Central banks are now insolvent

Feb 17, 2022·Alasdair MacleodNot only does this expose them to the interest rate cycle, but they have not increased their capital base to keep pace with the expansion of their balance sheets. Hence the problem with rising interest rates and bond yields: on a mark-to-market basis the major central banks are insolvent with balance sheet liabilities now exceeding their assets.

This article finds this condition true of the Bank of England, the Federal Reserve Board, the Bank of Japan, and the entire euro system. Other central banks are not examined.

Doubtless this will be resolved in the short term by governments investing more equity in their central banks. But there is one major exception, which is the ECB and the euro system, with all its shareholders sinking into negative equity with the only minor exceptions of the Irish, Maltese, and Slovenian central banks.

Consequently, with the interconnectedness of the global financial system, the ability of central banks to guarantee the survival of their own commercial banking networks has almost certainly ended due to a collapse of the euro system. The precedent is the failure of a prototype central bank in 1720, John Law’s Banque Royale. That experience allows us to see how this is likely to play out.

Introduction

There is a widespread assumption that commercial banks bear risk while central banks bear none. Folding notes are superior to bank deposits for this reason. It is commercial banks which fail, and central banks that rescue the ones worth rescuing. They are the lenders of last resort.As such, their financial integrity goes unquestioned. Of course, we do not usually include central banks in emerging nations in this statement, but any risk is always perceived to be in their currencies rather than the institution. We know that the Reserve Bank of Zimbabwe can and does run some unconventional monetary policies, but you won’t hear the RBZ’s survival being questioned. It is generally assumed that in any nation a central bank that can issue its currency in unlimited quantities can never go bust, and that is why it is the currency that fails, and not the institution.

Consequently, commercial banks come and go, but like ol’ man river central banks just keep rolling along. At least, that appears to be the experience. But until recent decades, history has not seen major central banks routinely investing large amounts in their national bond markets, because any respectable central bank has always shied away from overtly inflationary financing of its government’s deficits.

Enter QE and its inflationary consequences

That changed in 2000, when the Bank of Japan was the first to introduce quantitative easing. Reassured by the unexpected price stability following the BOJ’s asset monetisation, QE was only introduced by the other major central banks in the wake of the financial crisis which led to the failure of Lehman. And after that precedent was created, QE has become a permanent feature of monetary policy, investing in longer maturity bonds than the commercial banks, which usually confine their maturities to less than five years.According to the central banking establishment, QE is an unconventional policy tool which is only deployed when interest rates have been reduced to extremely low levels. If the rate of price inflation is still below the mandated 2% target, and aggregate output is deemed to be below potential, QE is then deployed. And there is the Taylor rule, which posits that a central bank should lower interest rates when inflation is stubbornly below the target level of 2%, or when GDP growth is too slow and below its potential, even if it implies negative rates. QE is then justified as the alternative or in addition to this unnatural condition.

The result has been an explosion in the size of central bank balance sheets. The combined balance sheet total of the Fed, ECB, BOJ and Peoples Bank of China rose from $5 trillion in 2007 to $31 trillion at end-December — more than sixfold.[i] It is an increase which has driven the bubble in financial assets, the link being through the suppression of government bond yields from such massive market intervention through money printing.

The inevitable result of this coordinated global currency expansion has been widespread increases in prices for commodities, logistics, labour, and consumer goods. Having bought into the Japanese price experience following its QE trailblazing, the consequences for global prices appear to have caught central bankers unaware. They seem to have forgotten that if you expand the quantity of a currency, you dilute its purchasing power, a simple fact that tends to be reflected in rising prices for everything. To this day, you will not find any central banker linking price inflation to their so-called monetary policy, always blaming other unexpected private sector factors.

This wilful blindness extends to the anticipated remedy, which is to increase the cost of money, and which everyone involved with monetary policy believes is the role of interest rates. The hope is that they can raise the cost of credit marginally to bring demand back to non-inflationary levels and call a gradual halt to their bond purchases. However, it is all delusion.

Interest rates are only the cost of money to a borrower calculating a return on an investment. Savers, including foreign owners of a currency, look at it differently. In parting with ownership of a currency they expect compensation for loss of its use until it is returned, recompense for the risk associated with the borrower, and increasingly they will incorporate expectations of changes in the currency’s purchasing power between parting with it and its eventual return. An interest rate is always set by market expectations for these reasons, and the control a central bank wields over rates is always temporary. What we are witnessing today is the beginnings of the failure of a long-standing statist suppression of interest rates.

With that failure in mind, markets are now indicating that interest rates will rise, because current suppressed levels are unnatural. We cannot say how far they will rise to discount future purchasing powers of the major currencies — that is up to markets. But given the extraordinary levels of currency debasement since 2008 and more dramatically since March 2020, be in no doubt that markets will increasingly expect substantial further debasements to be in the pipeline.

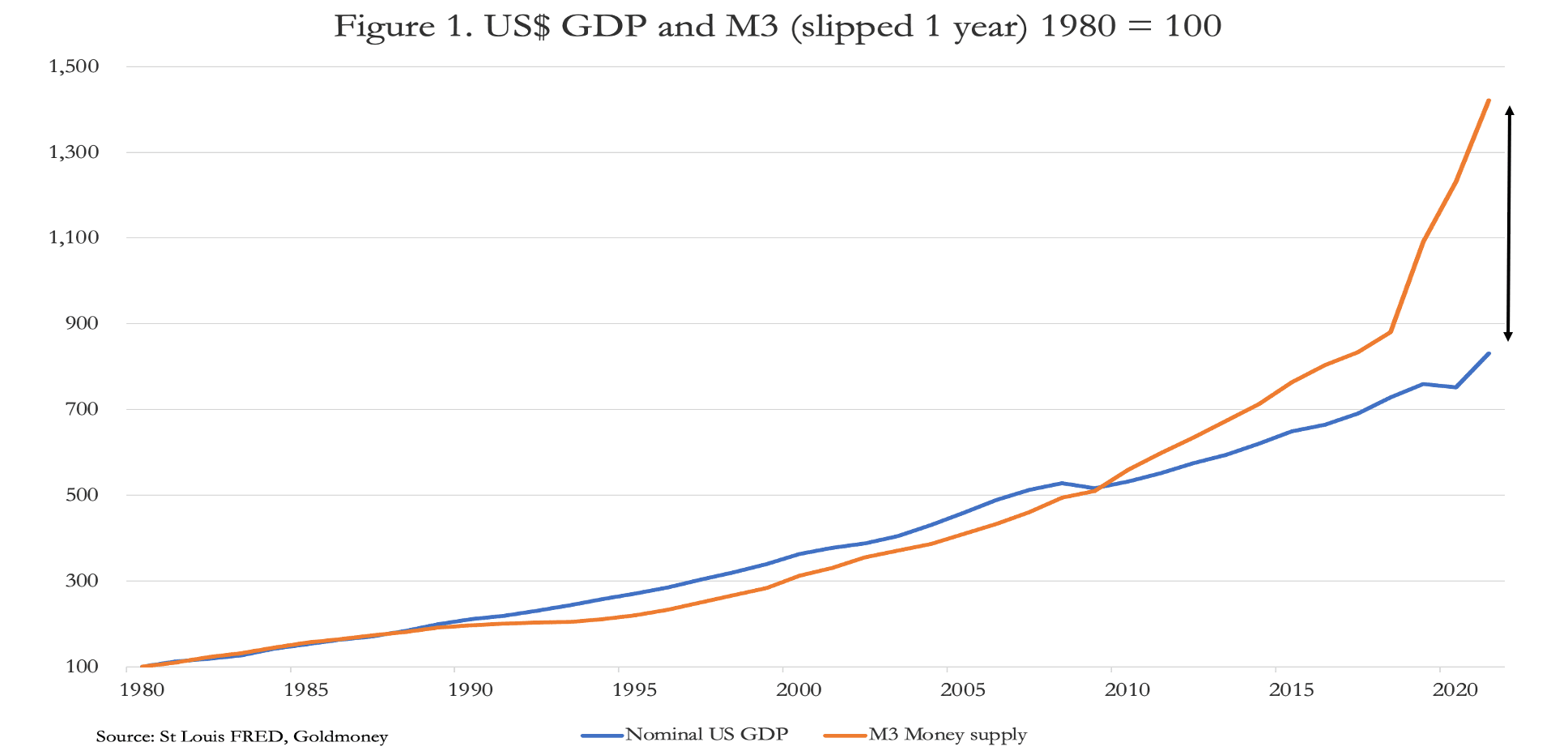

Just by looking at the dollar, we can see how entrenched these pressures are today. Figure 1 shows the amount of currency and credit expansion (M3) which is yet to be reflected in the expansion of GDP.

There can only be two explanations for the divergence indicated by the arrowed gap. The first is there are increasing quantities of currency and credit tied up in secondary financial markets, which will decline as interest rates rise and the speculative bubble ends. That has been partly fuelled by QE, to the extent that deposits in the hands of pension funds and insurance companies have not been invested in new issues (which with a variable time lag would then circulate in the non-financial economy), but used instead to purchase existing securities which are excluded from GDP statistics.

Secondly, the gap between M3 and GDP growth will be reduced by further price rises for GDP components. On the most recent official statistics, prices are rising at over 7 per cent. Unofficial statistics (such as from Shadowstats.com) claim the figure is more like 15 per cent. Whatever the true figure, clearly, there is much more pressure on prices to rise from past currency debasement, and monetary policy is furiously denying it.

Whatever the economic outlook (and this is not a matter for GDP, which is just a money total and nothing else), markets will force interest rates higher in all debasing currencies mainly to compensate for loss of purchasing power. As bond yields rise significantly, the global bubble in financial assets will be fatally undermined. This outcome is increasingly certain.

The question now arises as to what effect these developments will have on the banking system, including the central banks. Much has been written about the consequences for the cycle of bank credit, which affects commercial banks and need not be repeated here. Our focus instead must be on central banks with their massive portfolios of financial assets, and how they will be affected. This article looks at the consequences of a bond bear market on the finances of the Bank of England, the Federal Reserve Board, the Bank of Japan and the European Central Bank.

The Bank of England

In a recent article for The Sunday Telegraph Jeremy Warner pointed out that rising interest rates and bond prices will “dramatically increase the losses likely to be sustained on the Bank of England’s $895bn stockpile of government debt, built up over more than 10 years of so-called quantitative easing”.[ii] Quoting recent correspondence between the Governor and the Chancellor, Warner went on to point out that the dividend payments from its portfolio of gilts had been sent to the UK Treasury, and that reverse payments were likely to be needed in the future.Warner estimates that the Bank’s losses so far amount to about £100bn, and that reducing the portfolio by allowing it to run off could lead to initial losses for the Bank next month of £3bn from maturing bonds. Fortunately for the Bank of England, under a prior agreement the Treasury is required to cover the bank’s losses. The numbers in Table 1 above reflect the position in the last available audited accounts — accounts for the year to the end of this month will be released in a few months’ time and will be consistent with Warner’s estimates.

Bonds purchased through QE are off balance sheet and contained in the Bank of England Asset Purchase Facility Fund Limited, financed by a loan from the Bank. We can reasonably assume that maturities are spread out to twenty years and more, and our calculations in Table 1 assume an average maturity of ten years. In the year ending 28 February 2021, net losses on financial instruments (i.e. the portfolio of gilts acquired through QE) was £56,108 million. Negative equity, on our estimate in Table 1 of £78bn and on Warner’s more recent estimate of £94bn, will be covered in full by the Treasury.

How the Treasury deals with it is an interesting question. It is unlikely that the Treasury will cut its spending to cover the Bank’s losses. Instead, they will be added to the national deficit to be paid for by further gilt issues, increasing the funding requirement. And with the Bank running maturing gilts off its balance sheet at the same time as interest rates are forced higher by rising price inflation, while the borrowing requirement still must be satisfied, we have a recipe for a potential funding crisis.

Add to the mix a suspicion that the Bank of England is in effect being bailed out by the government, for foreign creditors any benefit of the doubt concerning currency stability might be badly undermined. With the insolvency of the Bank only relieved by a government bailout, the illusion for the British public that the government and the BoE have the magic power to make people happy by endless spending and inflation could come to a premature end.

But this also raises questions over the positions of other central banks, which might not have had the prescience or even the ability to strike rescue deals with their governments beforehand. Central banks are meant to be independent of their governments (though we all know this is a fiction) which suggests that deals should not have been struck as any part of QE.

The Fed’s position

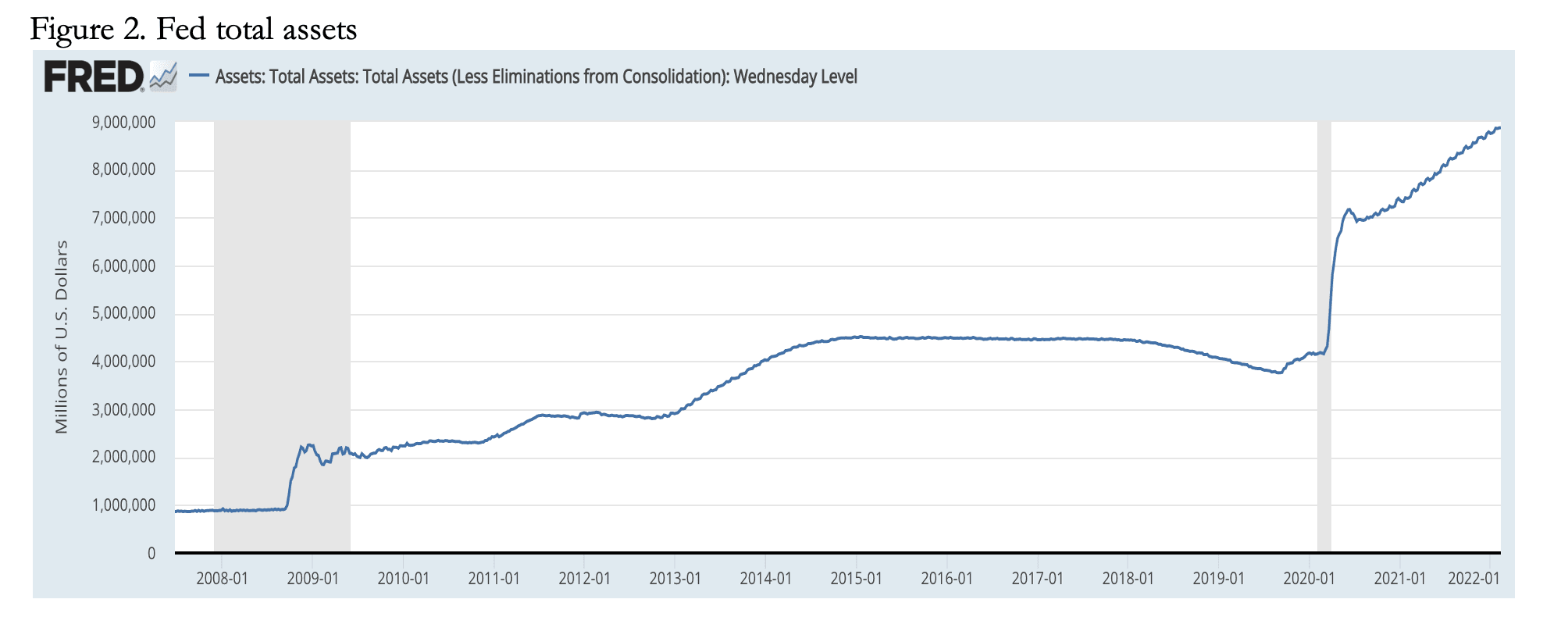

The Federal Reserve Board has accumulated substantial assets since the Lehman crisis in 2008, as the chart in Figure 1 illustrates.

From $900bn just before Lehman failed, QE took the balance sheet to $4,500bn in December 2014, when attempts to taper began, leading to the repo crisis in September 2019. And following covid lockdowns with nearly two years of zero Fed funds rates, the balance sheet now stands at $8,878bn, nearly ten times the pre-Lehman level. On the liabilities side, this has seen an expansion of commercial bank deposits to $3,859bn, and on the assets side, Treasury and agency bonds totalling $8,267bn. Treasury and Agency bonds are included in the balance sheet at face value, which saves the Fed from the embarrassment of declaring losses on these holdings. But if they were marked to market, then the Fed’s equity at just under $65bn would be wiped out many times over, as indicated in Table 2 above, which uses the change in gross redemption yield on the 5-year US Treasury bond as proxy for all the Fed’s Treasury and agency debt holdings. The maturity profile of US Treasury debt is short relative to those of other major nations and yields on agency debt are not a simple matter, when maturing mortgages within individual securitisations are considered.

From the end-September balance sheet date, the yield on the 5-year UST rose from 0.997% to 1.925% earlier this week, wiping out balance sheet equity more than five times over. And if bond yields rise again, the situation will deteriorate. Clearly, the practice of including these bonds in the Fed’s balance sheet at face value, on the assumption that they will be held to maturity, is conveniently face-saving. And one can understand the vested interest in believing that interest rates and bond yields are not going to rise, being followed by a high degree of panic when they do.

But the chart in Figure 1 shows that the feed-through of monetary inflation into rising prices has barely started. Because the private sector is also laden with large quantities of unproductive debt, as interest rates increase to reflect the falling purchasing power of the dollar there will be many bankruptcies. A combination of malinvestment liquidation and falling financial asset values will be virtually impossible for the Fed to ameliorate through monetary policy, let alone at a time when its own financial credibility might be in a state of collapse.

The Bank of Japan

The Bank of Japan has been buying government bonds since 2000 and has built up a substantial portfolio. It currently owns ¥528 trillion ($4.6 trillion) of government bonds, split 27% into two and five-year maturities, with the rest being of ten-years and longer. This means the BOJ is highly exposed to bond price volatility. For example, a 100-basis point rise in gross redemption yield on a 10-year bond leads to a fall in price of over 11% from current levels, and it is even greater for the 20-to-40-year maturities that make up 29% of the Bank’s JGB portfolio.[iii]In addition to the JGBs on the BOJ’s balance sheet, there are ¥11.5 trillion of corporate bonds and commercial paper, and ¥37.3 trillion in exchange traded funds and REITs.

The yield on the 10-year JGB has increased from 0.025% to 0.223% since the balance sheet date in Table 3, causing the bond price to fall by over 1%. The loss on the portfolio so far from this source alone is ¥7.4 trillion, compared with equity and capital reserves of ¥4.4 trillion. Since the September balance sheet, the BOJ’s equity has been eliminated on a mark-to-market basis.

It is small wonder that the BOJ has publicly stated it would buy an unlimited amount of 10-year JGBs at 0.25% to ease the bond sell-off. A higher yield would be more than embarrassing for the bank, already requiring a recapitalisation, presumably with its heavily indebted government stumping up the money.

Yet as we have seen, global monetary debasement has been unprecedented leading to higher prices everywhere. Prices for food, transport, energy, education, and healthcare are heavily subsidised by the government in Japan and that is the principal reason why consumer price inflation appears to be so low. In other words, if price inflation is to continue to be suppressed by subsidies it will be at the expense of further monetary inflation, which is what is causing pressure for bond yields to rise in the first place.

Japan will not be insulated from current and future global influences. Unless the Bank of Japan amends its QE policies, the yen is likely to fall heavily against commodities making price subsidies increasingly untenable.

With a government debt level of 266% of GDP and a budget deficit of about 8.5% expected in the current year, the Japanese economy is less than one quarter the size of that of the US. If the US Government had this level of debt, it would amount to $130 trillion, which gives us an indication of the severity of the debt trap faced by the Japanese government.

In conclusion, not only has the BOJ’s equity been wiped out by the rise in bond yields so far, but further substantial losses are only temporarily defrayed by doubling down on inflationary bond price intervention.

The ECB and the euro system

The ECB and its network of national central banks differs from the other central banks because the ECB is not responsible to any national government, and the national central banks have dual mandates, first to the ECB itself and to their national governments secondly.This means that the ECB cannot turn to a government to make up a shortfall in its accounts. Its shareholders are the national central banks in the euro area which own their ECB shares in varying quantities, totalling €8.2bn. The situation has arisen whereby rising bond yields are undermining the ECB’s finances and those of its shareholders at the same time, requiring the ECB and national central banks to all be refinanced.

Table 4, which assumes average bond durations of ten years, illustrates this point. With the exceptions of Ireland, Malta, and Slovenia all the national central banks have seen losses exceed their equity due to falling bond prices, with the table illustrating the effects for selected national banks, the ECB and the Eurosystem as a whole. The calculations in Table 4 are based on the change in yields on national eurobonds, with the ECB and Eurosystem assuming an average 600 basis point fall in bond prices in their portfolios since 31 December. For Italian, Spanish, Greek and Portuguese paper, which make up the bulk of the bonds, price declines are more.

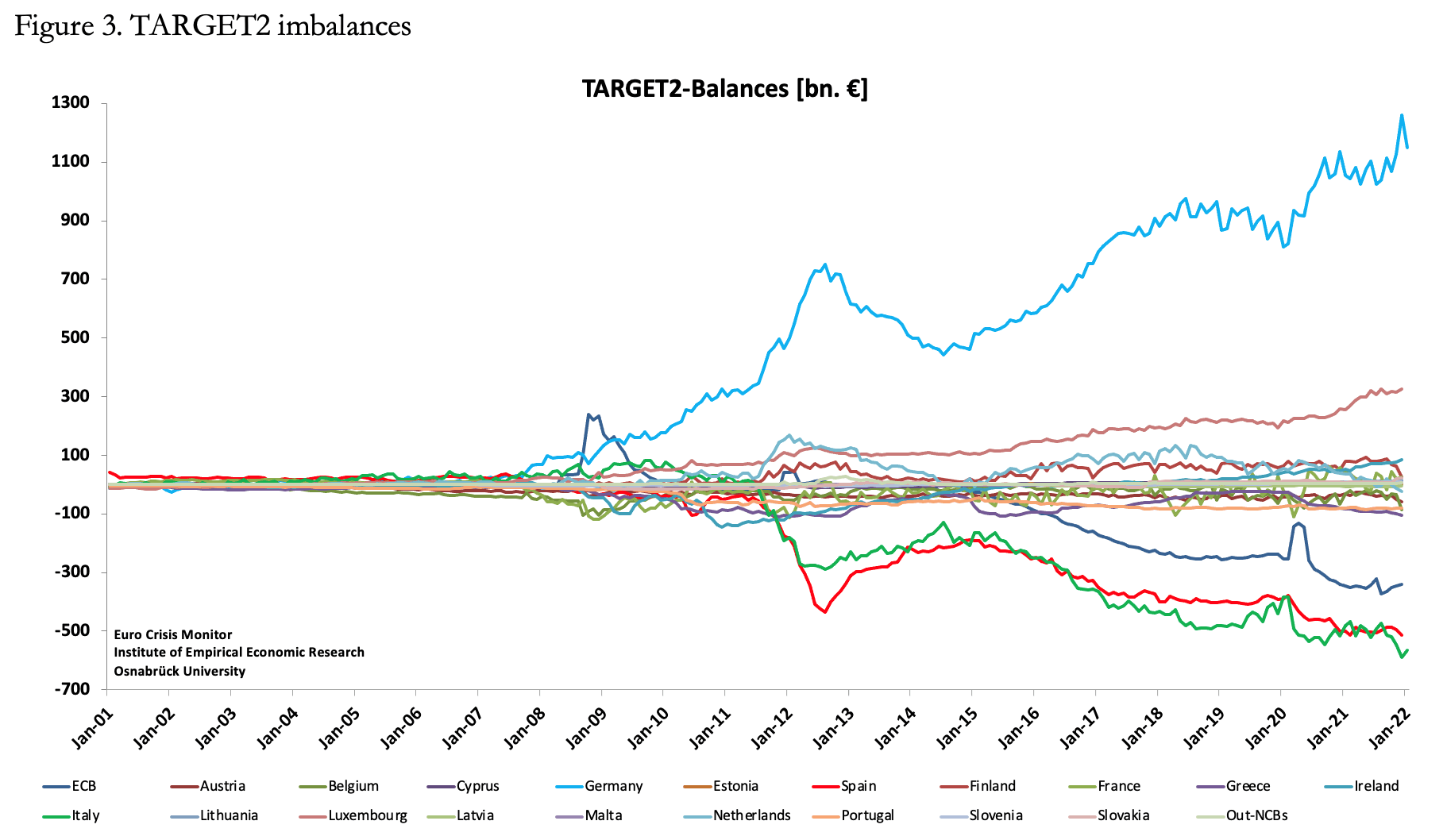

The results of this analysis are shocking. Meanwhile there is the additional problem of the TARGET2 settlement system, where imbalances add up to nearly €1.792 trillion, with additional factors taking total imbalance adjustments to €2.476 trillion. TARGET2 is believed to hide bad and doubtful debts in repo collateral, which if they remained in national commercial banking systems would almost certainly be classed as non-performing. The Eurozone’s settlement system also reflects balances from net exporters, such as Germany, and of net importers, such as Italy. Figure 3 shows the TARGET2 position at end-December.

In theory, these imbalances should never have arisen. They indicate, for example, that Germany’s Bundesbank is owed €1.261 trillion by other NCBs, particularly Italy and Spain as well as by the ECB itself. But with falling bond prices a new dynamic is introduced. The following is extracted from a paper by Karl Whelan criticising Jens Weidemann’s concerns about TARGET2 imbalances expressed in a letter to ECB President, Mario Draghi in 2012:[iv]

“…every national central bank in the Eurosystem currently has assets that exceed their liabilities and total Target2 credits equal Target2 liabilities. Thus, the most likely resolution of Target imbalances in the case of a full Euro breakup would be a pooling of assets held by Target2 debtors to be handed over to Target2 creditors to settle the balance. This may leave the Bundesbank holding a set of peripheral-originated assets that may be worth less that face value, but this scenario would result in losses to the Bundesbank that would be far short of the current value of its Target2 credit.”

Whelan’s criticism of Weidemann’s concerns is essentially Keynesian and in accordance with EU establishment opinion. But note that as of now, nearly all NCBs in the Eurosystem have negative equity, which is the condition denied in Whelan’s paper, where liabilities exceed assets. And as bond yields continue to rise a resolution of TARGET2 imbalances becomes impossible without the euro system falling apart.

Part of the problem is lending by the ECB and NCBs to commercial banks through repos. Together with repos between commercial banks, the entire repo market in euros is estimated to exceed €10 trillion. This market has grown strongly on the back of ultra-cheap funding and a blind eye turned to collateral quality by some of the NCBs. Rising interest rates will make repos less attractive, and trigger what amounts to a contraction of bank credit, at a time when help from central banking sources to bail out the commercial banking network will be compromised by their own deteriorating finances.

Consequences for commercial banks

The long-held supposition that central banks are the safety net, the lenders of last resort when there is an economic or financial crisis is set to be challenged by the fragile conditions of the major central banks. While there may be some damage to national currencies, the entire financial establishment assumes that that would be a reasonable cost for the protection of depositors’ interests, and that bank runs must be avoided at all costs. Behind it all is a belief that armed with a printing press, a central bank’s own financial position is immaterial.These assumptions ride roughshod over the issue of public confidence, which is unlikely to tolerate a situation whereby a government is seen to be the ultimate protector of the banks by recapitalising its central bank to deal with a crisis. Instead, there is a heightened risk that the masses are likely to take avoiding action to protect themselves, undermining any chance of success. It is one thing for central bankers to claim expertise in monetary affairs, but quite another for the political class to do so with credibility.

There is, therefore, a heightened risk of policy failure, and ultimately of currency failure as well. This is particularly acute when the link between the political class and a central bank does not exist. It is the unique position of the ECB, which now has the distinction of depending on its bankrupt shareholders to rescue itself from bankruptcy. And if interest rates rise in the coming weeks the Euro system’s bloated repo market will contract, leading inevitably to commercial bank failures within the Eurozone.

To think that Brussels can come to the rescue overnight with a rescue package represents the triumph of hope over experience. Disunited squabbling politicians and bureaucrats would need weeks, even months to agree a rescue package even if agreement can be reached, which with all the blaming and shaming is almost certainly forlorn hope. Shutting markets and banks for more than a few days while the debate rages would simply heighten the sense of crisis.

The financial structure of the Eurozone, the sharply different economic and political interests of the member states, together with the legacy of bad debt coverups over a string of financial crises and compromises since its inception all point to a lack of any desire to resolve the ECB’s insolvency. Only by individual governments standing behind their own national central banks can they be recapitalised, conditional on the ending of the euro system. No longer can Germany subsidise Italy, Spain and France. A recapitalised Bundesbank will have to walk away from its ECB capital key, as must all the other national central banks. And the Bundesbank will have its hands full stabilising its own commercial banking network.

The currency will be gone, replaced with — what? To succeed, a new German national currency would probably require a clear out of the existing Bundesbank management and more credible sound money executives to be appointed. Even then, the temptation to rescue every failing bank and business would be hard to resist. Government debt denominated in euros would be wiped out, but to succeed with a new currency government spending must be wholly funded by taxation — the currency and credit expansion must stop.

The chaos in other Eurozone states would almost certainly rule out any currency replacement succeeding without backing down from cherished socialism. Pleas from Italy, Greece, Spain, Portugal, and France for German subsidies to continue must be ignored for the sake of Germany’s new currency. The political and economic consequences are unimaginable, except for the almost certain collapse of the entire European Project.

The systemic risks for other banking networks exposed to the euro system’s commercial banks and the euro currency will add to the difficulties faced by them. The precedent of Austria’s Credit Anstalt failure in 1931 will haunt today’s central bankers, and they are sure to move as rapidly as their finances allow to prevent their own commercial banking networks to be destabilised.

The only way a global banking failure can possibly be stopped is for the other central banks to find a way of shoring up the Eurozone with the utmost urgency.

The John Law precedent points to the outcome

A way must be found to beef up the equity in central banks. Loan capital will not do — it must be equity. Perhaps the ECB will find a supra-national, like the IMF, to back it. However the central banks’ illiquidity problem is resolved, it will not only be embarrassing for statists but it will send a public signal that their faith in their fiat currencies may have been entirely misplaced.The similarities with the failure of John Law’s Mississippi scheme 302 years ago almost to the day are remarkable. At the end of February 1720, Law’s Banque Royale was due to merge with his Mississippi venture, but earlier in the month the scheme was already falling apart. The more shares that the bank bought to support the failing Mississippi share price, the more livre banknotes entered circulation undermining their purchasing power. Hoarding of gold and silver coin increased and the public began to reject the banknotes. Investors began selling shares and disposing of banknotes for any kind of portable asset when Law began confiscating gold and silver coin.

What is happening today to central banks is beginning to resemble the problems faced by the Banque Royale. The policies of quantitative easing to support financial asset values are no different from Law’s share support scheme for his Mississippi venture. The loss of faith in his paper livres reflected in soaring prices is just beginning to be echoed in today’s paper currencies.

The Mississippi shares started falling from 12,000 livres in mid-February to 8,500 livres on 1 March. The currency also began its collapse and by September there was no exchange rate for it on the exchanges in London and Amsterdam, meaning it had become worthless. Today, financial asset values have begun to decline, and reflected in their declining purchasing power, currencies have as well.

Based on the John Law precedent, not only have we been able to anticipate the progression of events today, but we are getting alarming confirmation that what happened in France in 1720 to Law’s forerunner of today’s central banks is now being repeated on a global scale. And surely, the bankruptcies of modern central banks have been the only pieces in the puzzle missing — until now.

[i] Yardini Research.

[ii] 13 February 2022.

[iii] Bank of Japan statistical release for 15 February 2022

[iv] See https://www.karlwhelan.com/IrishEconomy/WeidmannMunchau.pdf

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.