Market Report: Solid demand for PMs

Oct 16, 2015·Alasdair Macleod

Precious metal prices rose over the week, with gold up $30 and silver up 32 cents.

Platinum closed yesterday up over $50 on the week, but palladium was unchanged. Silver is now up 4% on the year and gold is at break-even.

Driving precious metal prices was dollar weakness, and the widely-followed US Dollar index (DXY) is now technically vulnerable to a significant drop. This weakness ties in with a gradual acceptance that dollar interest rate rises are on hold indefinitely. Furthermore, the usual chorus of Keynesian economists is beginning to talk about the necessity of negative interest rates, which would probably guarantee a substantial fall in the dollar, and a corresponding rise in commodity prices, bringing about their desired increase in price inflation.

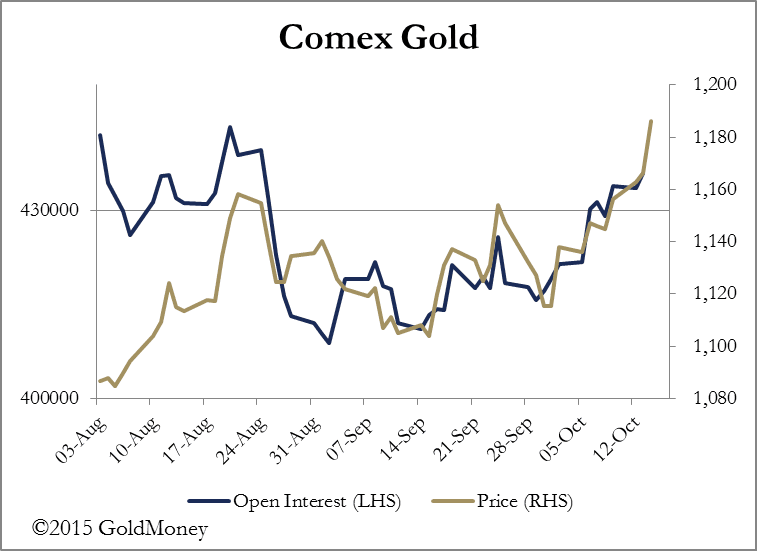

Negative interest rates would make it more costly to hold dollar cash than gold, with obvious price consequences. It is therefore logical that the bearishness over gold and silver that has prevailed in futures markets until recently is replaced by some genuine buying demand. The next chart shows how this has been reflected in Comex futures for gold, where a rising price has been underpinned by a rise in Open Interest.

The gold price has now risen by close to 10% from the 24th July low of $1078 to last night's close at $1183. The interesting bit is the rise from the low on 11th September, when Open Interest started to increase. Before then, the rise appeared to lack conviction, but since that date the increase in Open Interest is clear to see. This tells us the character of the market is fundamentally different from before, with buying throughout the week, and one would now expect to see profit-taking on Fridays ahead of the weekend. In this context, an initial fall of $4 in this morning's early European trade was to be expected, and the prospect of some profit-taking over the course of the day is as well.

If, instead, gold rallies to over $1185 by tonight's close, it could be taken to be an immensely bullish move. Even if this doesn't happen, seeing genuine buying develop is good news for gold, and traders are modifying their speculative behaviour accordingly. However, the Commercials (particularly the banks and swap dealers) are now running short positions, and are sure to take advantage of any opportunity to mark prices down and trigger stops. So while the rise in price has so far been relatively undramatic, we can expect increased volatility to develop in the coming weeks.

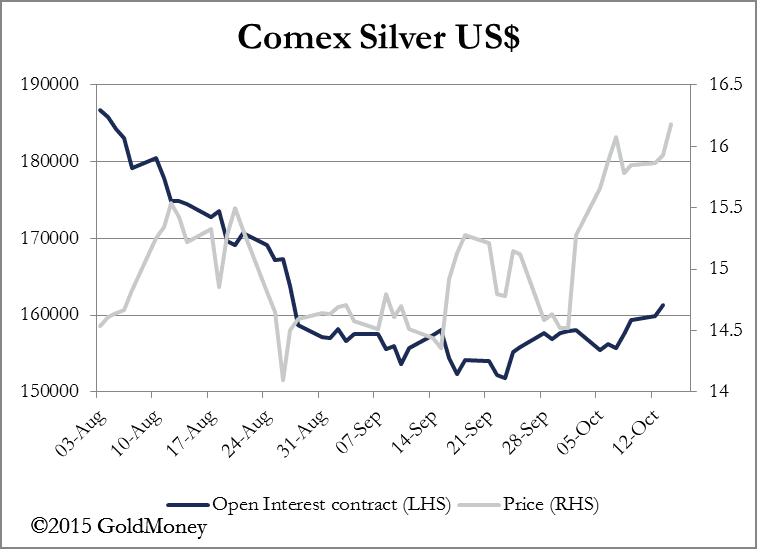

The silver chart of Comex Open Interest reflects the same basic theme as that of gold, though the price rise was more substantial relative to the more gradual increase in Open Interest, and occurred slightly ahead of that of gold.

Next week

Monday

Eurozone: Construction Output.

UK: CBI Business Optimism.

US: NAHB Housing Market Index.

Tuesday

US: Building Permits, Housing Starts.

Wednesday

Japan: Trade balance, All Industry Activity index.

UK: Public Sector Net Borrowing.

US: Mortgage Applications, EIA Crude Oil Stocks.

Thursday

Japan: Foreign Bond Investment.

UK: Retail Sales.

US: Initial Jobless Claims, Existing Home Sales.

Friday

Japan: Manufacturing PMI, Leading Indicator (Final).

Eurozone: Markit Composite PMI.

US: Markit Composite PMI, Leading Index.

The views and opinions expressed in the article are those of the author and do not necessarily reflect those of GoldMoney, unless expressly stated. Please note that neither GoldMoney nor any of its representatives provide financial, legal, tax, investment or other advice. Such advice should be sought form an independent regulated person or body who is suitably qualified to do so. Any information provided in this article is provided solely as general market commentary and does not constitute advice. GoldMoney will not accept liability for any loss or damage, which may arise directly or indirectly from your use of or reliance on such information.