Why interest rates are rising long-term

Nov 22, 2018·Alasdair MacleodThere are growing expectations that the current cycle of rising interest rates will result in a deflationary recession. While a credit crisis is increasingly likely to evolve in the coming months, it is a highly inflationary situation. A combination of higher interest rates and catastrophic falls in the purchasing power of fiat currencies will continue to plague welfare-driven states in the wake of a credit crunch. The standard post-crisis solution of monetary and fiscal reflation will not be available. This article examines the ultimate consequences of the West’s abandonment of sound money, free markets and wealth creation in favour of increasing state intervention and wealth destruction.

Introduction

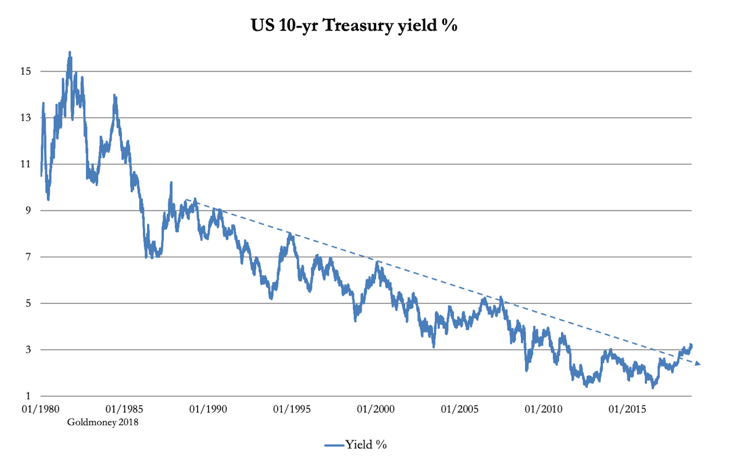

Since 1981, interest rates have been in a secular decline, falling from 20% to zero in US dollars. They are now on the rise, but the general assumption is the current low interest rate environment will broadly continue. This view is complacent and likely to be expensively wrong, being founded on the erroneous view that significant levels of price inflation have been banished.

For the last forty years or so, monetary expansion has taken over from savings as the means of funding business expansion. This accords with the wish expressed by Keynes in his General Theory for the euthanasia of the rentier (or saver) and for entrepreneurial capital to be provided through the agency of the state.[i] Not only have declining interest rates deterred personal savings and encouraged the proliferation of consumer debt, but pension funds, seen as a personal savings backstop, have been undermined by the reduction of compounding interest. Therefore, we can say that during the time of our headline chart, the state has taken over the role from free markets of setting interest rates and distributing capital.

The chart above of the 10-year US Treasury bond tells us that there is now a break in this trend (shown by the dotted line). It appears there is a significant reversal of falling bond yields, threatening the state’s control of interest rates and capital allocation. Lines on charts are notoriously misleading at times, but they also indicate a very low interest rate level is enough to create a credit crisis. That is one issue, another is the general assumption that interest rates can remain permanently low.

The origin of the hope that interest rates will remain low is in large part psychological. For millennia, high interest rates have been seen as usury, or unfair charges imposed by greedy money-lenders on defenceless borrowers. This was certainly Keynes’s view, and it persists with his followers today.[ii] Instead, low interest rates are seen as both an inducement to spend rather than save, and to favour the entrepreneur investing in production over the saver.

Keynes’s view appeared to be that savers, or rentiers as he called them, were the idle rich, not employed but living off usury. To him it was morally wrong that “functionless investors” should benefit from the scarcity of capital, hence his desire for the euthanasia of the rentier. To take this line of argument, he had to navigate round the sheet-anchor of classical economics, Say’s law. He did this by describing it in such a way that it was open to question. These were his words:

“Thus, Say’s law, that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output is the equivalent to the proposition that there is no obstacle to full employment.”[iii]

That is nearly all he had to say on the principle which previously had been the greatest obstacle in economic theory to government intervention. He does not define it, but interprets Say’s law sympathetically to his intentions, and misdirects the reader by alleging that Say’s law was a denial of the high levels of unemployment that persisted in the decade when he wrote these words. And if the greatest living English economist at the time implies that the evidence of mass unemployment shows Say’s law cannot be true, it from that moment dies like Monty Python’s parrot, becoming an ex-law.

Say did not write down a precise definition of what subsequently was associated with him as an iron rule, but he set out very clearly his understanding of how human exchange operated. He demonstrated that we work in order buy the things we need, and our savings are the source of finance for production. This means that all consumer demand is the consequence of and follows the production of supply. Says was describing the division of labour, which is the way humanity maximises relevant output and improves its lot. Say also made it clear that the role of money is only temporary to facilitate the process.

It is a system born from the market, where people freely negotiate their business. It particularly benefited Britain during the industrial revolution, improving the lives of ordinary people, creating wealth and economic progress. There was never any need to replace savers with the state as the provider of capital as Keynes described. Nor for that matter, to replace the peoples’ money, which was gold and silver, with the state’s money. If there was disruption of production, it always came from the government and its licenced banks, which created credit out of thin air through fractional reserve banking. Diluting money by expanding both it and associated credit is a fraud on existing owners of money.

This is Keynes’s inflationary financing, relying on the fact that no one can tell the difference between existing currency and the introduction into circulation of yet more. Obviously, if you expand the quantity of money, other things being equal you have more money chasing the same quantity of goods, so prices will rise. That is the message from Say. The Keynesians answer to this is the demonstrably false proposition, that higher prices encourage consumer demand. However, there is one circumstance where this is true, and that is when the average person shifts his ownership preferences away from money towards goods and services. But this is playing with fire, because such a move can undermine a currency’s purchasing power with surprising rapidity, building into an unstoppable momentum.

There are therefore two variables that alter a currency’s purchasing power: the quantity in circulation and the public’s judgement of its future value. Central banks tend to pay attention to the quantity. The qualitative element cannot be calculated by a mathematical approach, so is generally ignored. Furthermore, mathematical economists tend to overlook sectoral shifts, whereby currency and credit flow between financial and non-financial applications. It is the non-financial economy, the part that produces goods and services that they monitor, assuming financial activities and the asset inflation they stimulate are merely a by-product.

There is a further dimension we cannot ignore. Since the interest rate spike in the early-1980s, savings have migrated from earning interest to seeking equity participation. The simplistic economic model of consumers saving and businesses borrowing has disintegrated, with consumers increasingly taking entrepreneurial risk and funding their personal consumption with credit. Companies with low credit ratings have been happy to print equity rather than go to the bond markets, encouraged further by the freedom from having to pay any dividends.

The result of these changes has been to skew the economy in favour of asset inflation, which has replaced interest on bank deposits and bonds held to redemption as wealth-creator for the ordinary saver. Asset inflation is excluded from inflation statistics, which means it can be increased at will. But asset inflation reflects the passage of expanded money and credit into the financial sector, from whence it always leaks into the real world of production.

The CPI badly underestimates price inflation

The expansion of credit taken up by consumers should have an immediate effect on consumer prices. Yet, if official CPI statistics are to be believed, there has been little price impact from the expansion of consumer credit since the Lehman crisis. And here Say’s law partly explains why.

We specialise in our production to buy the goods and services we do not provide for ourselves. Therefore, when new unearned money is put in our pockets to spend, we bid up prices, reducing the purchasing power of the currency. Alternatively, we can buy goods and services from abroad because they are available at the old prices. This is why the expansion of credit leads to trade deficits. Our ability to import to spend reduces the immediate price impact of extra money and credit, and is a temporary safety-valve for the CPI.

When monetary inflation leads to a trade deficit, the adjustment to the currency’s purchasing power takes place in the foreign exchanges. However, in the case of the dollar, this is often delayed by demand for it as a reserve currency, allowing US price inflation to remain at a lower rate than otherwise. Inevitably, this contribution to price inflation will reverse at some point in the future, probably leading to a substantial adjustment.

There can be no doubt that lower import prices is one reason price inflation has been subdued. But there is another factor at play, phony statistics. You can talk of the general price level, but that doesn’t mean you can measure it. My experience of price inflation is not the same as yours, and yours is not the same as your neighbour’s. A concept is not the same as a statistic.

The CPI statistic is therefore inherently meaningless, which allows statisticians to take views on its composition. Bearing in mind that inflation-linking means a range of welfare payments becomes more expensive to the government if the CPI is rising, you can appreciate that adjustments in this slippery concept will incrementally favour its suppression.

By comparison, the Chapwood index[iv] makes this point by coming up with far higher rates of price inflation than official statistics. Chapwood is comprised of a fixed basket of 500 goods and services, typically bought by the average middle-class American in 50 major cities. It is calculated twice a year with these 2,500 inputs, and for the last five years the average annual price increase of these inputs has been 9.8% That means a dollar today has a buying power of only 62.8 2013 cents. But the government’s version of price inflation says it has averaged 1.53%, and that the dollar buys 92.7 2013 cents. It is an enormous difference.

The CPI’s constituents are continually updated and adjusted, with assumptions made about product substitution replacing rising prices, effectively deflating the index. Parts of the CPI index are adjusted for hedonics, which deflates prices for product improvements. Each adjustment may be small, but they add up. The Chapwood index is simply a fixed basket, with no adjustments at all, and therefore indicates the degree of corruption in the CPI.

Whichever way you cut it, the CPI dramatically understates price inflation. Incredibly, financial analysts think the CPI is not only authoritative, but they even get agitated by CPI calculations that differ from their forecasts by as little as 0.1%. Perhaps it’s the threat of rising price inflation to the long-term trend of asset inflation that subconsciously motivates their wilful blindness. Perhaps it is the unquestioned acceptance of government statistics. Perhaps it’s the inability of analysts to think independently (we certainly see a herd instinct when it comes to forecasting). The three wise monkeys’ syndrome is a combination of all three probabilities.

It amounts to intellectual complacency. Complacency thrives on trends, and so long as there is no disruption to them, there is no pressure for a rethink. But when the trend changes, then even the most supine analyst can no longer ignore reality. That is the worrying thing about the chart of the 10-year US Treasury bond. Not only have we the evidence that the post-1980s trend of lower interest rates may be over, but we can begin to see the inflation dynamics that are already wreaking havoc with consumer prices.

It is not just the US Government’s statisticians in the Bureau of Labor Statistics. CPI calculations are harmonised worldwide and must be producing similarly supressed results. It is obviously wrong to believe in a statistic that is used to manage public expectations and reduce government costs everywhere in the hope that inflation will not be noticed.

When the established order is threatened by a break in trend, doubts over official estimates of price inflation commence with anecdotal evidence. More people will begin to think Chapwood has a point. But has the purchasing power of the dollar really fallen to 62.8 cents in only five years? What does that mean for the GDP deflator: have we been assuming the presence of economic growth, when a properly defined deflator tells us the economy has been in recession ever since Lehman? Does that mean interest rates will have to rise far more than we earlier thought to control the inflation monster?

These questions are not yet being asked. Instead, markets are assuming the Fed is raising interest rates before there is firm evidence of price inflation. Indeed, anticipation is the Fed’s stated policy. The Fed is not even looking at the message from Chapwood. Instead, it sees President Trump’s budget deficit accelerating growth late in the cycle, expecting inflationary consequences. It may also be anticipating the price impact of new and future trade tariffs, which will drive up consumer prices on imported goods, and therefore on goods domestically produced as well.

These are inflation pressures, yet to develop, which are in addition to the existing price erosion hidden from us by the CPI.

The market effects

It is obvious that mainstream economists and analysts are wilfully ignorant of the extent of current price inflation, and only recognise the future pressures on prices that guide monetary policy. They have noticed that rising interest rates have a habit of tripping up the economy, sending it into recession, and that the Fed has a track record of not being able to judge interest rate neutrality. This next chart is what particularly worries them.

The rise in the Fed Funds Rate has taken it through a danger zone (between the two pecked lines), which in previous credit cycles triggered an asset deflation, followed by recession, financial crisis or both. The view gaining ground is that an economic downturn is becoming more likely, as well as the possibility of a systemic event, such as a banking crisis in the Eurozone.

For these reasons, a fall in equity markets is causing a shift of investment funds within the financial sector from equities to bonds, from high-risk to lower-risk, while the narrative is moving from growth to risk of recession. Wall Street is jumping to conclusions about Main Street, when the cause of financial markets instability is, so far, mostly bottled up in Wall Street itself.

The common view is that if a recession comes to pass, inflationary pressures will ease. This expectation is incorrect, as all past inflation episodes involving fiat money have proved. Inflation of fiat currencies continues in a recession because central banks are always ready to compensate for any contraction of bank credit. Stabilisation of consumer prices is only ever temporary, usually imagined rather than real. Instead, monetary inflation only conceals declining economic activity, particularly when the deflator is under-recorded. The simplistic view that price inflation only increases with expanding activity will almost certainly turn out to be a costly mistake for investors fleeing equity risk into bonds.

And here we are, entering the next credit crisis with the inflationary excesses of the previous one unresolved. From August 2008, the month Lehman went under, the total of checking accounts, cash and bank deposits, collectively the public’s dollar exposure, increased from $5.4 trillion to $12.9 trillion today. While this dollar exposure has increased by 140%, the increase in GDP has been only 37%. Clearly, the US economy is still awash with underemployed surplus dollars. Unless higher interest rates begin to properly compensate deposit holders for loss of purchasing power, their relative preferences in favour of holding deposit money will almost certainly begin to decline.

A central bank faced with that prospect risks losing control over interest rates and therefore over the cost of its government’s borrowing. The forthcoming credit crisis is unlikely to replicate Lehman, when a potential collapse of the entire financial system led to a temporary increased preference for holding deposit money in systemically important banks, and a corresponding decrease in preference for goods. That led to a short-term slump in some prices (such as for autos), which quickly passed following the introduction of zero interest rates and money-printing. Zero interest rates will not apply this time, because the problem will be accelerating price inflation that already exceeds interest rates by a substantial margin, coupled with an exceptionally high level of bank deposits relative to the size of the economy.

When financial markets wake up to these inflationary dangers and the consequences for interest rates, there is bound to be a sizeable reappraisal of investment values. At the time in the cycle when Keynesians expect fiscal and monetary policies to soften the recession, they will be forced in the opposite direction. The US Government, as well as other spendthrifts, will find rising borrowing costs have pushed it firmly into a debt trap.

The choice will be stark. Either the US Government and the Fed will have to abandon Keynesian policies and allow a cathartic slump to take hold, or they will have to sacrifice the currency. They lack the collective intellectual capacity to understand the starkness of the choice, so will probably fudge it, leading to the destruction of the currency anyway.

The only solution

For all governments, there is an escape route from this increasingly certain mess. It requires a government to do two things: call a halt to all inflationary financing, and switch from a welfare-driven to a wealth-creation model of fiscal and economic policy. The welfare-driven economies have consistently rejected this direction of travel and will find it especially difficult to change tack, given the totality of vested interests. The two nations that can do it are Russia and China. Russia is aggressively building her gold reserves so as to be independent from the influence and decline of fiat currencies. China will have to modify her economic policy, having supped at the table of bank credit, but her government finances are sound enough to contemplate it.Historians will look back to current times and note the credit crisis of 2018-2019 marked the end of an era that started with monetary cooperation between two central banks, the Fed and the Bank of England following the First World War. It evolved from there. It took the free world progressively into inflationism and the destruction of the wealth upon which economic progress previously depended. The final credit crisis fuelled by fiat currencies was the end of the Anglo-Saxon empire that had dominated world affairs.

Asia under communism had been a sleeping giant who awoke when socialism collapsed under its contradictions. Without the West’s accumulation of costly welfare systems, the Asian continent with nearly half the global population broadly escaped the calamity of the ending of fiat money by embracing sound money – gold. With it, China and Russia turned their backs on a Western currency collapse and built their own industrial revolution, embracing the whole continent.

For America, the Europeans and Japan, the end of the fiat money era was swift. The end of government policies of intervention allowed their peoples to take control over their own lives again, by embracing what for millennia had been central to Say’s law: their own choice of money to facilitate peaceful coexistence under free markets.

We can only hope the last bit turns out to be true. The rest appears increasingly certain.

[i] Keynes’s The General Theory of Employment, Interest and Money, Ch. 24, II.

[ii] Ibid.

[iii] Ibid. Ch.3, I.

[iv] http://www.chapwoodindex.com/

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.