The emerging evidence of hyperinflation

Oct 1, 2020·Alasdair MacleodNote: all references to inflation are of the quantity of money and not to the effect on prices unless otherwise indicated.

In last week’s article I showed why empirical evidence of fiat money collapses are relevant to monetary conditions today. In this article I explain why the purchasing power of the dollar is hostage to foreign sellers, and that if the Fed continues with current monetary policies the dollar will follow the same fate as John Law’s livre in 1720. As always in these situations, there is little public understanding of money and the realisation that monetary policy is designed to tax people for the benefit of their government will come as an unpleasant shock. The speed at which state money then collapses in its utility will be swift. This article concentrates on the US dollar, central to other fiat currencies, and where the monetary and financial imbalances are greatest.

Introduction

In last week’s Goldmoney Insight, Lessons on inflation from the past, I described how there were certain characteristics of Germany’s 1914-23 inflation that collapsed the paper mark which are relevant to our current situation. I drew a parallel between John Law’s inflation and his Mississippi bubble in 1715-20 and the Federal Reserve’s policy of inflating the money supply to sustain a bubble in financial assets today. Law’s bubble popped and resulted in the destruction of his currency and the Fed is pursuing the same policies on the grandest of scales. The contemporary inflations of all the major state-issued currencies will similarly risk a collapse in their purchasing powers, and rapidly at that.

The purpose of monetary inflation is always stated by central banks as being to support the economy consistent with maximum employment and a price inflation target of two per cent. The real purpose is to fund government deficits, which are rising partly due to higher future welfare liabilities becoming current and partly due to the political class finding new reasons to spend money. Underlying this profligacy has been unsustainable tax burdens on underperforming economies. And finally, the coup de grace has been administered by the covid-19 shutdowns.

The effect of monetary inflation, even at two per cent increases, is to transfer wealth from savers, salary-earners, pensioners and welfare beneficiaries to the government. In no way, other than perhaps from temporary distortions, does this benefit the people as a whole. It also transfers wealth from savers to borrowers by diminishing the value of capital over time.

Inflation of the money supply is now going into hyperdrive, so those negative effects are going to get much worse. It is time to move from empirical evidence to the situation today, which is the unprecedented increase in the global rate of monetary inflation and specifically that of the world’s reserve currency, the US dollar.

The dollar’s inflation

No doubt, the reluctance to reduce, or at least contain budget deficits is ruled out by the presidential election in November. But whoever wins, it seems unlikely that government spending will be reined in or tax revenue increased. For the universal truth of unbacked state currencies is that so long as they can be issued to cover budget deficits they will be issued. And as an inflated currency ends up buying less, the pace of its issuance all else being equal will accelerate to compensate. It is one of the driving forces behind hyperinflation of the quantity of money.

Since the Lehman crisis in August 2008, the pace of monetary inflation has accelerated above its long-term average, and the effect is illustrated in Figure 1 below.

Figure 1 includes the latest calculation of the fiat money quantity, to 1 August 2020. FMQ is the sum of Austrian money supply and bank reserves held at the Fed — in other words fiat dollars both in circulation and not in public circulation. Because commercial banks are free to deploy their reserves within the regulatory framework, either as a basis for expanding bank credit or to be withdrawn from the Fed and put into direct circulation, whether in circulation or not bank reserves at the Fed should be regarded as part of the fiat money total.

It can be seen that the rate of FMQ’s growth was fairly constant over a long period of time — 5.86% annualised compounded monthly to be exact — until the Lehman crisis when the rate of growth then took off. Since Leman failed in 2008 FMQ’s total has grown nearly 300%.

Since last March growth in the FMQ has been unprecedented, becoming almost vertical on the chart, triggered by the Fed’s response to the coronavirus. And now a second wave of it has hit Europe and the early stages of a resurgence appears to be hitting the land of the dollar as well. With lingering hopes of a V-shaped recovery being banished, a further substantial increase in FMQ is all but certain.

Already, FMQ exceeds GDP. If we take the last time things were normal, say, in 2005 when the US economy had recovered from the dot-com crash and before bank credit expansion and mortgage lending become overblown, we see that in a functioning relationship FMQ should be between 35%—40% of GDP. But with the US economy now crashing and FMQ accelerating, FMQ is likely to be in excess of 125% of GDP in the coming months.

What is the source of all that extra money? It is raised through quantitative easing by the central bank in a system that bends rules that are intended to stop the Fed from just printing money and handing it to the government. Yet it achieves just that. The US Treasury issues bonds by auction in the normal fashion. The major banks through their prime brokers bid for them in the knowledge that the Fed sets the yield for different maturities through its market operations. The Fed buys Treasury bonds up to the previously announced monthly QE limit, only now there is no limit, giving the primary brokers a guaranteed turn and crediting the selling banks’ reserve accounts with the proceeds.

This arm’s length arrangement absolves the Fed of the sin of direct money-printing but evades the rules by indirect money-printing. The Treasury gets extra funding through this roundabout arrangement. Participating banks generally expand their bank credit to absorb the new issue, which they then sell to the Fed, which in turn credits the banks’ reserve accounts. The Treasury gets the proceeds of the bonds to cover the deficit in government spending, and the banks get expanded reserves. The Fed’s balance sheet sees an increase in its liabilities to commercial banks and an increase in its assets of Treasury bonds. The Fed also funds agency debt in this manner, mostly representing mortgage finance.

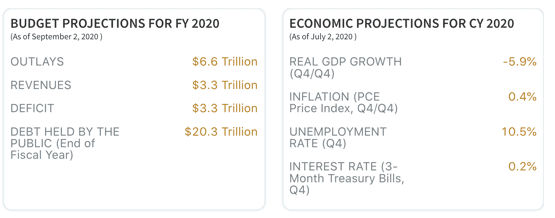

Under President Trump, the Treasury’s current deficit initially expanded as a planned supply-side stimulus to the US economy to the tune of just over a trillion dollars before covid-19 created additional financial chaos. Businesses experienced severe dislocation and have suffered a widespread collapse. Consequently, and together with the direct injection of money into each household, the Congressional Budget Office revised its trillion-dollar deficit for the financial year just ended as the following screenshot from its website indicates:

Note how half the government’s income arose from revenues and half is covered by sales of government debt to the public (i.e. the commercial banks), which at the end of fiscal 2020 (ended yesterday) is estimated to total $20.3 trillion. But given that the first half of that fiscal year was pre-lockdown and the annualised rate of the deficit at that time was about a trillion dollars, simplistically the annualised rate of the deficit’s increase since last March is in the region of $4.4 trillion. Incidentally, the CBO’s economic projections look too optimistic given recent events, in which case budget projections for this new calendar year will be adjusted for considerably lower revenue figures, and significantly greater outlays at the least. We shall address the price inflation estimates later in this article.

Why QE is inflationary

On 23 March the Federal Open Markets Committee (FOMC) announced unlimited QE for both US Treasury stock and agency debt as well as however much liquidity commercial banks need.[i] While judging the expansion of the budget deficit to be inflationary, it is only inflationary to the extent that it is not financed by savers, either increasing the proportion of their savings relative to immediate spending, or to the extent they divert their savings from other investment media. In the latter case, citizens have been committing their savings more to equity markets than bond markets. The returns for discretionary portfolios managed on the public’s behalf have also found better returns in equities than in government and corporate bonds, though when assessing increasing investment risk Treasury stock is seen to be a safe haven in bond portfolios. Pension funds and insurance companies also allocate cash flow to US Treasuries and to the extent that this is the case, the issuance of further government debt is non-inflationary.

Furthermore, if a bank does not increase its balance sheet by expanding bank credit, its participation in the Fed’s QE programme is not inflationary either. For this to be the case, it would have to sell existing stock, call in loans or subscribe on behalf of clients.

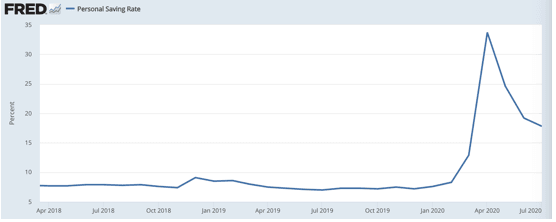

By seeing them through a Nelsonian blind eye these factors give some encouragement to the Fed in funding the Treasury through QE, particularly since the statistics reflect a jump in savings, as the following chart from the St Louis Fed illustrates.

More correctly, the chart reflects the fall in spending when people locked down, as well as the $1,200 stimulus checks distributed to households at end-April, which marked the peak in the chart. Since then, there has been some downward adjustment, partly because some spending has returned, and the backlog of essential spending, such as property maintenance, is being addressed.

The evidence is not yet strong enough to claim this statistical shift in savings habits is permanent. Furthermore, being calculated as the percentage of personal disposable income that is not spent and given the high levels of personal debt throughout the population, much of these so-called savings will have disappeared into credit card and debt repayments. It is more likely that with rising unemployment and roughly 80% of the American salaried population living paycheque to paycheque, that far from there being a higher savings rate, personal finances have deteriorated so much that money is being withdrawn from savings on a net basis, to acquire life’s essentials. In fact, the savings rate is one of those unmeasurable economic concepts, and the reality is that Joe Average is worse off in today’s contracting economy and is drawing down on savings in order to subsist.

The non-inflationary element of QE then boils down roughly to increases in insurance company and pension fund investments in Treasury stock and the increase in bank holdings and reserves at the Fed not funded through the expansion of bank credit. But this creates another factor: the extent to which existing bond investments are sold in order to subscribe for Treasury stock inevitably undermines corporate bond markets and their ability to satisfy their funding requirements. And it is for this reason the Fed has appointed BlackRock to spearhead its purchases of corporate debt to ensure liquidity is available for those markets and to put a cap on risk premiums. Therefore, where banks do not expand credit to buy new Treasury stock, the Fed steps in to compensate with additional monetary inflation.

It has been necessary to go into the mechanisms behind funding government deficits in some detail to establish the inflationary consequences of QE, and to refute claims by monetary authorities and others that QE is either not or only partly inflationary, and so is consistent with the Fed’s mandate. No, with the exception of insurance and pension fund subscriptions, the Fed’s QE is almost pure monetary inflation

The relationship between inflation and prices

Assuming no change in the average cash balances held by a population, over time there must be an inverse relationship between the expansion in the quantity of money in circulation and the diminution of its purchasing power. This is unarguable in logic and to argue otherwise is to subscribe to a version of monetary perpetual motion. By the same token, while the effects on individual prices also have to allow for changes in the factors specific to them, the effects of monetary debasement on the general level of prices should be clear. Now it is time to introduce a second factor; changes in the average cash balances held by a population.

Changes in cash balances are an expression of relative preferences between money and goods. If a population as a whole is satisfied with the stability of money as the medium of exchange, it will be happy to retain balances surplus to its immediate needs. We see this even with inflating currencies, such as the Japanese yen, where irrespective of the level of interest rates monetary expansion merely accumulates as bank deposits. It is unusual for a population to go to the extremes evident in Japan, but equally, a population which realises its currency is declining in purchasing power has every reason to dispose of it in favour of goods, maintaining lower balances in consequence.

The complete rejection of a currency as the medium of exchange renders it utterly valueless and is the common outcome to every hyperinflationary collapse. Governments that become ensnared by inflationary financing face the growing certainty of a Venezuelan outcome.

For now, monetary authorities around the world are relying on public ignorance about money and the theory of exchange. Those who trouble themselves to consider how their currency’s purchasing power is actually changing will notice how it is declining more rapidly than official statistics say. This is deliberate. After the introduction of widespread indexation in the early 1980s governments devised methods to reduce the costs incurred. Changes in statistical methodology have achieved that, with consumer price indices now entirely suppressed, so much so that central banks claim to be struggling to get the CPI to rise to its two per cent target.

The evidence from independent analysts in America such as Shadowstats and the Chapwood Index is that real world prices there are rising at closer to a ten per cent rate and have been for the last ten years. With the FMQ having grown at a monthly compounding annualised rate of 9.6% from the Lehman crisis to the end of 2019, the truth about price inflation appears closer to independent analysts’ calculation than the official CPI. Furthermore, there is little evidence of noticeable change in savings rates or cash hoarding over the period, which would have affected the general level of prices.

The first to realise that the purchasing power of a currency is declining and will continue to do so are usually those who own it for reasons other than as a normal medium of exchange. These are foreign holders who have accumulated currencies other than their own government’s fiat money as a result of trade and have chosen to retain it instead of selling it in the foreign exchanges. And there is a second group of foreign holders which has diversified investment portfolios into foreign financial markets.

These groups are primarily sensitive to external economic and financial factors, such as changes in the outlook for trade, financial asset values and their requirements to hold liquidity in their own currencies. It stands to reason that a state that manages to run continuing deficits on the balance of trade and retain an accumulation of foreign ownership of its currency is vulnerable to changes in international sentiment. This is the situation the dollar finds itself in, with US Treasury TIC figures revealing foreigners own financial securities worth approximately $20.6 trillion, and additionally bank deposits and commercial and US Treasury short-term bills totalling $6.15 trillion. In other words, foreign ownership of the dollar is 130% of the CBO’s estimate of current US GDP.

The accumulation of foreign dollar positions was due to a number of factors: the dollar is the international reserve currency, trade expectations were of continual global growth, the perpetuation of US trade deficits, increasing portfolio investment and a rising dollar. Global trade is now contracting, and the dollar has begun to decline. Commercial priorities are changing from global expansion to conserving capital.

With the global economic outlook deteriorating rapidly, the dollar is notably over-owned by foreigners, which is not counterbalanced by American ownership of foreign currencies. Most of US foreign financial interests are denominated in dollars with exposure to foreign currencies remarkably small at $714bn at end-June.[ii]

China has already declared a policy of reducing her dollar investments in US Treasury bonds and is selling her dollars to buy commodities. Few realise it, but China is doing what ordinary people do when they begin to abandon a currency — dumping it for tangible goods which will cost more in future due to the dollar’s declining purchasing power. And as the dollar’s purchasing power declines measured in commodities more nations are likely to follow China’s lead.

When you see a chart of the expansion of money supply, as illustrated in Figure 2 below and combine that with a falling dollar in the foreign exchanges, it is only a matter of time before increasing members of the domestic population begin to follow the foreigners’ lead.

Compared with the past, there is a generation of millennials which through their understanding of cryptocurrencies has learned about the debasement of fiat currencies by their governments. It remains to be seen whether this knowledge will bring forward the general public’s understanding of monetary affairs for an earlier abandonment of money for goods.

Banking and its cyclical consequences

Not only are some of the global systemically important banks (G-SIBs) highly leveraged on their balance sheets — which one would expect at the end of a period of bank credit expansion — but in most cases stock markets are valuing their equity at a fraction of their balance sheet book values, contrasting with outrageously high valuations for non-financial stocks in the most severe economic downturn ever seen in peacetime.

Table 1 below illustrates the point by incorporating the combination of balance sheet gearing and stock market valuations for all the G-SIBs to give a multiple of balance sheet assets to market capitalisation, ranking them from most dangerous to the least on this measure. The only banks in the list with market capitalisations higher than balance sheet equity — price to book ratios of more than one — are North American banks, which might explain why critical leverages are not recognised as a systemic problem in US financial markets

The three highest leverages by a country mile are of Eurozone banks: remember these are just the G-SIBs — there will be many commercial banks as highly leveraged which are not on this list. To have your equity valued at only 15% of book value, which is the indignity suffered by the French bank, Société Générale, should send warning signals to French banking regulators. But they insist on only looking at the ratio of balance sheet assets to balance sheet equity; which for Soc Gen is still an eye-watering 21.4 times. Unlike the regulator, investors appear to think this bank is most likely bankrupt, its share price little more than a call option on its survival.

It is a problem which particularly affects banks in the Eurozone. And experience tells us that the numbers reported by banks are bolstered by their gaming of the regulatory system, which is why when a bank fails the outcome is always worse than the pre-failure numbers would suggest possible.

Large banks do not operate in national silos, having trade finance activities, foreign exchange and derivative trading, lending in foreign currencies and even substantial branches and subsidiary operations abroad. The idea that a crisis in the Eurozone, or Britain for example, can be contained to national boundaries is wishful thinking. With the exception of Wells Fargo, US G-SIBs come out better than those of other jurisdictions, but that will not save them from a systemic crisis originating elsewhere.

While we can point to the end of the credit cycle, there is no doubt that Covid-19 has precipitated a more immediate crisis for commercial banks. The official talk is no longer of a V-shaped recovery, and businesses are on life support.

In the near future, a banking crisis seems inevitable. The best case is it is contained by either governments nationalising all banks subject to failure, or they end up supported directly by their respective central banks, which given the crisis in the US repo market a year ago can be said to be already happening. For the inflationists there is the consolation that money-printing can then be used to support failing businesses through the banks with obstructive commercial considerations removed.

Interest rates

The principal control mechanism deployed by monetary planners is management of interest rates. They are under the delusion that a reduction of interest rates is a stimulus to industrial investment and therefore the betterment of the economy, whereas all their suppression achieves is the destruction of savings and the advancement of malinvestments.

Their delusions were Keynes’s, and remain so with all his acolytes, among which monetary policy planners are numbered. Interest rates are simply the expression of time preference, the cost that a borrower pays to achieve temporary possession. All goods share this feature, and sound money in free markets reflects an average of the time preference of these goods.

In Keynes’s General Theory, a search of the index reveals just one reference to time preference, which occurs three times on the same page and nowhere else.[iii] This vital topic is thus dismissed. Keynes accepted that there is time preference but became confused as to what it represents. He merely saw it as a psychological counterpart to his invention of the propensity to consume and failed to make the connection between time preferences for goods and their monetary representation. Since he judged it to be solely related to money as opposed to possession, for him it left open the possibility that interest rates can be managed for a desired economic outcome. This was despite the evidence of which he was otherwise aware, that managing interest rates with a view to controlling the rate of inflation did not work, and that the correlation was between wholesale borrowing costs and the general price level, not its rate of change represented by an inflation rate.[iv] Keynes named it Gibson’s paradox after its discoverer, but since he could not explain the paradox, he chose to ignore it as have all his followers.

For these reasons, managing interest rates to achieve economic outcomes, including recent introductions of negative rates, has proved to be a lamentable failure. But as the currency loses purchasing power, the reflection of time preferences for goods will see an additional factor related to money itself. Thus, time preference expressed in dollar terms becomes significantly higher than justified solely by the deferred ownership of goods. The foreign exchanges insistence that future currency depreciation due to monetary inflation be taken into account will then render the authority’s task of suppressing interest rates impossible.

The Fed will find that in the absence of a significant increase in savings — something it is determined should not happen anyway — as well as financing a deteriorating Federal deficit, it will have to absorb foreign sales of US Treasury, agency and corporate bonds. Foreigners are then reluctant possessors of surplus dollars.

In the absence of a rising level of domestic savings, a rapidly deteriorating budget deficit feeds through to one or both of two outcomes. As an identity of national accounting and in the absence of an increase in savings, a budget deficit is mirrored by a trade deficit, both of which in this new fiscal year on present indications are likely to expand to anything between three and five trillion dollars. That is the first outcome, and if President Trump is re-elected next month this deterioration will likely lead to increased hostility against America’s importers.

The second problem, in view of the first, is how importers already overloaded with dollars will respond to the increasing quantity of additional dollars accumulating in their bank accounts from an increasing trade imbalance. The answer must be that they have no reason to hold on to them. And unless the US Treasury buys these unwanted dollars, deflating the quantity in circulation, these dollars will end up driving the exchange rate lower and inflating prices in the domestic economy.

We can see the conditions where the dollar is driven down against other currencies as only a first step, and we are now aware that China is in the vanguard of selling dollars for commodities, likely to be joined by others as the dollar declines. Consequently, the purchasing power of the dollar — already deteriorating at a ten per cent clip according to independent estimates — is bound to deteriorate at a greater pace.

By its statements and actions, the Fed confirms a belief that an increase in price inflation can be controlled by raising interest rates. Consequently, a falling dollar in the foreign exchanges will present it with an insuperable dilemma: does it raise interest rates to protect the dollar and thereby burst the bubble in financial assets and force the Federal Government’s finances into insolvency? Or does it just let price inflation rip? The choice will be as black or white as that.

Almost always, central banks in this invidious position end up with a compromise, raising interest rates too little too late. Just occasionally, they raise overnight interest rates to stratospheric levels in an attempt to restore order by squeezing the speculators. Other than the temporary effects of the latter expedient, we know from Gibson’s paradox that raising interest rates to control price inflation does not work. And with 130% of the GDP statistic currently represented by foreign ownership of dollars, the bulk of nearly $27 trillion like an elephant in the room is overhanging the foreign exchanges. Worse still for the Fed, Gibson’s paradox tells us that even if the Fed raised interest rates to compensate fully for loss of purchasing power it would not be sufficient to stabilise the currency: that requires the adoption of sound money policies and a stop to inflationism.

The way to look at it is by understanding the foreigners’ assessment of time preference, comprised of a general level for the exchange of goods and an additional level peculiar to a depreciating currency. Therefore, irrespective of the Fed’s interest rate policy market forces represented by foreign interests will take over control of interest rates, and the Fed’s bond bubble will be burst. Rising yields for US Treasuries will collapse the equity market and the market for corporate debt. These events will threaten any remaining foreign interest in the dollar and its capital markets even further. In short, the policy of inflating a financial asset bubble becomes impossible to sustain and its failure will take the dollar down with it as well.

This was why when John Law’s Mississippi bubble burst three hundred years ago, by October 1720 his currency, the livre, was worthless on the foreign exchanges. The collapse had started eleven months earlier, when Law accelerated the inflation of the livre to support a failing share price. The Fed embarked on a doppelganger acceleration of monetary inflation on 23 March for the whole US bond market. If we replicate the John Law experience, the dollar could become valueless in a matter of months.

It is becoming clear to a growing audience that in the absence of a change in inflationary policies, the days of an unbacked dollar are rapidly coming to an end, and it will take down the international fiat order upon which it is based.

[i]See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323a.htm

[ii] Line 1 less Line 2: https://ticdata.treasury.gov/Publish/bctype.txt

[iii] See pp 166, The General Theory of Employment Interest and Money, Palgrave Macmillan 2007 edition.

[iv] The mistake was to assume that in free markets interest rates are set by savers, when in fact they are set by borrowers in their demand for capital.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.