A whale is accumulating silver futures

Jul 11, 2019·Alasdair MacleodSilver’s recent price performance has been disappointing. Normally, it is almost twice as volatile as gold, so when the gold price rises 11%, as it has since last December, you would expect silver to rise about 20%. Instead it has fallen marginally.

When we dig into the weekly Commitment of Traders’ Reports covering Comex futures, we see something very odd indeed. The largest four traders, normally bullion banks or major producers hedging future output, almost always run short positions against speculators’ longs. The more bullish speculators are, the more shorts are carried by the big four to accommodate them. Equally, they only go net long when the speculators are extremely bearish and are collectively marginally long or exceptionally net short. Not now, as the following chart of the Largest Four Traders net positions shows.

The number of contracts either net long or net short are derived from the concentration ratios in the weekly COT releases. The net long position is standing at a record high, a move that started in March 2017, marked by the arrow.

With respect to the concentration ratios, the CFTC’s explanatory notes state the following:

“The report shows the per cents of open interest held by the largest four and eight reportable traders, without regard to whether they are classified as commercial or non-commercial. The concentration ratios are shown with trader positions computed on a gross long and gross short basis and on a net long or net short basis. The "Net Position" ratios are computed after offsetting each trader’s equal long and short positions. A reportable trader with relatively large, balanced long and short positions in a single market, therefore, may be among the four and eight largest traders in both the gross long and gross short categories, but will probably not be included among the four and eight largest traders on a net basis.”[i]

So, anyone can be a large reportable trader. Gross positions include straddles and swaps between different silver futures, and do not concern us. It is the net position ratios that are relevant. Chart 1 above is of the four largest traders net positions in the markets calculated on this basis.

The next largest 4 traders can also be calculated by taking the concentration ratios of the eight largest and subtracting the four largest. It turns out, as one would expect when gold is very overbought, the silver positions of the next largest four at net short 20,131 contracts are close to a record short. The second four see prices have hardly moved, and the speculators in the Managed Money category are only moderately long. Despite their individual short positions, they don’t realise they are in acute danger of being victims of a major bear squeeze.

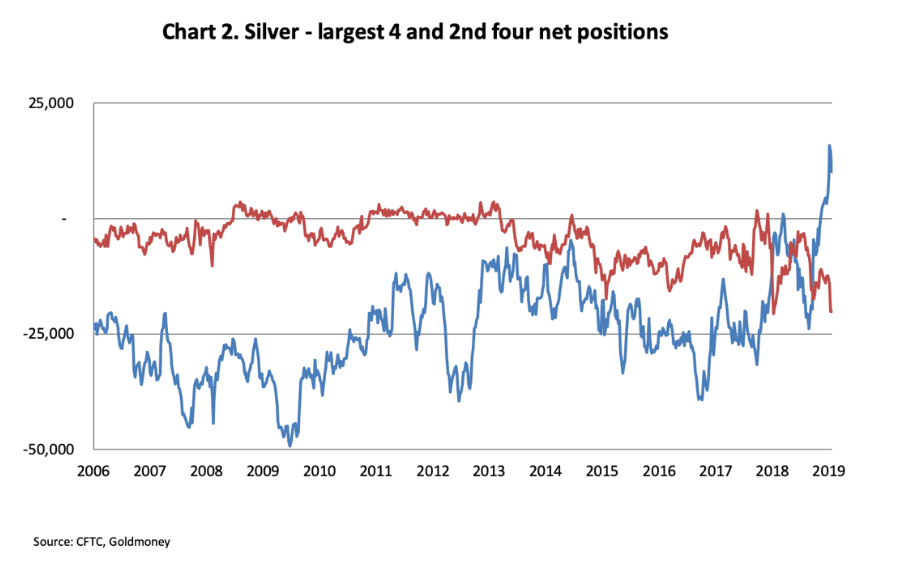

They appear to be blissfully unaware that they are as a group short to a very larger buyer in their own ranks. It is certainly possible no one has done the analysis covered in this article, because analysts and traders rarely look at the concentration figures. Furthermore, the correlation of the positions between the four largest and next four have not closely followed each other for some time as Chart 2 shows, which perhaps also encourages complacency.

We will return to that point later. However, it is only recently that the second largest four’s net shorts have exceeded those of the first largest four, and now we see the largest four traders are record long while the second largest four are record short.

This is the first time this has happened. It seems unlikely that in normal circumstances any of the largest eight would be running a diametrically opposed trading position to the other seven. Comex doesn’t work like that, consisting of distinct groupings: producers and merchants hedging their future deliveries, bullion banks acting as market-makers, and speculators, who take on the price risk by going long. They all tend to stick within their group motivations.

Given these normally clear distinctions we can probably rule out a collaboration between more than one large trader. If two or more large traders were involved, it would be known by insiders and the other large traders would not risk being short.

Therefore, it is likely to be only one long position, far larger than the charts above indicate, given the largest four traders will include three other large shorts. We can only guesstimate its size. However, if we assume that the other three largest trades are short in tune with the others, our long trader, our whale, is very long indeed. The long position probably began in March 2017, when collectively the large four were net short 39,215 contracts. This is marked by the up arrow in Chart 1, where the trend reversed. If we take that as our starting point, we can see that as of 2 July (the most recent COT figures) the swing is nearly 50,000 contracts. That is an indication of the long position of our large trader, accounting for over 20% of silver’s open interest. Since each contract is for 5,000 ounces, it represents as much as 7,775 tonnes, which is 28% of 2018’s global mine production of 27,550 tonnes.

In the context of the silver futures market it is huge. But it seems unlikely to be an attempt to corner the silver market, because Comex-registered vaults have about 9,500 tonnes of silver bullion and LBMA vaults at the end of March had 36,195 tonnes. In other words, there is 1.66 times annual mine supply in these two vaulting systems alone. Given healthy vaulting supply, someone attempting a repeat of the Bunker-Hunts’ attempt to corner the market in 1979 has a massive hill to climb, particularly when such an attempt might be thwarted by the regulators changing the rules.

Putting cornering the market aside, we can also rule out a large speculator taking a punt on silver. A look at the Managed Money category net position tells us our whale is not there. Nor does a whale this size show up in the Non-Reportable category either.

By a process of elimination, it looks like a commercial entity, which uses silver for manufacturing purposes and is a continuing buyer of the metal. It would make sense that such a buyer would wish to hedge against future price rises by going long of futures. This being the case, it is a behemoth, larger than any individual processor. And that leads to one conclusion: it is probably the Peoples’ Bank of China, the state institution charged with managing all China’s silver distribution. But with a purely circumstantial case, we need more evidence.

Why the trail of evidence leads to China

In 2012, I was speaking at a conference in New York at which a number of silver mining minnows had stands in the hope of attracting investors. I visited all of them to establish the answer to a simple question: how did they ship their silver out, who paid them, and when?

The reason for asking this question was there were allegations going the rounds about the dark deeds of JPMorgan manipulating the silver futures market. That the silver market was open to manipulation by the big banks there was little doubt, and JPMorgan was definitely a major force in the silver market. By not appearing to take credible allegations seriously, Comex and the CFTC as regulator gave the impression they were colluding with JPMorgan, giving the whole story an extra spin.

The assumption that JPMorgan could simply ride roughshod over the CFTC and Comex rulebook was really the weakness in the conspiracy theories. We are all aware of the crony capitalism between banks and regulators, but there are limits. Bending the interpretation of the rules is one thing. Flagrantly breaking them to create false markets is another.

However, there was little doubt JPMorgan dominated trading in Comex silver futures, and my feeling was they were acting for a legitimate client instead of its own trading book. This was confirmed when Blythe Masters, then head of global commodities at JPMorgan and a hate-figure for silver conspiracy theorists, a month earlier than the New York conference gave an interview where she clearly stated that JPMorgan acted only for clients and did not run directional positions as principal.

The outcry from conspiracy theorists was predictable, but I found it impossible to believe that Masters would give an interview, which appeared to be for the main purpose of refuting the rumours, and then tell a barefaced lie. When an interviewee says before answering, “that is a great question” you can be reasonably sure it was pre-agreed, so is an important and considered revelation. The recording of the interview confirms this is what happened.[ii]

The question then was what role was JPMorgan playing in the market? They had inherited their silver business from the acquisition of Bear Sterns in 2008 and continued to develop it. And there was no doubt that such a large investment bank had greater clout than Bear Sterns to manage silver positions. Given Blythe Master’s unequivocal denial that JPMorgan was running a trading position on its own book, it must have been acting for one very large client, and that was the evidence I was looking for at the New York conference.

The silver miners all told the same story. When they had enough doré to ship, a specialist from Glencore would assess and certify the value of the silver content and arrange for it to be shipped to a refiner. Glencore was working with JPMorgan, and the silver miner would be paid as soon as the doré was being shipped, enabling the miner to cover its day-to-day costs. Using the doré as collateral, JPMorgan would cover the price risk by selling Comex silver futures or possibly by selling silver on the LBMA for forward delivery. This was why Masters could truthfully say JPMorgan did not take a directional position.

We should bear in mind that Glencore’s assessors would also be assessing the silver content of base metal ores, because more than half of silver mine production is a by-product of base metal processing, and in total involves very large amounts of silver. The sale of large amounts of futures contracts would follow to offset price risk.

This is not the whole story, raising the question as to the doré’s destination. At the New York conference, there was no consensus among the silver miners. But at that time, as it still does today, China had a major position in the global silver market. Furthermore, China had invested in processing and refining facilities when environmental factors led to the closure of rival facilities in western nations, such as Canada. It was therefore almost certain that a big slug of the doré was bound for China, which not only had ample low-cost silver refining capacity, but had also invested heavily in base metal refining for the extraction of silver as well.

All purchases of silver imported into China are the responsibility of the Peoples’ Bank of China, and that would be JPMorgan’s underlying client, not Glencore. Given the standing and resources of the Peoples Bank, and the leading positions of JPMorgan and Glencore in their respective industries, it is easy to envisage the existence of this high-level partnership and the importance of confidentiality.

I could then conclude my own conspiracy theory, which seemed far more likely than the others swirling around: JPMorgan extended the miners credit against the collateral of doré shipments, the price risk being covered by selling futures on Comex and forwards on the LBMA. This was not JPMorgan as a principal, but on behalf of China’s central bank. China had a vested interest in keeping the price as low as possible, which is the natural consequence of this hedging activity.

In their conspiracy theories, frustrated silver bulls were missing the one obvious conclusion confirmed by the Blythe Masters interview, that JPMorgan was, and probably still is, working for the Chinese central bank as their client. China is the whale in the market, which explains why, in Chart 2 above, we see the lack of correlation between the largest four traders and the second four going back over a decade. Bear in mind also that the commitment of trader’s reports covering Comex are not the whole story. Forward trades in London on the LBMA are a significantly larger market and JPMorgan operates its own vaults in London as well.

Switching dealings between OTC forwards and regulated futures makes it very difficult to analyse silver markets. Analysing Comex is like observing the dog’s tail and not seeing the dog. The result is China has managed to import over half her silver needs at suppressed prices. By using both markets it appears that JPMorgan has discharged this role skilfully for the Peoples’ Bank, and it also explains why the regulators were unable to bring them to account, despite evidence that JPMorgan’s actions may have been suppressing the silver price: strictly speaking, there was no wrongdoing within Comex’s rules.

The change from bear to bull

Price management at the behest of the Peoples’ Bank, within certain limits, is a reasonable objective and the bedrock of all large client/broker relationships. In that context, the broker is often given a degree of discretion. Regular liaison between JPMorgan’s dealers and those of the client would be normal, perhaps monthly or quarterly to review both progress and objectives. This allows the broker to act on the clients’ behalf on a semi-discretionary basis within agreed guidelines.

In this case, the client (i.e. the Peoples’ Bank) would be an ongoing buyer of physical silver. In the past, silver prices have been suppressed in the futures market by selling enough futures to cover doré and silver-bearing base metal ore shipments. Doing business this way would have been a significant benefit to China.

None of this explains why a substantial long position appears to have now materialised on Comex. Instead of selling futures to suppress the price, our market whale appears to have turned buyer; buying enough to cover China’s annual silver imports, the equivalent of about 43,000 Comex contracts. Clearly, the new strategy is to hedge against rising prices instead of suppressing the silver price. Given this new development, one would have thought that the other seven large traders would have tried to limit their silver shorts and at least keep an even book. There are several reasons why they may not have not felt the need to do so:

- There are ample quantities of bullion in the vaults in London and Comex depositories, currently totalling 1.66 years’ worth of mine supply, unlike gold where the underlying bullion stock is very small relative to the paper contracts based upon them.

- They appear to be unaware of China’s actions and motives. They may not even be aware of the existence of this long position. If they are aware of it, they may think it is just a technical long, against a short in London’s OTC market.

- With global commercial demand declining due to the economic slow-down, they probably feel relaxed about the price outlook for silver, which they will regard as an industrial metal. Base metals show little sign of entering a bull market.

Why is China now buying futures?

If I am correct in thinking the whale in the market is the Peoples Bank of China, then instead of suppressing the silver price, she is now hedging approximately one year’s silver imports against future price rises. Having pinpointed the switch from price suppression to futures accumulation to approximately March 2017, we can now say that courtesy of JPMorgan’s dealing skills, no one was aware of the Peoples Bank’s change in price strategy.

This was shortly after President Trump was elected and assumed office, which could have had a bearing. From China’s point of view, the geopolitical outlook had become very unstable, with its Washington sources reporting the Deep State’s conflict with Trump and its attempts to destabilise his administration. At the same time, the global economic outlook was improving, which would have led to greater global demand for silver, making it difficult for China to continue to suppress the price. These are good enough reasons to change price strategy and lock in silver prices by buying futures to cover future shipments.

More recently, China has begun to declare monthly additions of monetary gold reserves, a trend led by Russia and copied by other Eurasian central banks. Gold has suddenly caught a bid and having risen sharply become dangerously overbought. This is in sharp contrast to silver, which on the surface appears to have been side-lined.

The traders at the Peoples Bank now appear to have protected themselves against an increase in the silver price, which normally rises nearly twice as much as gold. Since the Peoples Bank also controls the nation’s gold, the silver desk could have known about the plans to announce monthly increases in China’s monetary gold reserves in advance. It would have been an added incentive for the desk to buy silver futures from the beginning of this year.

It will be interesting to see if this move, combined with China’s increasing gold reserves, results in a significant jump in the silver price. If the silver whale is China, then it’s a reasonable supposition that China is signalling by its actions that it expects dollar prices for gold, and therefore silver, to continue higher over time. An advantage of taking up a silver position is if things cut up rough in the gold market, China will not be implicated so far as Comex futures are concerned. Unlike large-scale dealings in Comex gold futures (which China appears to have studiously avoided), protecting prices on her silver imports is what the futures market is for and is unlikely to be politically contentious.

The message for silver investors is seven of the eight largest traders appear to have become complacent. If China is the whale in the market, then discovery could be a very painful process for them. Its unfolding could be dramatic, likely to coincide with the next move upwards in the gold price.

[i] See https://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm

[ii] The topic of JPMorgan’s silver position starts in the CNBC interview 2.40 minutes in. https://www.youtube.com/watch?v=gc9Me4qFZYo

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.