Goldmoney Inc. Reports Financial Results for the Year Ended March 31, 2017

Jun 22, 2017TORONTO – (June 22, 2017) – Goldmoney Inc. (TSX:XAU) (“Goldmoney”), a precious metal financial service and technology company, today announced financial results for the year ended March 31, 2017. All amounts are expressed in Canadian dollars unless otherwise noted.

Financial Highlights

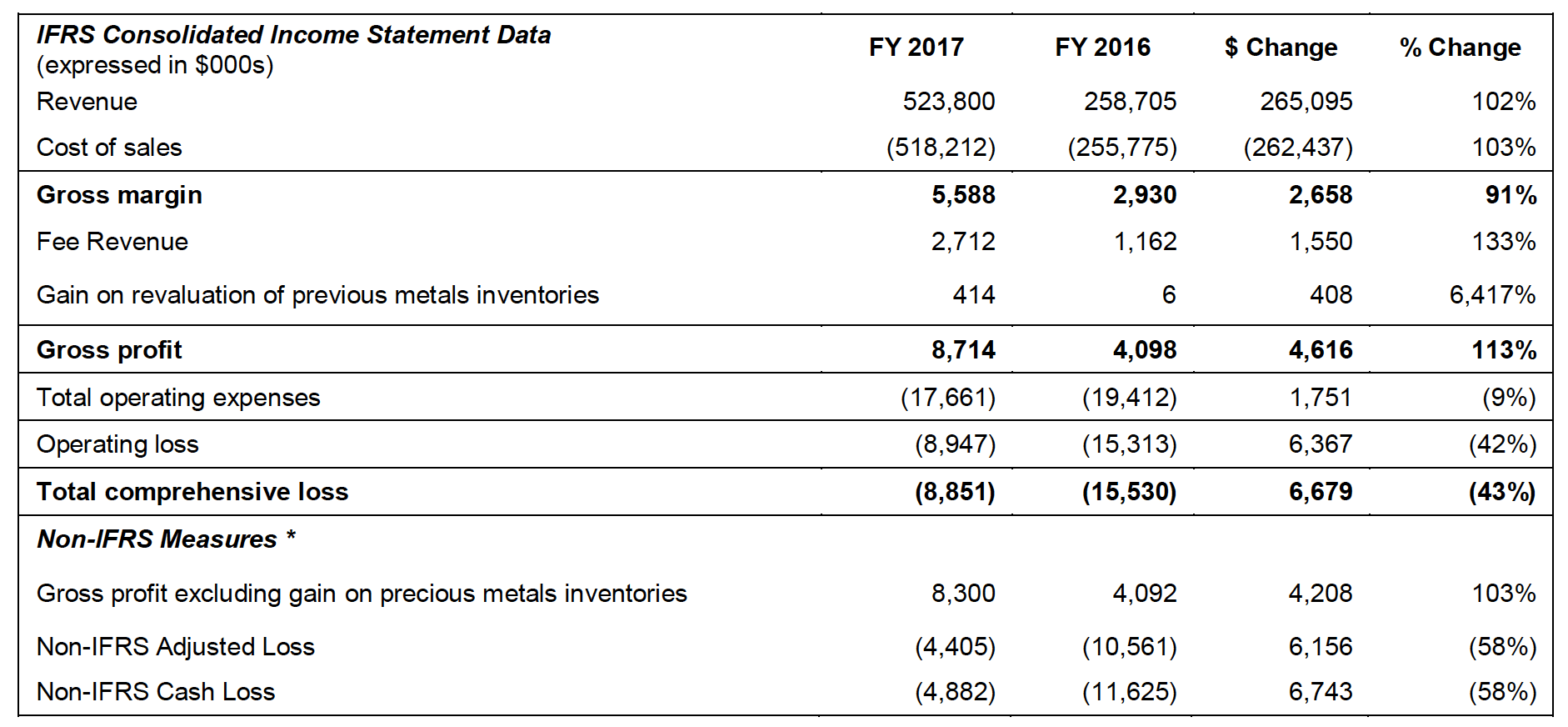

- Consolidated Revenue of $523.8 million, an increase of $265.1 million (+102%) over FY 2016.

- Group Gross Operating Profit of $8.7 million, an increase of $4.6 million (+113%) over FY 2016.

- Gold equivalent client assets under custody growth of 10% to 34.8 tonnes ($1.86 Billion).

- Client gold metal weight growth of 6.5% year-over-year (“YoY”) to 20.74 tonnes.

- Goldmoney Network Revenue of $171.6 million, a 168% YoY increase from $63.95 million in FY 2016.

- Goldmoney Wealth generated an Operating Profit of $4.4 million in its first full-year of profit since present management took over, and a Gross Profit of $7.16 million, up 103% YoY.

- Basic and diluted net loss per share of $0.11, improved from $0.30 per share in FY 2016 ($0.03 loss for Q4, improved from $0.04 in Q3).

- Non-IFRS Adjusted Loss of $4.4 million, improved by $6.2 million over $10.6 million in FY 2016.

- Non-IFRS Tangible Common Equity of $58.8 million at March 31, 2017 vs. $59.9 million at March 31, 2016.

- Bitcoin position of $2.1 million (at $1,083 USD Bitcoin spot) at March 31, 2017.

- Currency loans totaling $8.6 million of balance sheet capital extended to platform users against fully-reserved metal.

- Schiff Gold business unit generated $33 million in revenues on four-and-a-half months of operation. The business unit is now in its integration phase and producing free cash flow to the group each month.

- Introduced a processing-type adjusted gold spread in the last weeks of FY 2017 that will reduce up to $3 million in annual net processing fee cash costs as compared to FY 2016.

- Results include increased YoY investments in new projects at the Goldmoney group level, including physical branch locations, Menē Inc., wealth service products, and other platform products and features not yet contributing revenue and anticipated to grow client base and generate higher unit margins.

Operational Highlights

- Launched a new Goldmoney website, bringing the BitGold and GoldMoney businesses under a unified Goldmoney brand.

- Launched a new Goldmoney App for iOS and Android.

- Launched Goldmoney Business and its suite of global payment solutions.

- Unveiled PayPal integration and exclusive vault for PayPal users.

- Initiated the development of Goldmoney branch locations and began construction on Toronto and Jersey branches.

- Acquired commercial property at 9 Bond Street in St. Helier, Jersey, Channel Islands, which will serve as the second Goldmoney branch location and headquarters for Goldmoney Wealth Limited.

- Entered the lending space with the launch of the Goldmoney Maximizer tool, which enables verified Canadian Goldmoney Network users to borrow select currencies against up to 85% of their fully-reserved gold assets.

- Completed the Schiff Gold Acquisition and entered into a Marketing and Service Agreement with Peter Schiff.

- Added the Royal Canadian Mint’s secure precious metal storage facility in Ottawa as a vault on the Goldmoney Network, and entered into an agreement with the Mint to explore future co-marketing activities that aim to boost awareness and accessibility of precious metals.

- Extended P2P transfer capabilities to Goldmoney Network users residing in the U.S and registered a U.S. subsidiary with the Financial Crimes Enforcement Network (“FinCEN”).

- Launched Goldmoney concierge service for Goldmoney clients with Full Holdings.

- Reduced Goldmoney Network fees by 50%, enabling users to deposit, redeem, and make vault-to-vault gold transfers for 0.5% above the spot gold price.

- Accelerated direct-to-bank value settlement and added local processing capabilities for AUD, CHF, CZK, EUR, GBP, HKD, SGD, USD, JPY, and ZAR for Goldmoney Network.

- Unveiled several Goldmoney Network advancements including expanded and new payment options in the U.S. and Latin America, an improved user interface and deposit flow, the integration of Alipay, the expansion of PayPal deposits and redemptions to Canada and the U.S., and the future integration of Apple Pay and WeChat Pay.

- Announced that Goldmoney Network accounts and Wealth Holdings had been endorsed as Shariah-compliant by the Shariah Supervisory Board of Amanie Advisors.

- Launched payment integrations allowing for direct-to-bank redemptions and credit card processing in Indian rupees for Goldmoney Network.

- Announced acceptance by the Toronto Stock Exchange of the Company’s Notice of Intention to make a normal course issuer bid (“NCIB”) to purchase for cancellation a maximum amount of 3 million common shares of Goldmoney Inc.

The Company made several key advancements following the close of the fourth quarter:

- Introduced a new unified Goldmoney Holding® that incorporates the best features and functionality of current Network and Wealth accounts, began consolidating the Network and Wealth business divisions into a streamlined service with one unified account and discontinued offering new Goldmoney Network accounts on June 20, 2017.

- Introduced an updated fees structure, monthly storage credit program, and metal payments for Goldmoney Wealth clients (now part of unified Goldmoney Holding).

- Announced an investment in and partnership with Isle of Man–based investment company LBT Holdings Ltd. (“LBTH”), parent company of Lend & Borrow Trust Company Ltd. (“LBT”).

- Announced an investment in Menē Inc. (“Menē”), a newly formed direct-to-consumer fine jewelry venture founded by Roy Sebag and Diana Widmaier-Picasso.

“The powerful Goldmoney value proposition – now enhanced by the new singular Goldmoney Holding structure – will continue to expand for individuals and businesses globally, and the larger our scale the stronger our network effect becomes,” said Darrell MacMullin, COO and head of payments & technology. “We have made meaningful progress in expanding accessibility with more global funding and redemption options, and have been laying the framework for upcoming global distribution points. Some of these take time to build, and we continue to focus on deepening engagement with our expanding customer base and feel well-positioned for future growth and profitability.”

* Refer to “Use of Non-IFRS Financial Measures” and “Reconciliation of Non-IFRS Financial Measures” in the MD&A.

Please visit our SEDAR profile to view the consolidated financial statements and MD&A.

“These gratifying results are the direct outcome of the diligent efforts of the entire Goldmoney team, a group of people who should be congratulated for their achievements. There were many pieces to the puzzle when we brought GoldMoney and BitGold together less than two years ago that are now in place and form a solid foundation,” said Lead Director James Turk. “I look forward to the team’s future accomplishments as they continue developing and improving Goldmoney’s core business model to the benefit of customers and shareholders.”

Annual Comments from Founders

“Just two years ago, we launched an idea – BitGold – a savings and payments platform completely powered by physical allocated gold. That business has grown from a standing start to $172 million in revenue and nearly 3 tonnes of customer metal under custody. While this achievement would stand on its own as exemplary for most two-year-old startups, it is my view that our capital management and M&A activity has been equally important. While building the BitGold business, launching dozens of features never before available for physical gold, navigating through myriad global regulations and licensing, and building in-house software engineering, client services, and digital marketing divisions from scratch, we also completed two acquisitions (GoldMoney and SchiffGold), which fundamentally transformed our idea and transformed the Company into the leading and most trusted name in direct-to-consumer precious metals,” said Goldmoney CEO Roy Sebag. “The unified Goldmoney business has now reported its first full-year financial results that reflect the first phase of consolidation between the various brands and operations. We are very proud of these results, which I believe show the fundamental value inherent in our business today, as well as the various asymmetry our business has to macroeconomic events and a rising gold price environment.”

“I would like to point investors to a few fundamental points of value that I believe may be disguised by non-cash accounting under IFRS reporting. The first is the way in which we manage your capital, which we believe underpins our assurances of integrity for our clients who entrust us with nearly $2 billion of assets. In FY 2016, our tangible common equity totaled $59.6mm; one year later, it stood at $58.8mm. This reduction of just $1.1 million in common equity produced an increase of 113% in topline revenue, 97% in gross profit, and 10% growth in metal weight under custody which totaled 34.8 gold equivalent tonnes or $1.86 billion at March 31, 2017,” said Sebag. “The simplest way to understand how we view this business at the group level is that we generated an adjusted cash loss of $4.4 million FY 2017 on nearly $8.2 million of costs we view as variable and not necessarily recurring. These include underwritten processing fees of $3.1 million, new client acquisition costs through advertising and marketing of $3.4 million, and professional fees that primarily relate to the buildout of key licensing and regulatory infrastructure for payments of $1.7 million. In the case of the variable processing fee cost, we introduced a processing-type spread on March 21, 2017 that turns the variable cost into a variable profit. Adjusting for these important factors, it should be apparent that the company – as evidenced by the accompanying financial report for the period ended March 31, 2017 – is now producing significant operational cash flow. As highlighted in the new presentation uploaded to our investor relations site today, management doesn’t view Goldmoney Inc. as maximizing short-term Canadian dollar earnings as our accounting financial statements show. We view this business model as a way to earn a long-term capital surplus in the form of a growing weight of precious metals, which management can choose to redeploy and compound or return to you in the form of buybacks and dividends. In combination with the asymmetric tail risk embedded in inflation-targeted fiat currency, we view this business model as the best way to serve our clients while fundamentally delivering a unique value proposition to shareholders: long-term profit maximization as measured by a return on metal weight.”

“As we look to the future, we’re energized and passionate about growing this unique service globally through new marketing channels. I am personally excited for the launch of our two physical branches and will eagerly assess whether our hypothesis for this channel will prove correct; if so, many more can be developed around the world,” said Sebag. “I would like to thank our team of extremely talented engineers, operations, compliance, and customer service personnel for their diligence and hard work over the past two years. I would also like to thank our investors and stakeholders, precious metal dealers and vault providers, processors and payment technology providers, banking partners, and legal advisers. Lastly, I would like to thank our clients for entrusting us with their hard-earned savings and helping to extend the Goldmoney community to more than 150 countries.”

“As we close the books on our second year of operations, we’d like to further outline our long-term vision for the Company now that a solid operating base and proof of concept has been established. We continue to position clients and shareholders at the cross section of three global tailwinds: the mass digitization of money and connected global commerce; the fragmentation of traditional wealth, banking, and payment relations with new technology; and global real interest rates collapsing asymptotically to – and below – zero, eschewing an inevitable paradigm shift in global monetary systems,” said Chief Strategy Officer & CFO Josh Crumb. “We have witnessed an increasing number of data points that have validated our investment thesis over the past year: a market for cryptocurrencies that has progressed from a scientific experiment to more than 100 billion dollars in market capitalization seemingly overnight; major digital payment providers in China and India launching early-stage gold wallet products; banks and wealth managers everywhere scrambling to innovate and retain clients; and a collective global insanity in experimental monetary policy that has driven lending rates below zero for the first time in recorded human history, thus rendering unbacked fiat currencies illogical and destined to lose market share to durable commodities for wealth preservation and transactions. In this environment, the Company is investing in new client relationships, technology, and new business segments in which we believe there is a fundamental competitive advantage by being the only financial institution running on a tested and superior form of global commodity money. We have now proven that a large and growing market exists for our services, and have started the process of investing in the next phases of our service for our clients.”

“Our trailing revenues and now stable operating profit base primarily reflect our growing market share in retail precious metal savings, trading, and custodial services, areas in which we are already considered one of the world’s preeminent non-bank platforms. While this will continue to be our core business line in the near future, we have also invested in payment and transfer services that do not exist elsewhere in the market and thus have yet to drive meaningful revenues as we slowly cultivate first-mover network effects,” said Crumb. “We are also approaching the launch of the first stage of our physical branch strategy, and we’ve made small investments to prove out an ecosystem model in which Goldmoney powers an underlying physical infrastructure and provides clients with other innovative services. While these types of investments in innovation take time, we have also committed to be prudent with your capital and have made steps in recent months to position shareholders for a period of investment from retained cash flow. We thus position the Company for exposure to innovation and secular macro trends, but fund that tail option from a stable and growing base, and we remain committed to a metal-weight accounted focus on long-term profit maximization.”

The selected financial information included in this release is qualified in its entirety by, and should be read together with, the Company’s unaudited condensed consolidated interim financial statements for the three months ended March 31, 2017, prepared in accordance with International Financial Reporting Standards (“IFRS”) and corresponding management’s discussion and analysis, which are available under the Company’s profile on SEDAR at www.sedar.com.

Conference Call Information

The company will host its annual conference call today, June 22, 2017, at 11:00 a.m. ET to discuss earnings and provide a general corporate update. The call is open to investors and will be held by Josh Crumb, CFO of Goldmoney Inc. and Roy Sebag CEO of Goldmoney Inc.

PARTICIPANT ACCESS CODE: 362764

DIAL-IN NUMBERS:

Toronto: +1 647 478 7145

New York: +1 917 962 0650

London: +44 203 7696819

To view additional local dial-in numbers, please click here.

QUESTIONS:

Please note that the conference line will be muted to all callers excluding select analysts, who will be able to participate in the Q&A portion of the call. Questions to be answered during the call can be emailed ahead of time to: [email protected].

Non-IFRS Measures

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company’s performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company’s operating results.

Non-IFRS Adjusted Loss1 is a non IFRS financial measure. This figure excludes from comprehensive loss the impact of the following amounts: (i) any gains or losses on precious metals inventory, (ii) non-cash items, including the amortization of intangible assets or stock based compensation, (iii) the impact of foreign exchange gains or losses, and (iv) unrealized gains or losses on investments held for sale. Refer to the MD&A for a detailed breakdown of these items.

Non-IFRS Cash Loss is a non IFRS financial measure. This figure excludes from comprehensive loss the impact of non-cash items, including the amortization of intangible assets or stock based compensation. Refer to the MD&A for a detailed breakdown of these items.

Tangible Common Equity is a non-IFRS measure. This figure excludes from total shareholders’ equity (i) intangibles, and (ii) goodwill, and is useful to demonstrate the tangible capital employed by the business.

For a full reconciliation of non-IFRS financial measures used herein to their nearest IFRS equivalents, please see the section entitled “Reconciliation of Non-IFRS Financial Measures” in the Company’s MD&A for the year ended March 31, 2017.

About Goldmoney Inc.

Goldmoney Inc., a financial service company traded on the Toronto Stock Exchange (TSX:XAU), is a global leader in precious metal investment services and the world’s largest precious metals payment network. Safeguarding $1.9 billion in assets for clients located in more than 150 countries, Goldmoney is focused on a singular mission to make precious metals-backed savings accessible to all. Powered by Goldmoney’s patented technology, the Goldmoney Holding® is an online account that enables clients to invest, earn, or spend gold, silver, platinum, and palladium that is securely stored in insured vaults in seven countries. All bullion assets are fully allocated and physically redeemable property. Goldmoney Wealth Limited is regulated by the Jersey Financial Services Commission (JFSC) as a Money Services Business. Goldmoney Network is a reporting entity to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), and is registered with the Financial Crimes Enforcement Network (FinCEN) in the U.S. For more information about Goldmoney, visit goldmoney.com.

Media and Investor Relations Inquiries:

Jacquelyn Humphrey

Director of Global Communications

Goldmoney Inc.

[email protected]

Josh Crumb

Chief Strategy Officer & CFO

Goldmoney Inc.

+1 647-499-6748

Forward-Looking Statements

This news release contains or refers to certain forward-looking information. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “may”, “potential” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. All information other than information regarding historical fact, which addresses activities, events or developments that the Goldmoney Inc. (the “Company”) believes, expects or anticipates will or may occur in the future, is forward looking information. Forward-looking information does not constitute historical fact but reflects the current expectations the Company regarding future results or events based on information that is currently available. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking information will not occur. Such forward-looking information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not limited to, statements with respect to: service times for transactions on the Goldmoney network; growth of the Company’s business, expected results of operations, and the market for the Company’s products and services and competitive conditions. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: the Company’s limited operating history; history of operating losses; future capital needs and uncertainty of additional financing; fluctuations in the market price of the Company’s common shares; the effect of government regulation and compliance on the Company and the industry; legal and regulatory change and uncertainty; jurisdictional factors associated with international operations; foreign restrictions on the Company’s operations; product development and rapid technological change; dependence on technical infrastructure; protection of intellectual property; use and storage of personal information and compliance with privacy laws; network security risks; risk of system failure or inadequacy; the Company’s ability to manage rapid growth; competition; effectiveness of the Company’s risk management and internal controls; use of the Company’s services for improper or illegal purposes; uninsured and underinsured losses; theft & risk of physical harm to personnel; precious metal trading risks; and volatility of precious metals prices & public interest in precious metals investment; and those risks set out in the Company’s most recently filed annual information form, available on SEDAR. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to update or revise any forward-looking information, except as required by law.