1971. The start of the petrodollar era in 1973 led to a second phase, the financialisation of the global economy. And finally, from now the return to a commodity standard brought about by sanctions against Russia is driving prices in the Western alliance’s currencies higher, which means their purchasing power is falling anew.

While America might feel some comfort that the security of its energy supplies is unaffected, that is not the case for Europe. In recent years Europe has been closing its fossil fuel production and Germany’s zeal to go green has even extended to decommissioning nuclear plants. It seems that going fossil-free is only within national borders, increasing reliance on imported oil, gas, and coal. In Europe’s case, the largest source of these imports by far is Russia.

Russia has responded by the Russian central bank announcing that it is prepared to buy gold from domestic credit institutions, first at a fixed price or 5,000 roubles per gramme, and then when the rouble unexpectedly strengthened at a price to be agreed on a case-by-case basis. The signal is clear: the Russian central bank understands that gold plays an important role in price stability. At the same time, the Kremlin announced that it would only sell oil and gas to unfriendly nations (i.e. those imposing sanctions) in return for payments in roubles.

The latter announcement was targeted primarily at EU nations and amounts to an offer at reasonable prices in roubles, or for them to bid up for supplies in euros or dollars from elsewhere. While the price of oil shot up and has since retreated by a third, natural gas prices are still close to their all-time highs. Despite the northern hemisphere emerging from spring the cost of energy seems set to continue to rise. The effect on the Eurozone economies is little short of catastrophic.

While the rouble has now recovered all the fall following the sanctions announcement, the euro is becoming a disaster. The ECB still has a negative deposit rate and enormous losses on its extensive bond portfolio from rapidly rising yields. The national central banks, which are its shareholders also have losses which in nearly all cases wipes out their equity (balance sheet equity being defined as the difference between a bank’s assets and its liabilities — a difference which should always be positive). Furthermore, these central banks as the NCB’s shareholders make a recapitalisation of the whole euro system a complex event, likely to question faith in the euro system.

As if that was not enough, the large commercial banks are extremely highly leveraged, averaging over 20 times with Credit Agricole about 30 times. The whole system is riddled with bad and doubtful debts, many of which are concealed within the TARGET2 cross-border settlement system. We cannot believe any banking statistics. Unlike the US, Eurozone banks have used the repo markets as a source of zero cost liquidity, driving the market size to over €10 trillion. The sheer size of this market, plus the reliance on bond investment for a significant proportion of commercial bank assets means that an increase in interest rates into positive territory risks destabilising the whole system.

The ECB is sitting on interest rates to stop them rising and stands ready to buy yet more members’ government bonds to stop yields rising even more. But even Germany, which is the most conservative of the member states, faces enormous price pressures, with producer prices of industrial products officially increasing by 25.9% in the year to March, 68% for energy, and 21% for intermediate goods.

There can be no doubt that markets will apply increasing pressure for substantial rises in Eurozone bond yields, made significantly worse by US sanctions policies against Russia. As an importer of commodities and raw materials Japan is similarly afflicted. Both currencies are illustrated in Figure 5.

The yen appears to be in the most immediate danger with its collapse accelerating in recent weeks, but as both the Bank of Japan and the ECB continue to resist rising bond yields, their currencies will suffer even more. The Bank of Japan has been indulging in quantitative easing since 2000 and has accumulated substantial quantities of government and corporate bonds and even equities in ETFs. Already, the BOJ is in negative equity due to falling bond prices. To prevent its balance sheet from deteriorating even further, it has drawn a line in the sand: the yield on the 10-year JGB will not be permitted to rise above 0.25%. With commodity and energy prices soaring, it appears to be only a matter of time before the BOJ is forced to give way, triggering a banking crisis in its highly leveraged commercial banking sector which like the Eurozone has asset to equity ratios exceeding 20 times.

It would appear therefore that the emerging order of events with respect to currency crises is the yen collapses followed in short order by the euro. The shock to the US banking system must be obvious. That the US banks are considerably less geared than their Japanese and euro system counterparts will not save them from global systemic risk contamination.

Furthermore, with its large holdings of US Treasuries and agency debt, current plans to run them off simply exposes the Fed to losses, which will almost certainly require its recapitalisation. The yield on the US 10-year Treasury Bond is soaring and given the consequences of sanctions on global commodity prices, it has much further to go.

This is now changing, with interest rates set to rise significantly, bursting a financial bubble which has been inflating for decades. While bond yields have started to rise, there is further for them to go, undermining not just the collateral position, but government finances as well. And further rises in bond yields will turn equity markets into bear markets, potentially rivalling the 1929-1932 performance of the Dow Jones Industrial Index.

That being the case, the collapse already underway in the yen and the euro will begin to undermine the dollar, not on the foreign exchanges, but in terms of its purchasing power. We can be reasonably certain that the Fed’s mandate will give preference to supporting asset prices over stabilising the currency, until it is too late.

China and Russia appear to be deliberately isolating themselves from this fate for their own currencies by increasing the importance of commodities. It was noticeable how China began to aggressively accumulate commodities, including grain stocks, almost immediately after the Fed cut its funds rate to zero and instituted QE at $120 billion per month in March 2020. This sent a signal that the Chinese leadership were and still are fully aware of the inflationary implications of US monetary policy. Today China has stockpiled well over half the world’s maize, rice, wheat and soybean stocks, securing basics foodstuffs for 20% of the world’s population. As a subsequent development, the war in Ukraine has ensured that global grain supplies this year will be short, and sanctions against Russia have effectively cut off her exports from the unfriendly nations. Together with fertiliser shortages for the same reasons, not only will the world’s crop yields fall below last year’s, but grain prices are sure to be bid up against the poorer nations.

Russia has effectively tied the rouble to energy prices by insisting roubles are used for payment, principally by the EU. Russia’s other two large markets are China and India, from which she is accepting yuan and rupees respectively. Putting sales to India to one side, Russia is not only commoditising the rouble, but her largest trading partner not just for energy but for all her other commodity exports is China. And China is following similar monetary policies.

There are good reasons for it. The Western alliance is undermining their own currencies, of that there can be no question. Financial asset values will collapse as interest rates rise. Contrastingly, not only is Russia’s trade surplus increasing, but the central bank has begun to ease interest rates and exchange controls and will continue to liberate her economy against a background of a strong currency. The era of the commodity backed currency is arriving to replace the financialised.

And lastly, we should refer to Figure 2, of the price of oil in goldgrams. The link to commodity prices is gold. It is time to abandon financial assets for their supposed investment returns and take a stake in the new commoditised currencies. Gold is the link. Business of all sorts, not just mining enterprises which accumulate cash surpluses, would be well advised to question whether they should retain deposits in the banks, or alternatively, gain the protection of possessing some gold bullion vaulted independently from the banking system.

[i] Shadowstats.com

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.

To explain why fiat currencies are failing I started by defining money. I then described the relationship between fiat money and its purchasing power, the role of bank credit, and the interests of central banks.

Undoubtedly, the recent sanctions over Russia will have a catastrophic effect for financialised currencies, possibly leading to the end of fifty-one years of the dollar regime. Russia and China plan to escape this fate for the rouble and yuan by tying their currencies to commodities and production instead of collapsing financial assets. The only way for those of us in the West to protect ourselves is with physical gold, which over time is tied to commodity and energy prices.

What is money?

To understand why all fiat currency systems fail, we must start by understanding what money is, and how it differs from other forms of currency and credit. These are long-standing relationships which transcend our times and have their origin in Roman law and the practice of medieval merchants who evolved a lex mercatoria, which extended money’s legal status to instruments that evolved out of money, such as bills of exchange, cheques, and other securities for money. And while as circulating media, historically currencies have been almost indistinguishable from money proper, in the last century issuers of currencies split them off from money so that they have become pure fiat.At the end of the day, what constitutes money has always been determined by its users as the means of exchanging their production for consumption in an economy based on the division of labour. Money is the bridge between the two, and while over the millennia different media of exchange have come and gone, only metallic money has survived to be trusted. These are principally gold, silver, and copper. Today the term usually refers to gold, which is still in government reserves, as the only asset with no counterparty risk. Silver, which as a monetary asset declined in importance as money after Germany moved to a gold standard following the Franco-Prussian war, remains a monetary metal, though with a gold to silver ratio currently over 70 times, it is not priced as such.

For historical reasons, the world’s monetary system evolved based on English law. Britain, or more accurately England and Wales, still respects Roman, or natural law with respect to money. To this day, gold sovereign coins are legal tender. Strictly speaking, metallic gold and silver are themselves credit, representing yet-to-be-spent production. But uniquely, they are no one’s liability, unlike banknotes and bank deposits. Metallic money therefore has this exceptional status, and that fact alone means that it tends not to circulate, in accordance with Gresham’s Law, so long as lesser forms of credit are available.

Money shares with its currency and credit substitutes a unique position in criminal law. If a thief steals money, he can be apprehended and charged with theft along with any accomplices. But if he passes the money on to another party who receives it in good faith and is not aware that it is stolen, the original owner has no recourse against the innocent receiver, or against anyone else who subsequently comes into possession of the money. It is quite unlike any other form of property, which despite passing into innocent hands, remains the property of the original owner.

In law, cryptocurrencies and the mooted central bank digital currencies are not money, money-substitutes, or currencies. Given that a previous owner of stolen bitcoin sold on to a buyer unaware it was criminally obtained can subsequently claim it, there is no clear title without full provenance. In accordance with property law, the United States has ruled that cryptocurrencies are property, reclaimable as stolen items, differentiating cryptocurrencies from money and currency proper. And we can expect similar rulings in other jurisdictions to exclude cryptocurrencies from the legal status as money, whereas the position of CBDCs in this regard has yet to be clarified. We can therefore nail to the floor any claims that bitcoin or any other cryptocurrency can possibly have the legal status required of money.

Under a proper gold standard, currency in the form of banknotes in public circulation was freely exchangeable for gold coin. So long as they were freely exchangeable, banknotes took on the exchange value of gold, allowing for the credit standing of the issuer. One of the issues Sir Isaac Newton considered as Master of the Royal Mint was to what degree of backing a currency required to retain credibility as a gold substitute. He concluded that that level should be 40%, though Ludwig von Mises, the Austrian economist who was as sound a sound money economist as it was possible to be appeared to be less prescriptive on the subject.

The effect of a working gold standard is to ensure that money of the people’s choice is properly represented in the monetary system. Both currency and credit become bound to its virtues. The general level of prices will fluctuate influenced by changes in the quantity of currency and credit in circulation, but the discipline of the limits of credit and currency creation brings prices back to a norm.

This discipline is disliked by governments who believe that money is the responsibility of a government acting in the interests of the people, and not of the people themselves. This was expressed in Georg Knapp’s State Theory of Money, published in 1905 and became Germany’s justification for paying for armaments by inflationary means ahead of the First World War, and continuing to use currency debasement as the principal means of government finance until the paper mark collapsed in 1923.

Through an evolutionary process, modern governments first eroded then took away from the public for itself the determination of what constitutes money. The removal of all discipline of the gold standard has allowed governments to inflate the quantities of currency and credit as a means of transferring the public wealth to itself. As a broad representation of this dilution, Figure 1 shows the growth of broad dollar currency since the last vestige of a gold standard under the Bretton Woods Agreement was suspended by President Nixon in August 1971.

From that date, currency and bank credit have increased from $685 billion to $21.84 trillion, that is thirty-two times. And this excludes an unknown increase in the quantity of dollars not in the US financial system, commonly referred to as Eurodollars, which perhaps account for several trillion more. Gold priced in fiat dollars has risen from $35 when Bretton Woods was suspended, to $1970 currently. A better way of expressing this debasement of the dollar is to say that priced in gold, the dollar has lost 98.3% of its purchasing power (see Figure 4 later in this article).

From that date, currency and bank credit have increased from $685 billion to $21.84 trillion, that is thirty-two times. And this excludes an unknown increase in the quantity of dollars not in the US financial system, commonly referred to as Eurodollars, which perhaps account for several trillion more. Gold priced in fiat dollars has risen from $35 when Bretton Woods was suspended, to $1970 currently. A better way of expressing this debasement of the dollar is to say that priced in gold, the dollar has lost 98.3% of its purchasing power (see Figure 4 later in this article).While it is a mistake to think of the relationship between the quantity of currency and credit in circulation and the purchasing power of the dollar as linear (as monetarists claim), not only has the rate of debasement accelerated in recent years, but it has become impossible for the destruction of purchasing power to be stopped. That would require governments reneging on mandated welfare commitments and for them to stand back from economic intervention. It would require them to accept that the economy is not the government’s business, but that of those who produce goods and services for the benefit of others. The state’s economic role would have to be minimised.

This is not just a capitalistic plea. It has been confirmed as true countless times through history. Capitalistic nations always do better at creating personal wealth than socialistic ones. This is why the Berlin Wall was demolished by angry crowds, finally driven to do so by the failure of communism relative to capitalism just a stone’s throw away. The relative performance of Hong Kong compared with China when Mao Zedong was starving his masses on some sort of revolutionary whim, also showed how the same ethnicity performed under socialism compared with free markets.

The relationship between fiat currency and its purchasing power

One can see from the increase in the quantity of US dollar M3 currency and credit and the fall in the purchasing power measured against gold that the government’s monetary statistic does not square with the market. Part of the reason is that government statistics do not capture all the credit in an economy (only bank credit issued by licenced banks is recorded), dollars created outside the system such as Eurodollars are additional, and market prices fluctuate.Monetarists make little or no allowance for these factors, claiming that the purchasing power of a currency is inversely proportional to its quantity. While there is much truth in this statement, it is only suited for a proper gold-backed currency, when one community’s relative valuations between currency and goods are brought into line with the those of its neighbours through arbitrage, neutralising any subjectivity of valuation.

The classical representation of the monetary theory of prices does not apply in conditions whereby faith in an unbacked currency is paramount in deciding its utility. A population which loses faith in its government’s currency can reject it entirely despite changes in its circulating quantity. This is what wipes out all fiat currencies eventually, ensuring that if a currency is to survive it must eventually return to a credible gold exchange standard.

The weakness of a fiat currency was famously demonstrated in Europe in the 1920s when the Austrian crown and German paper mark were destroyed. Following the Second World War, the Japanese military yen suffered the same fate in Hong Kong, and Germany’s mark for a second time in the mid 1940s. More recently, the Zimbabwean dollar and Venezuelan bolivar have sunk to their value as wastepaper — and they are not the only ones.

Ultimately it is the public which always determines the use value of a circulating medium. Figure 2 below, of the oil price measured in goldgrams, dollars, pounds, and euros shows that between 1950 and 1974 a gold standard even in the incomplete form that existed under the Bretton Woods Agreement coincided with price stability.

It took just a few years from the ending of Bretton Woods for the consequences of the loss of a gold anchor to materialise. Until then, oil suppliers, principally Saudi Arabia and other OPEC members, had faith in the dollar and other currencies. It was only when they realised the implications of being paid in pure fiat that they insisted on compensation for currency debasement. That they were free to raise oil prices was the condition upon which the Saudis and the rest of OPEC accepted payment solely in US dollars.

In the post-war years between 1950 and 1970, US broad money grew by 167%, yet the dollar price of oil was unchanged for all that time. Similar price stability was shown in other commodities, clearly demonstrating that the quantity of currency and credit in circulation was not the sole determinant of the dollar’s purchasing power.

The role of bank credit

While the relationship between bank credit and the sum of the quantity of currency and bank reserves varies, the larger quantity by far is the quantity of bank credit. The behaviour of the banking cohort therefore has the largest impact on the overall quantity of credit in the economy.Under the British gold standard of the nineteenth century, the fluctuations in the willingness of banks to lend resulted in periodic booms and slumps, so it is worthwhile examining this phenomenon, which has become the excuse for state intervention in financial markets and ultimately the abandonment of gold standards entirely.

Banks are dealers in credit, lending at a higher rate of interest than they pay to depositors. They do not deploy their own money, except in a general balance sheet sense. A bank’s own capital is the basis upon which a bank can expand its credit.

The process of credit creation is widely misunderstood but is essentially simple. If a bank agrees to lend money to a borrowing customer, the loan appears as an asset on the bank’s balance sheet. Through the process of double entry bookkeeping, this loan must immediately have a balancing entry, crediting the borrower’s current account. The customer is informed that the loan is agreed, and he can draw down the funds credited to his current account from that moment.

No other bank, nor any other source of funding is involved. With merely two ledger entries the bank’s balance sheet has expanded by the amount of the loan. For a banker, the ability to create bank credit in this way is, so long as the lending is prudent, an extremely profitable business. The amount of credit outstanding can be many multiples of the bank’s own capital. So, if a bank’s ratio of balance sheet assets to equity is eight times, and the gross margin between lending and deposits is 3%, then that becomes a gross return of 24% on the bank’s own equity.

The restriction on a bank’s balance sheet leverage comes from two considerations. There is lending risk itself, which will vary with economic conditions, and depositor risk, which is the depositors’ collective faith in the bank’s financial condition. Depositor risk, which can lead to depositors withdrawing their credit in the bank in favour of currency or a deposit with another bank, can in turn originate from a bank offering an interest rate below that of other banks, or alternatively depositors concerned about the soundness of the bank itself. It is the combination of lending and depositor risk that determines a banker’s view on the maximum level of profits that can be safely earned by dealing in credit.

An expansion in the quantity of credit in an economy stimulates economic activity because businesses are tricked into thinking that the extra money available is due to improved trading conditions. Furthermore, the apparent improvement in trading conditions encourages bankers to increase lending even further. A virtuous cycle of lending and apparent economic improvement gets under way as the banking cohort takes its average balance sheet assets to equity ratio from, say, five to eight times, to perhaps ten or twelve. Competition for credit business then persuades banks to cut their margins to attract new business customers. Customers end up borrowing for borrowing’s sake, initiating investment projects which would not normally be profitable.

Even under a gold standard lending exuberance begins to drive up prices. Businesses find that their costs begin to rise, eating into their profits. Keeping a close eye on lending risk, bankers are acutely aware of deteriorating profit prospects for their borrowers and therefore of an increasing lending risk. They then try to reduce their asset to equity ratios. As a cohort whose members are driven by the same considerations, banks begin to withdraw credit from the economy, reversing the earlier stimulus and the economy enters a slump.

This is a simplistic description of a regular cycle of fluctuating bank credit, which historically varied approximately every ten years or so, but could fluctuate between seven and twelve. Figure 3 illustrates how these fluctuations were reflected in the inflation rate in nineteenth century Britain following the introduction of the sovereign gold coin until just before the First World War.

Besides illustrating the regularity of the consequences of a cycle of bank credit expansion and contraction marked by the inflationary consequences, Figure 3 shows there is no correlation between the rate of price inflation and wholesale borrowing costs. In other words, modern central bank monetary policies which use interest rates to control inflation are misconstrued. The effect was known and named Gibson’s paradox by Keynes. But because there was no explanation for it in Keynesian economics, it has been ignored ever since. Believing that Gibson’s paradox could be ignored is central to central bank policies aimed at taming the cycle of price inflation.

The interests of central banks

Notionally, central banks’ primary interest is to intervene in the economy to promote maximum employment consistent with moderate price inflation, targeted at 2% measured by the consumer price index. It is a policy aimed at stimulating the economy but not overstimulating it. We shall return to the fallacies involved in a moment.In the second half of the nineteenth century, central bank intervention started with the Bank of England assuming for itself the role of lender of last resort in the interests of ensuring economically destabilising bank crises were prevented. Intervention in the form of buying commercial bank credit stopped there, with no further interest rate manipulation or economic intervention.

The last true slump in America was in 1920-21. As it had always done in the past the government ignored it in the sense that no intervention or economic stimulus were provided, and the recovery was rapid. It was following that slump that the problems started in the form of a new federal banking system led by Benjamin Strong who firmly believed in monetary stimulation. The Roaring Twenties followed on a sea of expanding credit, which led to a stock market boom — a financial bubble. But it was little more than an exaggerated cycle of bank credit expansion, which when it ended collapsed Wall Street with stock prices falling 89% measured by the Dow Jones Industrial Index. Coupled with the boom in agricultural production exaggerated by mechanisation, the depression that followed was particularly hard on the large agricultural sector, undermining agriculture prices worldwide until the Second World War.

It is a fact ignored by inflationists that first President Herbert Hoover, and then Franklin Roosevelt extended the depression to the longest on record by trying to stop it. They supported prices, which meant products went unsold. And at the very beginning, by enacting the Smoot Hawley Tariff Act they collapsed not only domestic demand but all domestic production that relied on imported raw materials and semi-manufactured products.

These disastrous policies were supported by a new breed of economist epitomised by Keynes, who believed that capitalism was flawed and required government intervention. But proto-Keynesian attempts to stimulate the American economy out of the depression continually failed. As late as 1940, eleven years after the Wall Street Crash, US unemployment was still as high as 15%. What the economists in the Keynesian camp ignored was the true cause of the Wall Street crash and the subsequent depression, rooted in the credit inflation which drove the Roaring Twenties. As we saw in Figure 3, it was no more than the turning of the long-established repeating cycle of bank credit, this time fuelled additionally by Benjamin Strong’s inflationary credit expansion as Chairman of the new Fed. The cause of the depression was not private enterprise, but government intervention.

It is still misread by the establishment to this day, with universities pushing Keynesianism to the exclusion of classic economics and common sense. Additionally, the statistics which have become a religion for policymakers and everyone else are corrupted by state interests. Soon after wages and pensions were indexed in 1980, government statisticians at the Bureau of Labor Statistics began working on how to reduce the impact on consumer prices. An independent estimate of US consumer inflation put it at well over 15% recently, when the official rate was 8%.[i]

Particularly egregious is the state’s insistence that a target of 2% inflation for consumer prices stimulates demand, when the transfer of wealth suffered by savers, the low paid and pensioners deprived of their inflation compensation at the hands of the BLS is glossed over. So is the benefit to the government, the banks, and their favoured borrowers from this wealth transfer.

The problem we now face in this fiat money environment is not only that monetary policy has become corrupted by the state’s self-interest, but that no one in charge of it appears to understand money and credit. Technically, they may be very well qualified. But it is now over fifty years since money was suspended from the monetary system. Not only have policymakers ignored indicators such as Gibson’s paradox. Not only do they believe their own statistics. And not only do they think that debasing the currency is a good thing, but we find that monetary policy committees would have us believe that money has nothing to do with rising prices.

All this is facilitated by presenting inflation as rising prices, when in fact it is declining purchasing power. Figure 4 shows how purchasing power of currencies should be read.

Only now, it seems, we are aware that inflation of prices is not transient. Referring to Figure 1, the M3 broad money supply measure has almost tripled since Lehman failed, so there’s plenty of fuel driving a lower purchasing power for the dollar yet. And as discussed above, it is not just quantities of currency and credit we should be watching, but changes in consumer behaviour and whether consumers tend to dispose of currency liquidity in favour of goods.

The indications are that this is likely to happen, accelerated by sanctions against Russia, and the threat that they will bring in a new currency era, undermining the dollar’s global status. Alerted to higher prices in the coming months, there is no doubt that there is an increased level of consumer stockpiling, which put another way is the disposal of personal liquidity before it buys less.

So far, the phases of currency evolution have been marked by the end of the Bretton Woods Agreement in 1971. The start of the petrodollar era in 1973 led to a second phase, the financialisation of the global economy. And finally, from now the return to a commodity standard brought about by sanctions against Russia is driving prices in the Western alliance’s currencies higher, which means their purchasing power is falling anew.

The faux pas over Russia

With respect to the evolution of money and credit, this brings us up to date with current events. Before Russia invaded Ukraine and the Western alliance imposed sanctions on Russia, we were already seeing prices soaring, fuelled by the expansion of currency and credit in recent years. Monetary planners blamed supply chain problems and covid dislocations, both of which they believed would right themselves over time. But the extent of these price rises had already exceeded their expectations, and the sanctions against Russia have made the situation even worse.While America might feel some comfort that the security of its energy supplies is unaffected, that is not the case for Europe. In recent years Europe has been closing its fossil fuel production and Germany’s zeal to go green has even extended to decommissioning nuclear plants. It seems that going fossil-free is only within national borders, increasing reliance on imported oil, gas, and coal. In Europe’s case, the largest source of these imports by far is Russia.

Russia has responded by the Russian central bank announcing that it is prepared to buy gold from domestic credit institutions, first at a fixed price or 5,000 roubles per gramme, and then when the rouble unexpectedly strengthened at a price to be agreed on a case-by-case basis. The signal is clear: the Russian central bank understands that gold plays an important role in price stability. At the same time, the Kremlin announced that it would only sell oil and gas to unfriendly nations (i.e. those imposing sanctions) in return for payments in roubles.

The latter announcement was targeted primarily at EU nations and amounts to an offer at reasonable prices in roubles, or for them to bid up for supplies in euros or dollars from elsewhere. While the price of oil shot up and has since retreated by a third, natural gas prices are still close to their all-time highs. Despite the northern hemisphere emerging from spring the cost of energy seems set to continue to rise. The effect on the Eurozone economies is little short of catastrophic.

While the rouble has now recovered all the fall following the sanctions announcement, the euro is becoming a disaster. The ECB still has a negative deposit rate and enormous losses on its extensive bond portfolio from rapidly rising yields. The national central banks, which are its shareholders also have losses which in nearly all cases wipes out their equity (balance sheet equity being defined as the difference between a bank’s assets and its liabilities — a difference which should always be positive). Furthermore, these central banks as the NCB’s shareholders make a recapitalisation of the whole euro system a complex event, likely to question faith in the euro system.

As if that was not enough, the large commercial banks are extremely highly leveraged, averaging over 20 times with Credit Agricole about 30 times. The whole system is riddled with bad and doubtful debts, many of which are concealed within the TARGET2 cross-border settlement system. We cannot believe any banking statistics. Unlike the US, Eurozone banks have used the repo markets as a source of zero cost liquidity, driving the market size to over €10 trillion. The sheer size of this market, plus the reliance on bond investment for a significant proportion of commercial bank assets means that an increase in interest rates into positive territory risks destabilising the whole system.

The ECB is sitting on interest rates to stop them rising and stands ready to buy yet more members’ government bonds to stop yields rising even more. But even Germany, which is the most conservative of the member states, faces enormous price pressures, with producer prices of industrial products officially increasing by 25.9% in the year to March, 68% for energy, and 21% for intermediate goods.

There can be no doubt that markets will apply increasing pressure for substantial rises in Eurozone bond yields, made significantly worse by US sanctions policies against Russia. As an importer of commodities and raw materials Japan is similarly afflicted. Both currencies are illustrated in Figure 5.

The yen appears to be in the most immediate danger with its collapse accelerating in recent weeks, but as both the Bank of Japan and the ECB continue to resist rising bond yields, their currencies will suffer even more. The Bank of Japan has been indulging in quantitative easing since 2000 and has accumulated substantial quantities of government and corporate bonds and even equities in ETFs. Already, the BOJ is in negative equity due to falling bond prices. To prevent its balance sheet from deteriorating even further, it has drawn a line in the sand: the yield on the 10-year JGB will not be permitted to rise above 0.25%. With commodity and energy prices soaring, it appears to be only a matter of time before the BOJ is forced to give way, triggering a banking crisis in its highly leveraged commercial banking sector which like the Eurozone has asset to equity ratios exceeding 20 times.

It would appear therefore that the emerging order of events with respect to currency crises is the yen collapses followed in short order by the euro. The shock to the US banking system must be obvious. That the US banks are considerably less geared than their Japanese and euro system counterparts will not save them from global systemic risk contamination.

Furthermore, with its large holdings of US Treasuries and agency debt, current plans to run them off simply exposes the Fed to losses, which will almost certainly require its recapitalisation. The yield on the US 10-year Treasury Bond is soaring and given the consequences of sanctions on global commodity prices, it has much further to go.

The end of the financial regime for currencies

From London’s big bang in the mid-eighties, the major currencies, particularly the US dollar and sterling became increasingly financialised. It occurred at a time when production of consumer goods migrated to Asia, particularly China. The entire focus of bank lending and loan collateral moved towards financial assets and away from production. And as interest rates declined, in general terms these assets improved in value, offering greater security to lenders, and reinforcing the trend.This is now changing, with interest rates set to rise significantly, bursting a financial bubble which has been inflating for decades. While bond yields have started to rise, there is further for them to go, undermining not just the collateral position, but government finances as well. And further rises in bond yields will turn equity markets into bear markets, potentially rivalling the 1929-1932 performance of the Dow Jones Industrial Index.

That being the case, the collapse already underway in the yen and the euro will begin to undermine the dollar, not on the foreign exchanges, but in terms of its purchasing power. We can be reasonably certain that the Fed’s mandate will give preference to supporting asset prices over stabilising the currency, until it is too late.

China and Russia appear to be deliberately isolating themselves from this fate for their own currencies by increasing the importance of commodities. It was noticeable how China began to aggressively accumulate commodities, including grain stocks, almost immediately after the Fed cut its funds rate to zero and instituted QE at $120 billion per month in March 2020. This sent a signal that the Chinese leadership were and still are fully aware of the inflationary implications of US monetary policy. Today China has stockpiled well over half the world’s maize, rice, wheat and soybean stocks, securing basics foodstuffs for 20% of the world’s population. As a subsequent development, the war in Ukraine has ensured that global grain supplies this year will be short, and sanctions against Russia have effectively cut off her exports from the unfriendly nations. Together with fertiliser shortages for the same reasons, not only will the world’s crop yields fall below last year’s, but grain prices are sure to be bid up against the poorer nations.

Russia has effectively tied the rouble to energy prices by insisting roubles are used for payment, principally by the EU. Russia’s other two large markets are China and India, from which she is accepting yuan and rupees respectively. Putting sales to India to one side, Russia is not only commoditising the rouble, but her largest trading partner not just for energy but for all her other commodity exports is China. And China is following similar monetary policies.

There are good reasons for it. The Western alliance is undermining their own currencies, of that there can be no question. Financial asset values will collapse as interest rates rise. Contrastingly, not only is Russia’s trade surplus increasing, but the central bank has begun to ease interest rates and exchange controls and will continue to liberate her economy against a background of a strong currency. The era of the commodity backed currency is arriving to replace the financialised.

And lastly, we should refer to Figure 2, of the price of oil in goldgrams. The link to commodity prices is gold. It is time to abandon financial assets for their supposed investment returns and take a stake in the new commoditised currencies. Gold is the link. Business of all sorts, not just mining enterprises which accumulate cash surpluses, would be well advised to question whether they should retain deposits in the banks, or alternatively, gain the protection of possessing some gold bullion vaulted independently from the banking system.

[i] Shadowstats.com

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.