Keynesians going all in

Jan 21, 2021·Alasdair MacleodMainstream economists are celebrating Joe Biden’s election as US President. For Keynesians, the outlook is for a reaffirmation of economic management by the state, and of reflationary monetary policies to restore economic growth, following the damage caused by covid lockdowns.

This article points out the fallacies in the Keynesian argument. It shows how key economic statistics have been manipulated and misrepresented to conceal the delusions behind state interventions. And based on inflationary programmes only announced so far, we can expect the US budget deficit in fiscal 2021 to rise to over $5 trillion. Furthermore, the twin deficit hypothesis suggests that when the temporary increase in the savings ratio unwinds, the US trade deficit will also increase accordingly.

This assumes no disruption from the known unknowns, such as an inevitable banking crisis and foreigners’ liquidation of their $27 trillion pile of financial assets and bank deposits, causing a sharp rise in interest rates.

As with every cycle of bank credit, Keynesian monetary policies will be disproved again. But this time and without a major shift in economic and monetary policies, fiat currencies are almost certain to collapse, necessitating their urgent replacement with sound money.

Introduction

The Keynesians, who overwhelmingly outnumber monetarists and sound money men, are firmly in charge. Yesterday (20 January), Joe Biden officially became US President with a “new deal” agenda which will exceed in ambition any stimulus in American history; to put the coronavirus to bed, promote economic growth and restore America to the green agenda. There is little doubt in Keynesian minds that for changes in economic policy, Donald Trump was Herbert Hoover to Joe Biden’s Franklin Roosevelt. Keynesians are heaving a sigh of relief that state control over the macro economy is back in safe hands.

Now that Biden can reflate, they say the US economy will recover and grow. Investment will come flooding into America from around the world, driving the dollar higher against the currencies that persist with austerity measures (in other words, every currency of every nation that refuses to reflate as much). Even the IMF is exhorting all governments to spend as much as possible. For Keynesian Americans, the economic outlook has improved immeasurably with Trump gone.

The investment and banking establishment undoubtedly believes in this improved outlook, because of their Keynesian credentials and their commercial interests. They are citing three things. Inflation is at bay with the CPI growing at less than two per cent, giving ample room for monetary expansion within the Fed’s dual mandate. Industry can begin to invest again with increasing confidence when the pandemic is over. And with the savings rate having been boosted during lockdowns, there is ample consumer spending to be unleashed, which could even result in a latter-day roaring-twenties economy.

For now, Keynesian investment strategists and managers can with renewed enthusiasm dismiss gold as a pet rock. They see gently rising interest rates returning markets to normality in future, and as economic recovery morphs into sustained growth, national finances will return to a balance and then surplus when tax revenues fully recover. It is the Keynesian argument of the 1960s resuscitated and repackaged for the 2020s.

How many times have we seen this? Every turn of the credit cycle, the Keynesian argument fails only to return as the establishment’s beacon of hope.

There are two stand-out statistical falsehoods behind Keynesian assumptions. The first concerns the relationship between monetary inflation and prices, and the second is the representation of GDP as a measure of economic activity. While much of this is trolling over ground already covered in earlier articles for Godmoney, it is essential to fully comprehend the fallacies over these two macroeconomic measures before we can proceed to assess the seriousness of any disinformation they provide, and how these misrepresentations will affect economic outcomes.

Changes in the general level of prices

The general level of prices is an economic concept that is just that: it simply cannot be measured. The fact that it is only a concept gives anyone who tries to establish a proxy considerable latitude in their method. Government statisticians have taken full advantage of this fact to reduce the burden of inflation compensation written into their governments’ commitments with both their general public and investors holding index-linked government bonds.

It is an cumulative process that commenced soon after governments agreed to compensate their citizens for rising prices in the wake of the inflationary 1970s. John Williams at Shadowstats.com has reverse-engineered the changes in statistical method deployed by the US Bureau of Labour Statistics since the early 1980s to arrive at a figure for price inflation without those changes. The difference from official CPI estimates is remarkable.[i] And if we look at the publicly available Chapwood Index, which covers the prices “of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities” we see that annualised prices measured this way have risen recently by as much as 13.4% (Sacramento) and at the least by 7.1% (Albuquerque), all being several multiples of the official CPI estimate. Major cities also have high rates: New York 12.7%, Los Angeles 13.1% and San Francisco 12.8%. But with an arithmetic average across all 50 cities at 10.1%, this is remarkably different from the CPI’s All Items rate for 2020 of 1.4%.[ii]

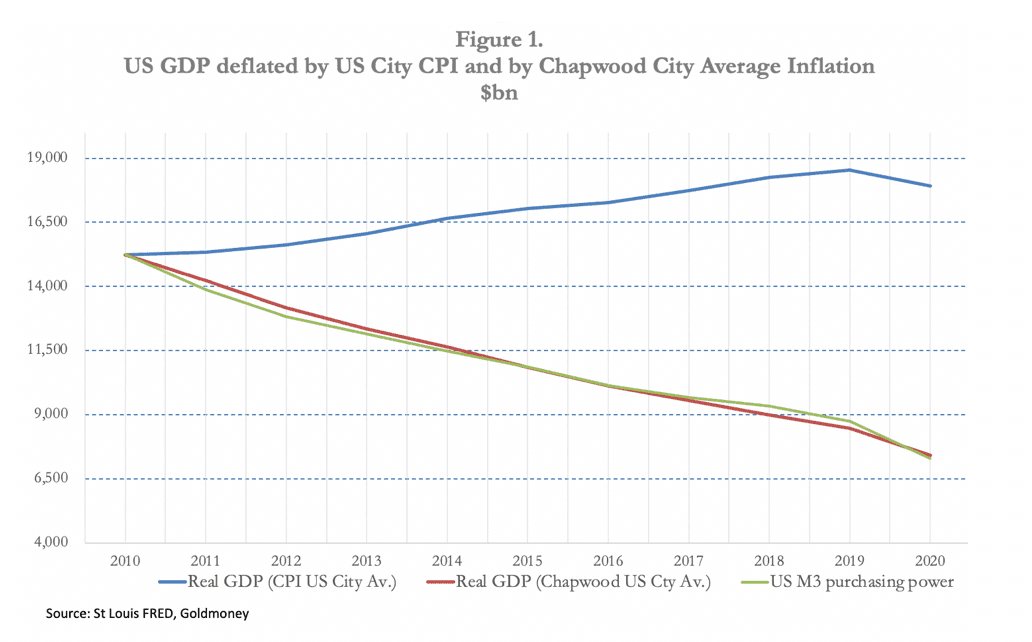

Furthermore, Chapwood shows an average annual inflation rate of 9.97% over all cities between 2011—20. Taking its calculations, we can derive the chart shown in Figure 1.

Using 2010’s nominal GDP as a starting point, we can chart “real” GDP, deflated by the consumer price index (US City Average, therefore comparable to Chapwood), nominal GDP deflated by Chapwood, and nominal GDP deflated by increases in M3, the broad version of money supply. It is immediately obvious that the government version is the outlier, with Chapwood and monetary expansion confirming each other. The implication is that the US economy did not grow in official inflation-adjusted terms. Instead, it contracted continually after adjusting for both price inflation estimates from Chapwood and monetary inflation measured by broad money, corelating very closely with one another. Furthermore, after the initial destabilising effects in the wake of the Lehman failure, the pattern for this correlation was set. And the compounding effect from a base of 2010 led to GDP more than halving in adjusted terms by 2020 deflated by these two measures.

The mirroring of Chapwood and M3 broad money as deflators suggests that there has been little alteration in the general level of liquidity in the hands of consumers, otherwise they would show some divergence. As an approximation, other than a brief spike in 2012 the savings rate has remained reasonably constant over the period, as shown in the screenshot below.

By 2010 this correlation would have become sufficiently established to nullify evidence of the time lag between new money entering circulation and its effects on the dollar’s purchasing power.

It becomes obvious why monetary policy planners need to believe the CPI numbers. Having set themselves a policy target of full employment consistent with a 2% inflation target, it is clear that on realistic figures interest rates are mightily suppressed. The planners’ solution has been for Keynesian investment strategists, fund managers and even foreign investors to be made to believe that price inflation is subdued and no threat to inflationist policies. It has been remarkably successful: they all now subscribe to a fairy-tale that is parallel to the world in which they actually exist. They are Hans Christian Andersen’s citizens frightened to admit their foolishness in pointing out that the emperor wears no clothes. Consequently, statists have got away with imposing inflationary monetary policies with public impunity — so far.

When the deception is finally rumbled the consequences will be dramatic. Not only has the suppression of interest rates as a means of stimulating the US economy been a total failure, and that inflation of the money supply has been the best metric to adjust nominal to real GDP, but the consequences of discovery are likely to be both shocking and sudden.

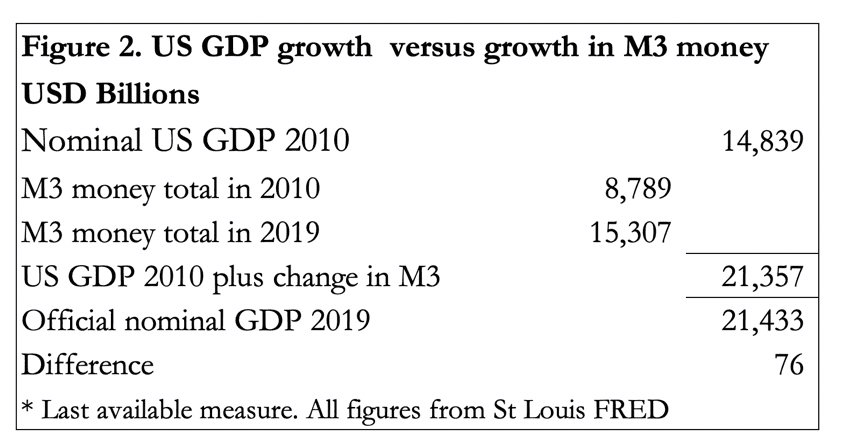

As in the fairy-tale, an innocent child can point out the arithmetic which evades the comprehension of PhD economists. For the purpose of illustration, let us assume an economy with a balance of trade, and no net capital inflows or outflows. And let us further assume that GDP is made up from all economic activity. Then we can illustrate the point.

Nothing has changed to the economy apart from its numeric representation. If money is added to that already in circulation, GDP is increased accordingly. But at the same time, the previously existing money is diluted, which means that the value of all transactions is reduced in proportion to the additional money. Despite the temporary boost of new money entering the economy, once that distortion is fully absorbed the debasement of the value of all transactions will mean that there has been no increase in economic activity.

For confirmation of the assertion, that an increase in GDP is no more than the addition of inflated money, we turn to Figure 2, which covers the same period in Figure 1: i.e., 2010 to the end of 2019. There is almost no difference between the sum total of 2010 GDP and the increase in broad money, and the GDP statistic for 2019.

That there is such a small difference confirms the thesis that GDP is no more than a money total. In other words, the common perception that increases in GDP represent economic growth is entirely false; it represents no more than the growth of money. And given that all major currencies are undergoing unprecedented expansions in their quantities, the divergence between GDP statistics taken to be economic growth from economic reality will become increasingly misleading.

The Keynesians have misled themselves into believing that an increase in GDP equates with economic progress and represents increased production and consumption. Economic progress is a separate, unmeasurable issue, which in the merry-go-round of Keynesian explanations is confused with monetary growth.

It is testament to the power of free markets that economic progress is not quashed easily by Keynesian interference. Evidence of the free market’s ability to escape from economic and monetary planners is seen in the creation of new industries, forcing state regulators to come up with new sets of regulations ex post. Instead of letting new innovation and businesses prosper, statists can hardly wait to impose their restrictive regulations upon them. But it is that innovation which chalks up economic progress, which is as unmeasurable as the general level of prices and beyond the reach of statist bean counters.

The mistakes made by ignoring these obvious factors are going to be exposed too late at a time of unprecedented American and global monetary inflation. And they are not confined to America: the suppression of CPI price inflation, with minor variations, is internationally standardised, which means that all central banks are free, for now, to make the same mistakes.

The consequences of US monetary policies in fiscal 2021

Now that we have identified the mistakes that will be made by Keynesian and macro-economists with President Biden in charge, it is time to assess the extent to which they will be made in the current fiscal year to end-September 2021. We must first assume Biden’s and the Fed’s policies will run their course without a global banking crisis or any other significant interruption.

Biden has already laid out plans to add a stimulus package of $1.9 trillion, on top of the Coronavirus Response and Relief Act’s $935bn passed by Congress in late-December. Add in the continuation of the Paycheck Protection Programme’s $700bn (part of the earlier CARES Act), plus a few other disbursements, and so far in Fiscal 2021 we have an extra $3.535 trillion in covid-related spending, on top of the Congressional Budget Office’s estimate last September of a budget deficit of $1.810 trillion. Assuming there are no further covid-related packages, the budget deficit for 2021 is already heading towards $5.345 trillion.

Government estimates for GDP to September 2020 — in line with the fiscal year — are that it was $21 trillion. Assuming all of the budget deficit is financed by quantitative easing and bank credit expansion, in other words by monetary inflation, we can expect nominal GDP for fiscal 2021 to grow significantly, only reduced by two significant factors: the contraction of bank lending to private sector borrowers, a process already underway, and the accumulation of savings from helicopter drops. Allowing for these headwinds, the outcome for nominal GDP from an additional monetary inflation of $5.345 trillion is likely to be lauded by Keynesians as a sharp recovery in annualised nominal GDP of about 20%, fully justifying Biden’s stimuli. For those wedded to the untruth that GDP is economic growth, this would seem a remarkable and perhaps unexpected outcome.

It should begin to be reflected in the first quarter of calendar 2021’s estimated GDP, covering the time when deficit spending to offset the economic effects of the coronavirus is at its height. But one wonders how many will notice the dichotomy between this statistical outcome and other non-monetary estimates of economic activity, such as product shipments and levels of employment.

Tracing the effect on prices

Of one thing we can be reasonably certain, and that is when some sort of post-covid normality returns, that both individuals and businesses will seek to reduce their money liquidity back to their usual levels. By taking personal disposable income multiplied by the savings rate, we get a recent savings total of $2,230bn, about $1,000 bn above the normal level. This will increase as a result of planned helicopter drops into family bank accounts of $1400 for every qualifying adult, on top of the $600 delivered by the previous administration. Together with supplemental unemployment insurance weekly benefits of $400, the extra spending to be eventually unleashed is likely to be in the region of $2,500bn, pursuing limited quantities of goods and services.

There is little doubt that this spending is part of the plan by policymakers as the means of getting the economy back to normal. But that does not take account of the lack of immediate production available to supply this demand. Nor does it take account of the disruption to supply chains, particularly in sensitive industries such as food production. Food prices are already rising, at both ends of their supply chains. It is also notable that in the long history of currency debasement, factors seem to conspire at times of monetary inflation to drive up food prices more than anything else, leading to social disruption as price rises accentuate poverty.

Indeed, we are entering the realms of unintended consequences. With the near-certain prospect of global food prices increasing, the low paid, retirees and unemployed will suffer most. The marginal price effect of 19% of GDP being unleashed in a short period of time by cash-laden consumers will be a disaster to behold. It can only be satisfied by a sharp rise in the trade deficit with a difference from the recent past: as advocated by the IMF, global demand fuelled by other government spending increases, but without the production capacity to cover it, will lessen the ability of imports to act as the customary brake on overall price increases.

Interest rates

This brings us to interest rates. It seems inconceivable that through this inflationary process markets will continue to believe the CPI numbers — the emperor’s lack of clothing is likely to be pointed out by some child, perhaps an Austrian one at that. Even before this increasingly certain event, the risk to Keynesian spending plans is already growing in the form of rising dollar bond yields. The latest position is illustrated in Figure 3, of the yield on the benchmark 10-year US Treasury bond.

The uptrend is firmly established. While Keynesians may nervously argue that bond yields are anticipating a return to economic growth, a more realistic assessment is that bondholders are beginning to suspect dilution of the dollar’s purchasing power, and therefore will require compensation in the form of higher interest. That being the case, it is clear that bond yields must rise to the point where the Chapwood index and the broad money growth curves shown in Figure 1 above indicate the compensation level required. Without any further acceleration from the position at end-2019, theoretically the unsuppressed yield on US Treasuries should be within a few percentage points of 10%.

But as we have seen, there has been an accelerated monetary debasement since then, which if continued, instead of being only temporary would raise even that astounding yield target even further. The effect on the Federal Government’s finances would be catastrophic, and many corporate debtors are likely to be wiped out.

The more likely outcome

So far, we have assumed a course of events without the disruption of systemic and other unanticipated events, with the objective of plotting the US economy’s course through the coronavirus crisis. The monetary and economic policies announced so far are designed to stabilise the US economy. Further stimuli are expected in order to kick-start economic growth, and to support investment in green energy. Even without the additional monetary debasements to those announced so far, there are some important threats that could foreshorten likely timescales.

- Widening trade deficits. The only offset to a trade deficit matching a government’s budget deficit is an increase in the savings rate. For the US economy, this is a temporary effect, likely to conceal for a short time a substantial deterioration in America’s trade deficit. With my estimate of a best-case budget deficit of $5.345 trillion in the current fiscal year, when post-lockdown consumer spending is unleashed and personal cash liquidity levels return to normal, there will be a similar overall trade deficit to the budget deficit. Aside from the political and protectionist consequences, we must consider the effect on the balance of payments. Unless the additional $5 trillion dollars arising from the trade deficit is reinvested in dollars instead of being sold on the foreign exchanges, the Fed will have no option but to see interest rates to rise beyond its control. Not only will the Fed then need to support deteriorating government finances through yet more quantitative easing, but it will have to absorb the consequences of a falling dollar on US bond markets as well.

- A collapse in financial asset values. QE was initially aimed at non-banks such as pension funds and insurance companies. Coupled with interest rate suppression the Fed has deliberately created a financial bubble. With rising bond yields in prospect, the bubble will surely burst. And as demonstrated by John Law who fuelled his Mississippi bubble by money-printing, the collapse of an inflated financial bubble takes the fiat currency down with it. Bear in mind that foreigners already own some $27 trillion in dollar-denominated financial assets and dollar deposits, which they are bound to liquidate when they realise the consequences of US monetary policies.

- A banking crisis. The covid crisis has destroyed swathes of businesses which rely on bank finance to defer insolvency and bankruptcy. Escalating bad debts will be magnified at operationally geared banks, which is all of them, leading to systemic failures spreading from the weakest banking systems to others in other jurisdictions through counterparty risk. Banks in the Eurozone are obviously weakest, but they are not alone. It is increasingly likely that central banks will have to either arrange for their commercial banks to be nationalised or at least for their bad debts to be underwritten in their entirety. Whatever the solution it will require significant additional monetisation of private sector debts to prevent a full-scale global depression.

- Markets discounting future currency debasement. In 2020 we witnessed substantial falls in fiat currencies’ purchasing power, measured in commodities, cryptocurrencies, stock markets and gold. As described above, there are also substantial falls in purchasing power measured against everyday goods and services, not reflected in the US CPI measure and by extension in other countries using the CPI standard. Exposure of the CPI’s underrepresentation of price inflation seems to be only a matter of limited time. Furthermore, the dollar has lost purchasing power against the other major currencies, reflecting the $27 trillion overhang invested by foreign sources in dollar-denominated financial assets and bank deposits. There is therefore substantial potential for selling of dollars on the foreign exchanges to accentuate the dollar’s decline.

- Loss of faith in fiat currencies. The final fate of the dollar is in the hands of the American people. Courtesy of inflation-fuelled cash balances, they will have an extra $2.5 trillion to dispose in order to restore the pre-covid ratio of cash balances to future purchases of goods. And as described above, this is certain to create a dramatic marginal effect on prices. When they finally understand that the problem is a collapsing dollar and not rising prices, consumers are likely to go even further, dumping as much monetary liquidity as possible, losing all faith in the currency. And with the dollar as nearly every nations’ reserve currency following similarly inflationary policies, their currencies will be threatened with a similar fate.

Conclusion

The acceleration of Keynesian stimulation programmes will hasten the destruction of the dollar’s fiat universe. In its misguided attempts control free markets the state always ends up impoverishing its people, an empirical truism that will once again be demonstrated.

On a positive note, the destruction of unbacked currencies must occur before national economies can return to free markets and maximise the progress of the human condition. It requires a form of money that is both sound and flexible — but not under the control of the state. The debasement of currency at the expense of its people as has always been the result of the state gaining control of money and setting its terms.

The sooner we return to sound money beyond the manipulative control of the state, the better. Fortunately, there is an easy solution. And that is to deploy national gold reserves to turn unbacked fiat currency into fully backed gold substitutes. The end of fiat money will force all nations to adopt this course, because it is the only way they can continue to collect taxes and finance essential state spending.

[i] See shadowstats.com

[ii] See chapwoodindex.com

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.