Gold - preparing for the next move

Mar 21, 2019·Alasdair MacleodNote: this article is not and must not be construed as investment advice. It is analysis based purely on economic theory and empirical evidence.

The global economic outlook is deteriorating. Government borrowing in the deficit countries will therefore escalate. US Treasury TIC data confirms foreigners have already begun to liquidate dollar assets, adding to the US Government’s future funding difficulties. The next wave of monetary inflation, required to fund budget deficits and keep banks solvent, will not prevent financial assets suffering a severe bear market, because the scale of monetary dilution will be so large that the purchasing power of the dollar and other currencies will be undermined. Failing fiat currencies suggest the dollar-based financial order is coming to an end. But with few exceptions, investors own nothing but fiat-currency dependent investments. The only portfolio protection from these potential dangers is to embrace sound money - gold.

The global economy is at a cross-road, with international trade stalling and undermining domestic economies. Some central banks, notably the European Central Bank, the Bank of Japan and the Bank of England were still reflating their economies by supressing interest rates, and the ECB had only stopped quantitative easing in December. The Fed and the Peoples’ Bank of China had been tightening in 2018. The PBOC quickly went into stimulation mode in November, and the Fed has put monetary tightening and interest rates on hold, pending further developments.

It is very likely this new downturn will be substantial. The coincidence of the top of the credit cycle with trade protectionism last occurred in 1929, and the subsequent depression was devastating. The reason we should be worried today is stalling trade disrupts the capital flows that fund budget deficits, particularly in America where savers do not have the free capital to invest in government bonds. Worse still, foreigners are now not only no longer investing in dollars and dollar-denominated debt, but they are suddenly withdrawing funds. According to the most recent US Treasury TIC data, in December and January these outflows totalled $257.2bn.[i] At this rate, not only will the US Treasury need to fund a deficit likely to exceed a trillion dollars in fiscal 2019, but the US markets will need to absorb substantial sales from foreigners as well.

In short, America is going to face a funding crisis. To have this funding problem coinciding with the ending of credit expansion at the top of the credit cycle is a lethal combination, as yet unrecognised as the most important factor behind both American and global economic prospects. The problem is bound to emerge in coming months.

While today’s trade protectionism is less vicious than the Smoot-Hawley Tariff Act, America’s drawn-out trade threats today are similarly destabilising. The top of the credit cycle in 1929 was orthodox; its principal effect had been to fuel a speculative stock market frenzy in 1927-29.

This time, the credit bubble is proportionately far larger, and its implosion threatens to be even more violent. Governments everywhere are up to their necks in debt, as are consumers. Personal savings in America, the UK and in some EU nations are practically non-existent. The potential for a credit, economic and systemic crisis is therefore considerably greater today than it was ninety years ago.

Bearing in mind the Dow fell just under 90% from its 1929 peak, the comparison with these empirical facts suggests we might experience no less than a virtual collapse in financial asset values. However, there is an important difference between then and now: during the Wall Street crash, the dollar was on a gold standard. In other words, the price-effect of the depression was reflected in the rising purchasing power of gold. This time, no fiat currency is gold-backed, so a major credit, economic and systemic crisis will be reflected in a falling purchasing power of fiat currencies.

The finances of any government whose unbacked currency is the national pricing medium are central to determining future general price levels. Just taking the US dollar for example, the government’s debt to GDP ratio is over 100% (in 1929 it was less than 40%). At the peak of the cycle, the government should have a revenue surplus reflecting underlying full employment and the peak of tax revenues. In 1929, the surplus was 0.7% of estimated GDP; today it is a deficit of 5.5% of GDP. In 1929, the government had minimal legislated welfare commitments, the net present value of which was therefore trivial. The deficits that arose in the 1930s were due to falling tax revenues and voluntary government schemes enacted by Presidents Hoover and Roosevelt. Today, the present value of future welfare commitments is staggering, and estimates for the US alone range up to $220 trillion, before adjusting for future currency debasement.[ii]

Other countries are in a potentially worse position, particularly in Europe. A global economic slump on any scale, let alone that approaching the 1930s depression, will have a drastic impact on all national finances. Tax revenues will collapse while welfare obligations escalate. Some governments are more exposed than others, but the US, UK, Japan and EU governments will see their finances spin out of control. Furthermore, their ability to cut spending is limited to that not mandated by law. Even assuming responsible stewardship by politicians, the expansion of budget deficits can only be financed through monetary inflation.

That is the debt trap, and it has already sprung shut on minimal interest rates. For a temporary solution, governments can only turn to central banks to fund runaway government deficits by inflationary means. The inflation of money and credit is the central banker’s cure-all for everything. Inflation is not only used to finance governments but to provide the commercial banks with the wherewithal to stimulate an economy. An acceleration of monetary inflation is therefore guaranteed by a global economic slowdown, so the purchasing power of fiat currencies will take another lurch downwards as the dilution is absorbed. That is the message we must take on board when debating physical gold, which is the only form of money free of all liabilities.

Gold can only give an approximation of the loss of purchasing power in a fiat currency during a slump, because gold’s own purchasing power will be rising at the same time. Between 1930 and 1933 the wholesale price index in America fell 31.6% and consumer prices by 17.8%.[iii] These price changes reflected the increasing purchasing power of gold, because of its fixed convertibility with the dollar at that time.

Therefore, the change in purchasing power of a fiat currency is only part of the story. However, the comparison between purchasing powers for gold and fiat currency is the most practical expression of the change in purchasing power of a fiat currency, because the choice for economic actors for whom gold has a monetary role is to prefer one over the other.

It is an ongoing process, about to accelerate. Chart 1 shows how four major currencies have declined measured in gold over the last fifty years. The yen has lost 92.4%, the dollar 97.42%, sterling 98.5%, and the euro 98.2% (prior to 2001 the euro price is calculated on the basis of its constituents).

The ultimate bankruptcy of currency-issuing governments, likely to be exposed by the forthcoming slump, will be reflected in another lurch downwards in currency purchasing powers.

Technical and market analysis of gold’s position

It should become apparent as time progresses that the price of gold in fiat currencies will continue to rise. The reasons are not yet clear to the consensus of portfolio investors and speculators, but it is likely that the more prescient among them will begin to realise that in the event of a significant recession, slump or depression, the dollar price of gold will rise substantially.

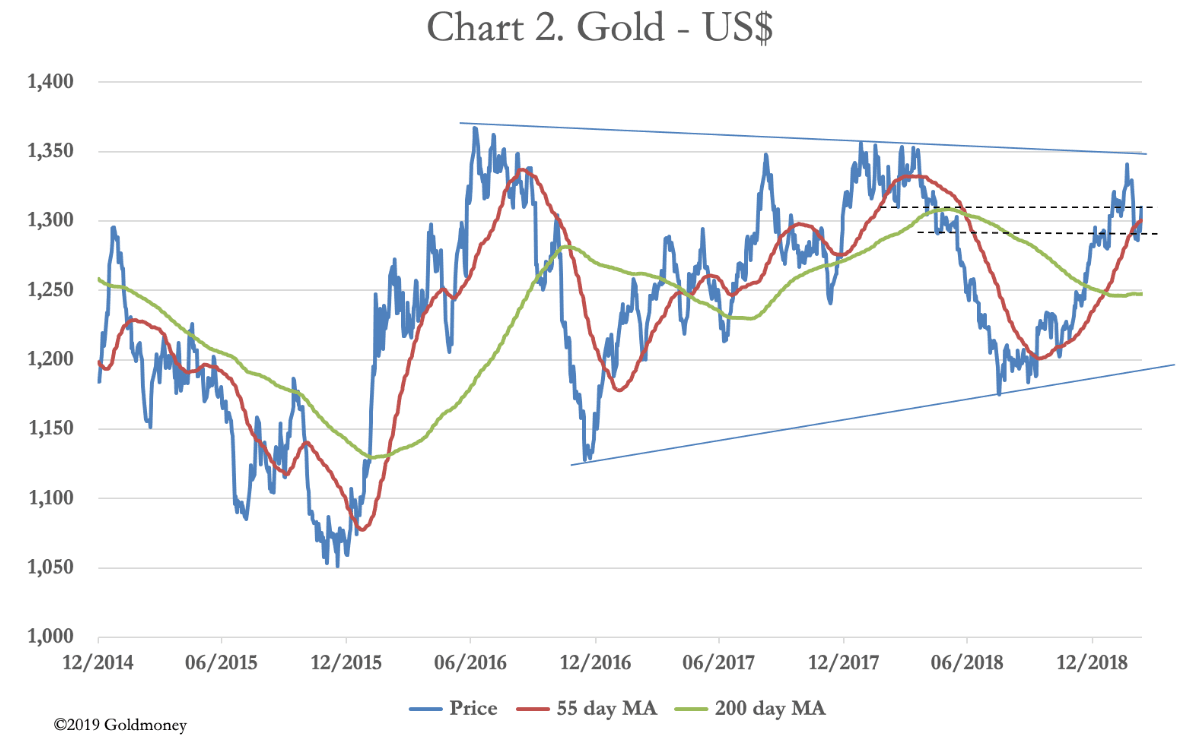

For the moment, they are likely to concentrate on timing, using technical analysis, rather than thinking through economic concepts. Chart 2 illustrates the current technical position.

Following its peak in September 2011, gold found a bottom at $1047 in December 2015. That was followed by a 31% rally to $1375 in July 2016, since when gold has established a triangular consolidation pattern. Last August, the price sold off to $1160, becoming oversold to record levels. That established the second point of a rising trend, marked by the lower solid line.

In February the gold price mounted a challenge to the upper parameter of the consolidation range before retreating to test established support at $1280-$1305, shown by the pecked lines.

There is a good chance that another attempt to break through the $1350 level will take place soon, and that it will succeed. The following bullet points sum up this positive case:

- The current rally commenced from a record oversold condition on Comex. The selloff was consistent with extreme selling exhaustion, indicating a major turning point.

- The net managed-money position on Comex indicates the gold contract is still moderately oversold. However, the April contract is running off the board, which means that some 200,000 expiring contracts are still to be sold, stand for delivery or rolled forward by the end of this month (March). This suggests a little more consolidation may be needed before gold advances to attempt a challenge on the $1350 level.

- The 55-day and 200-day moving averages recently completed a bullish golden cross, with the price above both signalling a bullish trend. A retest of the 55-day MA occurred at the beginning of this month and is normal.

- If, as the chart suggests, a triangle pattern is emerging, it is an ascending triangle, which is bullish. An ascending triangle has a flat top and a rising base. Admittedly, the top line declines slightly but not enough to put it in the class of symmetrical triangles, where the eventual break-out direction is less certain.

- It is possible for the gold price to trade another down leg within the confines of the triangle before making its final breakout to the upside. In which case, the gold price might decline towards the low $1200s before making its upwards break.

The possibility that the ascending triangle might need longer to play out leads to the common technical recommendation to wait until gold breaks through the $1350-$1365 level before buying for the next leg of the bull market.

Chart 3 gives a longer-term perspective of gold’s valuation. It is of the gold price adjusted by mine supply and for changes in the fiat money quantity. Simply put, FMQ is the sum of cash, bank deposits and savings accounts, and also bank reserves held at the Fed. It is the total amount of fiat money both in circulation and available for circulation.

In 1934-dollars, deflated by the increase in the fiat money quantity, gold has returned to the extreme lows seen on only two previous occasions. The first was when the London gold pool failed in the 1960s followed by the collapse of the Bretton Woods Agreement in 1971. At that time the decline in the FMQ-adjusted price of gold since 1934 was fuelled by monetary expansion until a point was reached which could go no further. This led to an explosive recovery taking the price of gold in adjusted terms back to 1934 levels.

The realisation that the dollar faced the prospect of uncontrolled price inflation forced the Fed to raise interest rates so that the banks’ prime rate exceeded 21% in December 1980. This was sufficient to prevent the gold price from further rises, and physical gold then became the collateral of choice for a developing carry trade. Central bank sales were designed to signal the demonetisation of gold and deter buyers. They leased significant quantities of bullion for the carry trade, which increased supply synthetically and drove the gold price back to the same extreme valuation lows seen in the 1960s. This was 2000-2002.

After rallying from these extreme lows to a nominal high in September 2011, an increase in derivative supply coupled with the banking and investment establishment retaining an increasingly rosy view of fiat currencies have been instrumental in returning gold to the valuation lows of the 1960s and 2000 – 2002.

It is in this context that the outcome predicted in Chart 2 should be considered. If, as argued earlier in this article, America and the rest of the world faces a global slump, a premium for physical gold is likely to arise relative to the systemic risks of holding gold substitutes, such as derivatives and even physically-backed ETFs. In that event, a return to the 1934 price level for gold in FMQ-adjusted terms before any further monetary dilution implies a nominal gold price of about $24,000.

This conclusion does no more than indicate an upper target for the price of gold adjusted for historic monetary inflation. If, as seems likely, a developing credit crisis occurs as a consequence of today’s events, the quantity of fiat money in issue will rise significantly from current levels as government debt is monetised. Therefore, given the extreme undervaluation of gold suggested by Chart 3, it is hard to see how the price of gold, measured in dollars, can go much lower.

Defining the gold market and vanishing liquidity

The gold market has three basic elements to it. There is an underlying stock of approximately 170,000 tonnes, increasing at about 3,000 tonnes a year. It is impossible to define how much of the total above-ground stock is monetary gold, not least because jewellery in Asia is bought as a store of monetary wealth and is used as collateral against loans. However, if we are to classify Asian jewellery as non-monetary gold, then monetary gold in the form of bars and coin is thought by many experts to represent between thirty and forty per cent of the total. Assuming a median estimate of 35%, this is 60,000 tonnes, of which 33,760 tonnes is stated to be in national reserves. This leaves an estimated 26,240 tonnes of investment gold in public hands, worth $1.1 trillion. Much of this can be regarded as being in long-term storage. For market purposes, the physical market on its own is relatively illiquid.

Secondly, there are regulated futures and options markets, the most important of which is America’s Comex. Currently, there are about 520,000 Comex contracts of 100 oz each outstanding, which are worth a total of $68bn. Options on futures total a further 220,000 contracts, which are impossible to notionally value, being puts and calls at varying strike prices.

Third, there are unregulated OTC derivatives, mostly forward contracts in London. The last Bank of International Settlements statistics estimated total gold forwards and swaps were valued at $419bn, over six times the size of Comex. In addition, there were $149bn of OTC options.

The liquidity is broadly confined to Comex, London forwards and other OTC media. These are all derivatives, with minimal physical settlement taking place. Consequently, the price of physical gold is not determined by the marginal supply and demand for bullion, but almost entirely reflects financial factors in the banking system. If financial market conditions return to an approximation of the 1929-32 period for the reasons described earlier in this article, there is likely to be a banking crisis, or at the very least a serious dislocation of financial markets. Therefore, it is possible that at the same time investment funds and private individuals seek to gain portfolio exposure to the gold price, they will be doing so while the means of doing so are contracting, or even disappearing altogether.

An outcome of this sort hinges on the depth and pace of economic deterioration. Time will tell as to whether the current rapid deterioration in the economic outlook goes on to replicate the 1929-32 precedent, but it is getting increasingly difficult to argue against it happening. In which case, the gold price could rise rapidly due to its current undervaluation, a shortage of monetary gold outside central bank reserves, systemic disruption of paper markets and a renewed pace of monetary inflation before the fiat-money investment community realises what is happening.

Portfolio switching from fiat to gold

If the combination of both a developing credit and trade crises leads to a modern version of the 1929-32 global economic slump, financial asset values will fall heavily. But this time, there is the additional factor of a renewed acceleration of monetary inflation, which at some point might offer some support to stock prices, at least in nominal currency terms. In every hyperinflation, an index of stock prices can perform well on this basis, but adjusted for the currency’s loss of purchasing power, stock prices actually suffer substantial losses.

That assumes, of course, the rest of the world’s economy is broadly stable, which is almost certainly not going to be the case in our scenario.

Additionally, the inflationary conditions of a fiat currency’s twilight moments involve the market imposing increasing levels of time-preference on everything, including bond prices. Therefore, the discount between market prices and final redemption values widens dramatically. Governments and other borrowers face a near-impossible funding task, unless they are prepared to pay increasingly higher interest coupons. Unlike the experience of the great depression when interest rates reflected those of gold, this time bond yields paid in fiat currencies will rise and continue rising.

This leads towards a different progression of notable developments compared with 1929-32. An approximate sequence of how these might evolve is described as follows:

1. Evidence of a looming recession becomes increasingly apparent. Central banks respond in their time-honoured way, by easing monetary policy and replacing stalling credit creation with extra base money. Government bond prices rise as they are seen to be the least risky investment in an uncertain economic outlook, and equities rally after an initial sell-off. At the same time, lending bankers observe increasing risk in commercial lending and respond by quietly withdrawing loan facilities from all but the largest manufacturers of goods and producers of services. This appears to approximate to the current situation.

2. With unsold inventory increasing, industrial production is reduced, and rising numbers of workers are laid off. Analysts revise their forecasts for corporate profits downwards, and the number of corporate failures increases. Bond dealers adjust their expectations of government borrowing, and quantitative easing is reintroduced by central banks to ensure government bonds can be issued at suppressed interest rates. At this stage, investors face a worrying combination of falling equity prices reflecting a deteriorating economic outlook, combined with unexpected monetary inflation in the form of QE.

3. Foreigners liquidate US investments in order to sell dollars (the reserve currency – this appears to have started early) and repatriate funds to support their base operations. Bond dealers facing a glut of government bond issues expect bond yields to continue to rise. Stock markets slide, and with it is a growing realisation that the recession is turning into a wealth-destroying slump.

4. As the markets’ demands for increased time-preference undermine all debtors’ finances, investors increasingly avoid bonds and equities, abandoning hope of any recovery in financial asset prices. Hedging into gold mines and gold ETFs gathers pace, and the purchasing power of gold continues to rise measured against both fiat currencies and against the commodity and energy complex.

5. Having fallen behind the time-preference demanded by markets, central banks are reluctantly forced to raise overnight interest rates to protect the currency and bring price inflation under control. They have no choice, but this is seen as capitulation by investors. Residential mortgage costs increase sharply, driving consumers into negative equity as property prices suffer from forced selling. In countries where the home has become the middle class’s principal asset, the effect on consumer spending is devastating. Governments end up bailing-out or bailing-in lenders while trying to moderate mortgage interest costs.

6. By now, the gold price measured in unbacked currency is beginning to discount a continuing acceleration in monetary inflation. The gold price will be at multiples of current levels in all currencies, including the dollar.

7. The sense of crisis escalates and mounting bad debts at the banks raise the prospect of a systemic banking crisis. Despite depositor protection schemes, depositors begin to take steps to reduce their bank balances. With the facility to encash bank deposits being strictly limited, alternatives to deposits in insolvent banks will be in high demand. These will be gold, silver and other perceived stores of value. Cryptocurrencies could come into their own as an escape route from holding deposits in the banking system.

8. Those who attempt to escape systemic risk by exchanging bank balances for alternatives are simply passing bank deposits to the vendors. This is fine, so long as vendors are happy to accept the systemic risk. If not, then prices of alternative stores of value must rise to compensate. A classic flight out of money into anything else develops and is made more urgent by the lack of a cash alternative.

9. The currency rapidly loses purchasing power, and it will be moving into its end-of-life. Government bonds will have lost nearly all their value, measured in gold, and governments will still be accelerating inflationary financing, because bond financing without the central bank buying them will not be possible.

An intense bear market destroys wealth. At some stage, investors will begin to realise their portfolios are almost totally exposed to fiat currency risk. The belief that inflation hedges, such as overweight equities and underweight bonds, offer protection against extreme monetary inflation will be disproved. Investors will need a radical new approach, using sound money as their performance criteria. This is cannot be an inflation index, which is likely to become increasingly manipulated by statistical method. It has to be gold, instead of rapidly depreciating fiat currency.

The problem investors will then face is mathematical. There are probably less than 30,000 tonnes of monetary gold, excluding Asian jewellery, in private hands, today worth about $1.1 trillion. According to The Boston Consulting Group[iv], in 2015 there were $71.4 trillion of portfolio assets, of which $36.1 trillion were in US dollars. With the monetary gold held outside government reserves being about 1.5% of portfolio assets, how do you replace non-performing fiat-currency dependent assets with a portfolio designed with sound money in mind?

This is why the return to sound money will destroy the West’s financial system, driving the purchasing power of gold higher, measured against commodities, goods and services, while that of paper fiat moves towards worthlessness. The destruction of financial wealth could easily compare with 1929-32, and if it wipes out fiat currencies will be even worse.

The removal of cash as an effective escape route for investors fleeing systemic risk turns systemic risk directly into a collapsing preference for money relative to goods, gold, cryptocurrencies and the rest. One it starts, it could happen quite quickly.

[i] See https://home.treasury.gov/news/press-releases/sm630

[ii] Lawrence Kotlikoff, November 2012.

[iii] NBER Working Paper No 3174 by Stephen Ceccetti, Table 1 pp3

[iv] http://www.agefi.fr/sites/agefi.fr/files/fichiers/2016/07/bcg-doubling-down-on-data-july-2016_tcm80-2113701.pdf

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.