Market Report: Seasonal slam

Dec 1, 2017·Alasdair MacleodGold and silver suffered a sell-off, repeating what we saw in late November in both the last two years. The attack on precious metals is futures-driven, and occurs during New York trading hours. Gold fell $12 from last Friday’s close to $1275 in early European trade this morning, and silver was hammered, falling 60 cents to $16.40.

Last year, gold fell between the last week of November and 15 December from $1184 to $1128. And in 2015, gold fell from $1075 to $1050 on 17 December. In both these cases, the December lows marked the end of significant declines, and were followed by strong rallies. In both these cases, the Fed signalled a rise in the Fed funds rate, well in advance. They were classic cases of sell the story, buy the fact.

The actions in Comex futures are a replay of these events. The shorts, backed by being too big to fail, use the opportunity to drive the narrative and close their positions, at least on Comex. Comex though, is only part of the story, with positions in London’s forward market and other off-market supply agreements. However, unlike 2015-16 and 2016-17, 2017-18 will be different in a crucial aspect: the outlook for the dollar is bearish, and therefore the outlook for gold is bullish. The previous two rallies were from very oversold conditions, which clearly undervalued gold, without the prospect of a weakening dollar.

As well as the dollar cycle having turned, the big American bullion dealers are refocusing their activities towards China, where payments for imported raw materials and energy are increasingly settled in yuan. The genuine aspect of futures trading, the hedging of price risk by producers, will therefore move to Shanghai, and much futures trading with it. All international bullion dealers are bound to go with it, or lose business.

That is the prospect facing the shorts on Comex. This being the case, it is clear that this is their last chance to position themselves for foreseeable market developments in 2018. The management of market expectations is more important than ever to them.

A failsafe target is technicians, who lacking any real brains, can be relied on to spread a bearish message from the charts. Our next chart illustrates this old trick once again.

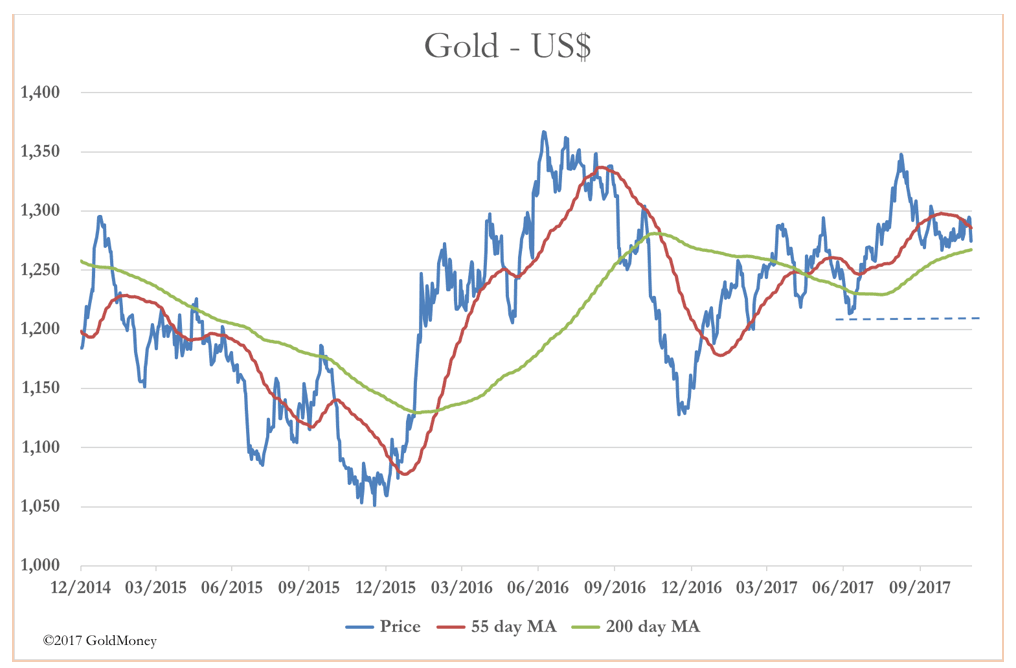

The 55-day moving average is already turning down with the price below it, which is a short-term bearish signal. For the moment, the price is above the important 200-day MA, currently at $1267. And the pace at which this moving average is rising has slowed to a crawl, and should turn negative in a week or so.

Therefore, if the shorts can push the gold price lower by about $10 or so, the last remaining bulls relying on technical analysis will probably capitulate.

That’s the bear case. Some of the positives have been mentioned already, and after the expected increase in the FFR mid-December, gold should go better. The dollar’s rally, if not over, is very long in the tooth, and its bear market can be expected to resume, if it hasn’t done so already. And my colleague, Stefan Wieler, wrote an important paper recently pointing out that a rising gold price correlates with rising interest rates. It is available here.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.